This judgment was handed down remotely at 10.00am on 11 April 2024 by circulation to the parties or their representatives by e-mail and by release to the National Archives.

.............................

Lady Justice Falk:

INTRODUCTION

- In 2009 the BlackRock group acquired the worldwide business of Barclays Global Investors ("BGI") for approximately US $13.5 bn, comprising $6.6 bn in cash and the balance in shares in BlackRock, Inc. ("BRI"), the group's parent company. The parties agreed that, out of the total consideration due, the amount that would be paid for BGI's US business ("BGI US") would be $2,252,590,706 in cash and BRI shares worth $8.5 bn (the "BRI Shares").

- This appeal concerns the structure that BlackRock used to acquire BGI US, and specifically the deductibility for UK tax purposes of interest payable on $4 bn of intra-group loans put in place for that purpose. HMRC challenged the claim to deduct on two grounds, namely (1) the transfer pricing rules in Part 4 of the Taxation (International and Other Provisions) Act 2010 ("TIOPA") (the "Transfer Pricing issue"), and (2) the unallowable purpose rule in s.441 of the Corporation Tax Act 2009 ("CTA 2009") (the "Unallowable Purpose issue"). In outline, HMRC's position on the Transfer Pricing issue is that the loans would not have been made at all between parties acting at arm's length, such that relief should be denied on that basis. On the Unallowable Purpose issue HMRC maintain that relief should alternatively be denied because securing a tax advantage was the only purpose of the relevant loans.

- In a decision of Judge John Brooks dated 3 November 2020, the First-tier Tribunal ("FTT") decided that the interest was deductible ([2020] UKFTT 443 (TC)) (the "FTT Decision"). In a decision of Michael Green J and Judge Rupert Jones dated 19 July 2022, the Upper Tribunal ("UT") allowed HMRC's appeal on both issues and confirmed HMRC's amendments to the relevant tax returns that denied the deductions ([2022] UKUT 199 (TCC)) (the "UT Decision").

- The appeals relate to returns for accounting periods ended 30 November 2010 to 31 December 2015 inclusive.

- The court is grateful for the assistance provided by the submissions of Kevin Prosser KC and David Yates KC for the appellant, BlackRock HoldCo 5, LLC ("LLC5"), and David Ewart KC and Sadiya Choudhury KC for HMRC.

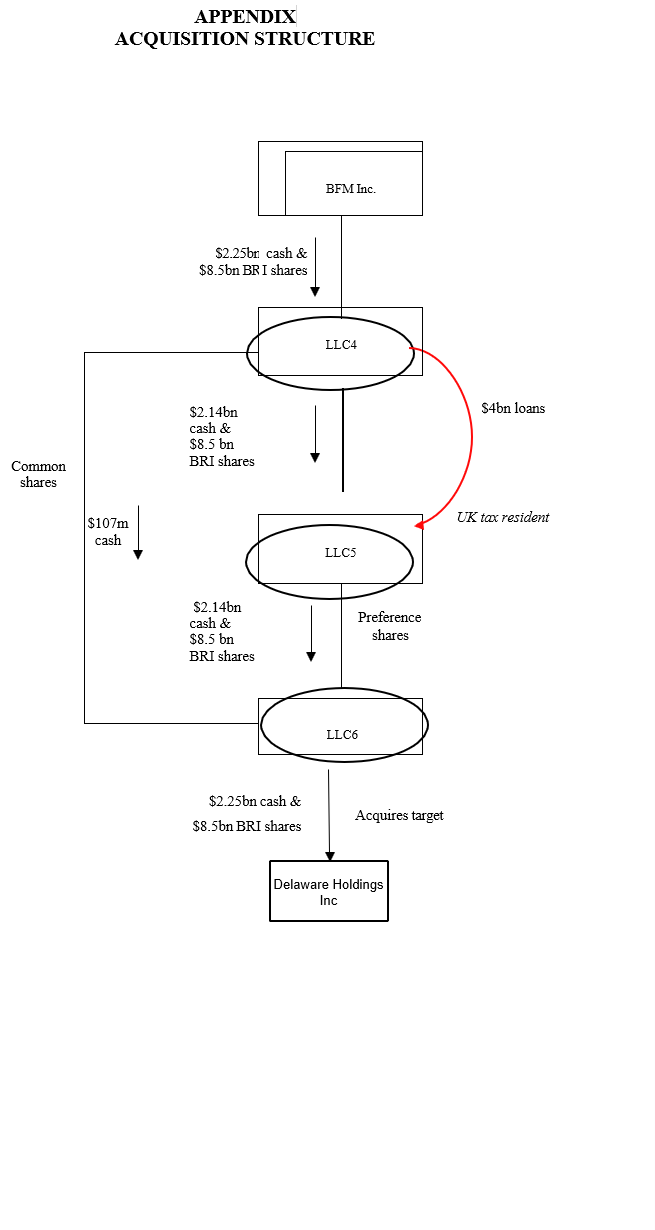

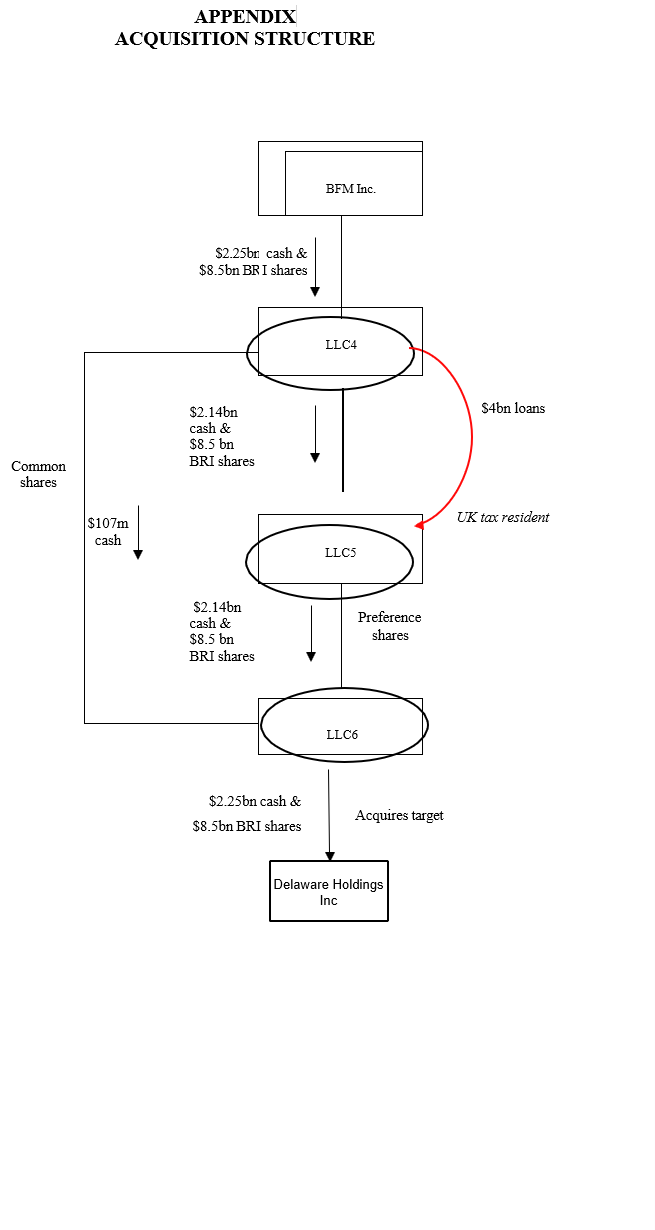

The acquisition structure

- The relevant acquisition structure is best viewed pictorially, and is included as an Appendix to this decision in a form reproduced from the UT Decision. BlackRock Financial Management, Inc. ("BFM"), shown as the parent company in the structure, was an existing Delaware corporation and an indirect wholly owned subsidiary of BRI. The acquisition structure involved the formation of three further entities which were incorporated in Delaware as limited liability companies ("LLCs"), namely BlackRock HoldCo 4, LLC ("LLC4"), LLC5 and BlackRock HoldCo 6, LLC ("LLC6"). In outline, BFM became the sole member of LLC4 and LLC4 became the sole member of LLC5. Both LLC4 and LLC5 became members of LLC6. It was LLC6 that acquired BGI US, by acquiring all of the outstanding shares in Delaware Holdings, Inc., the existing owner of BGI US, from the Barclays group.

- The transaction consideration was passed down to LLC6 in the following manner:

a) BFM contributed $2,252,590,706 in cash and the BRI Shares to LLC4.

b) LLC4 contributed $2,144,788,229 in cash and the BRI Shares to LLC5 in return for 100 common (that is, ordinary) shares in LLC5 and the issue by LLC5 of loan notes in four tranches totalling $4 bn (the "Loans").

c) LLC4 also contributed the balance of the cash, being $107,802,477, to LLC6 in return for the issue of 100,000 common shares in LLC6.

d) LLC5 contributed $2,144,788,229 in cash and the BRI Shares to LLC6 in return for the issue of 2,400,000 preference shares in LLC6.

- The holders of the common shares in LLC6 were entitled to 216 votes for each common share. The holders of the preference shares in LLC6 were entitled to one vote for each preference share. The effect was that LLC4 held 90% of the voting power in LLC6.

- Section 6.1 of the Limited Liability Company agreement of LLC6 stated that its board would determine in its sole and absolute discretion the amount of Available Assets (as defined) that were available for distribution and the amount, if any, of such Available Assets to be distributed to members in accordance with the following order of priority:

a) A total annual distribution of $300 per preference share (amounting to $720,000,000 on the basis of 2,400,000 shares).

b) A total annual distribution of $20 per common share (amounting to $2,000,000 on LLC4's 100,000 common shares), but no such distribution to be made unless and until all preference dividends for such period had been paid.

c) Any unpaid amounts of either preference or common dividends would be carried forward, with interest.

(Section 6.1 also gave the board of LLC6 the power, once these entitlements had been satisfied, to make additional distributions simultaneously to the holders of both classes of share, but on the basis that the amount distributed per preference share was four times the amount distributed per common share.)

- The effect of this was that, as preference shareholder, LLC5 would be entitled to the vast majority of the distributions from LLC6, and to priority over distributions paid to LLC4. However, LLC4 controlled LLC6, and therefore could control whether it made any distributions.

- Under US tax rules LLCs, unlike regular corporations, may elect to be disregarded for tax purposes. Each of LLC4, LLC5 and LLC6 made such an election. The effect of those elections included that transactions between those entities, including the Loans, fell to be ignored for US tax purposes.

- In contrast to other entities in the structure, LLC5 was resident for tax purposes in the UK by virtue of being managed and controlled here. Unlike the position for US tax purposes it did not fall to be disregarded for UK tax purposes, and was treated as an entity subject to UK corporation tax.

- The dispute concerns the claims by LLC5 to deduct interest on the Loans made to it by LLC4 in its corporation tax returns. If those claims were properly made they would give rise to losses (strictly, non-trading deficits on loan relationships) which could be surrendered to UK members of the BlackRock group to set against their own taxable profits. LLC5 sought to make such surrenders, and in accordance with the usual policy of the BlackRock group did so for no consideration. (LLC5 had no taxable income because its receipt of dividends on the preference shares was exempt from tax.)

Other relevant facts in outline

- As a preliminary observation, the scope of the FTT's findings is not immediately obvious. Large parts of the FTT Decision appear at first sight to summarise evidence without explicitly confirming that the evidence was accepted. However, while additional clarity would have assisted, it is tolerably clear that where evidence is summarised without qualification it was accepted and found as a fact. In the case of the evidence of the two witnesses of fact, Nigel Fleming and J. Richard Kushel, this is supported by the FTT's finding at para. 5 that they were both "credible, truthful witnesses who at all times sought to assist the Tribunal". Further, para. 9 expressly refers to making "the following additional findings of fact" to expand on those set out in a statement of agreed facts. The structure of the decision suggests that that comment covers the following sections up to para. 54.

- I will deal with some of the factual findings in greater detail below, but it is convenient to refer to four points now. Cross-references are to paragraphs of the FTT Decision.

- First, the FTT found that the split ownership structure of LLC6, with LLC4 rather than LLC5 having voting control of LLC6, was introduced because of concerns that the US financial regulator might have about a UK resident controlling a US bank, together with compliance-related concerns about the UK Treasury consent and UK controlled foreign company rules (para. 24). Those concerns had arisen in the context of an earlier proposal involving two rather than three LLCs, under which a UK tax resident LLC would itself acquire BGI US, and would be wholly owned by one further (non-UK resident) LLC owned by BFM (para. 21). It is not suggested that the UK related concerns themselves connote any tax avoidance purpose.

- Secondly, having considered expert evidence adduced by both parties, the FTT found that an independent lender would not have been prepared to enter into the Loans on the same terms as the parties actually did, but that it would have done so if it had obtained certain covenants from, in particular, LLC6 and BGI US that were not there in the actual transaction (para. 103, reflecting an agreement of the experts recorded at para. 77 and a further finding at para. 89). The FTT also accepted the evidence of BlackRock's expert that such covenants would have been forthcoming (para. 102).

- Thirdly, the board of LLC5 approved the proposal to take the steps relevant to that entity at a meeting held on 30 November 2009, one day before the acquisition of BGI US completed. While it is common ground that the structure outlined above was devised, and LLC5 was incorporated, in accordance with tax advice that anticipated that UK tax advantages could be obtained, BlackRock's position is that this is not relevant to the Unallowable Purpose issue because that is concerned solely with the subjective purpose of LLC5, determined by reference to the intentions of the board members. In that connection the FTT found that LLC5 "entered into the Loans in the furtherance of the commercial purpose of its business of making and managing passive investments" (para. 121). Although the FTT also found that the securing of a tax advantage was "an inevitable and inextricable consequence" and on that basis was itself a main purpose, BlackRock say that was an error of law because the board had left the anticipated tax advantages out of account in deciding whether to approve the transaction.

- Fourthly, it is uncontroversial that the relative amounts of debt and equity by which LLC5 was funded took account of the need to ensure that LLC5 was not "thinly capitalised", meaning having insufficient equity to justify the level of debt it took on.

THE TRANSFER PRICING ISSUE

The issues

- The UT allowed HMRC's appeal on the Transfer Pricing issue on the basis of an argument that was not raised in the FTT, namely that in determining whether an independent lender would be prepared to lend, the transfer pricing provisions do not permit the existence of third-party covenants to be hypothesised where those covenants are not present in the actual transaction. LLC5 challenges that conclusion as Ground 1 of its appeal.

- HMRC defend the UT Decision and also rely on an additional ground by way of Respondent's Notice, namely that the UT erred in holding that the FTT had been entitled to conclude on the basis of the expert evidence before it that an independent lender would have entered into the Loans subject to it being able to obtain the necessary covenants; and that the covenants would have been forthcoming (HMRC's Ground 1).

Relevant legislation

- The relevant legislation is contained in Part 4 of TIOPA.

- Section 147 TIOPA relevantly provides:

"147 Tax calculations to be based on arm's length, not actual, provision

(1) For the purposes of this section "the basic pre-condition" is that—

(a) provision ("the actual provision") has been made or imposed as between any two persons ("the affected persons") by means of a transaction or series of transactions,

(b) the participation condition is met (see section 148),

(c) …, and

(d) the actual provision differs from the provision ("the arm's length provision") which would have been made as between independent enterprises.

(2) Subsection (3) applies if—

(a) the basic pre-condition is met, and

(b) the actual provision confers a potential advantage in relation to United Kingdom taxation on one of the affected persons.

(3) The profits and losses of the potentially advantaged person are to be calculated for tax purposes as if the arm's length provision had been made or imposed instead of the actual provision."

- "Transaction" is broadly defined by s.150(1) TIOPA to include "arrangements, understandings and mutual practices (whether or not they are, or are intended to be, legally enforceable)". Section 150 also provides that "series of transactions" includes a number of transactions entered into in pursuance of the same arrangement, and expressly states that provision can be made between two persons by means of a series of transactions even if there is no direct transaction between them or the series includes transactions to which neither of them is a party. Section 148, read with ss.157 to 163, has the effect that the "participation condition" is met if, among other things, one of the persons controls the other. That is referred to as being a situation where one of the persons is "directly participating in the management, control or capital" of the other. The concept of "potential advantage" is defined in s.155 and includes the creation or increase in losses for tax purposes.

- Section 151 elaborates on the concept of arm's length provision, as follows:

"151 "Arm's length provision"

(1) In this Part "the arm's length provision" has the meaning given by section 147(1).

(2) For the purposes of this Part, the cases in which provision made or imposed as between any two persons is to be taken to differ from the provision that would have been made as between independent enterprises include the case in which provision is made or imposed as between two persons but no provision would have been made as between independent enterprises; and references in this Part to the arm's length provision are to be read accordingly."

- It is common ground that the relevant "actual provision" referred to in s.147(1) is the Loans made by LLC4 to LLC5, that the "participation condition" is met by virtue of LLC4's control of LLC5 (in the terms of the legislation, LLC4 was "directly participating in the management, control or capital" of LLC5) and that the Loans did confer a "potential advantage" in relation to UK taxation.

- Section 152 TIOPA deals specifically with debt financing between corporate entities, in the following terms:

"152 Arm's length provision where actual provision relates to securities

(1) This section applies where–

(a) both of the affected persons are companies, and

(b) the actual provision is provision in relation to a security issued by one of those companies ("the issuing company").

(2) Section 147(1)(d) is to be read as requiring account to be taken of all factors, including–

(a) the question whether the loan would have been made at all in the absence of the special relationship,

(b) the amount which the loan would have been in the absence of the special relationship, and

(c) the rate of interest and other terms which would have been agreed in the absence of the special relationship…

(3) Subsection (2) has effect subject to subsections (4) and (5).

(4) If—

(a) a company ("L") makes a loan to another company with which it has a special relationship, and

(b) it is not part of L's business to make loans generally,

the fact that it is not part of L's business to make loans generally is to be disregarded in applying subsection (2).

(5) Section 147(1)(d) is to be read as requiring that, in the determination of any of the matters mentioned in subsection (6), no account is to be taken of (or of any inference capable of being drawn from) any guarantee provided by a company with which the issuing company has a participatory relationship.

(6) The matters are—

(a) the appropriate level or extent of the issuing company's overall indebtedness,

(b) whether it might be expected that the issuing company and a particular person would have become parties to a transaction involving—

(i) the issue of a security by the issuing company, or

(ii) the making of a loan, or a loan of a particular amount, to the issuing company, and

(c) the rate of interest and other terms that might be expected to be applicable in any particular case to such a transaction."

- Section 154 defines some of these terms, as follows:

"154 Interpretation of sections 152 and 153

…

(3) "Special relationship" means any relationship by virtue of which the participation condition is met (see section 148) in the case of the affected persons concerned.

(4) Any reference to a guarantee includes—

(a) a reference to a surety, and

(b) a reference to any other relationship, arrangements, connection or understanding (whether formal or informal) such that the person making the loan to the issuing company has a reasonable expectation that in the event of a default by the issuing company the person will be paid by, or out of the assets of, one or more companies.

(5) One company ("A") has a "participatory relationship" with another ("B") if—

(a) one of A and B is directly or indirectly participating in the management, control or capital of the other, or

(b) the same person or persons is or are directly or indirectly participating in the management, control or capital of each of A and B.

(6) "Security" includes securities not creating or evidencing a charge on assets.

…"

- It is uncontroversial that s.152 is in point and that the necessary special relationship existed between LLC4 and LLC5 through the former's control of the latter. It is also undisputed that the third party covenants that the FTT found would have been in place in an arm's length transaction would not be "guarantees" within s.154(4).

- Finally, but importantly, s.164 provides that Part 4 of TIOPA is to be read "in such manner as best secures consistency" with the transfer pricing guidelines issued by the Organisation for Economic Co-operation and Development (the "OECD guidelines"):

"164 Part to be interpreted in accordance with OECD principles

(1) This Part is to be read in such manner as best secures consistency between—

(a) the effect given to sections 147(1)(a), (b) and (d) and (2) to (6), 148 and 151(2), and

(b) the effect which, in accordance with the transfer pricing guidelines, is to be given, in cases where double taxation arrangements incorporate the whole or any part of the OECD model, to so much of the arrangements as does so.

….

(3) In this section "the OECD model" means—

(a) the rules which, at the passing of [the Income and Corporation Taxes Act 1988] (which occurred on 9 February 1988), were contained in Article 9 of the Model Tax Convention on Income and on Capital published by the Organisation for Economic Co-operation and Development, or

(b) any rules in the same or equivalent terms.

…"

- As discussed in oral argument, this is perhaps not drafted as clearly as it might be. We are not concerned with double taxation arrangements. The explanation is that the OECD guidelines are produced with reference to the OECD model double tax convention, and specifically Article 9 of the model, which deals with "associated enterprises". Article 9 allows a contracting state to make adjustments to profits for tax purposes where, broadly, the terms of the actual arrangements between enterprises in the two contracting states differ from what would have been agreed between independent enterprises, and requires corresponding adjustments to be made by the other contracting state.

- Section 164(1)(b) refers to "transfer pricing guidelines". That term is defined in 164(4) by reference to guidelines published by the OECD. The definition changed over the relevant period. The effect in this case is that, for LLC5's accounting periods ended 30 November 2010, 31 December 2010 and 31 December 2011 the relevant version of the OECD guidelines is that published in 1995, and for the periods ended 31 December 2012 to 31 December 2015 inclusive, the version published in 2010.

- Later versions of the guidelines were published in 2017 and 2022. Although those later guidelines are not strictly applicable there was no dispute between the parties that we can consider them on the basis that (so far as they are relevant to this case) they simply elucidate or expand on points made in earlier versions. Indeed, both parties relied on the 2022 version on that basis.

The OECD guidelines

- Paragraph 1.6 of both the 1995 and 2010 versions of the OECD guidelines explains that what Article 9 of the model convention seeks to do is to adjust profits by reference to "the conditions which would have obtained between independent enterprises in comparable transactions and comparable circumstances" (a comparable "uncontrolled transaction", as opposed to the actual "controlled transaction"). The 2010 version adds that this comparability analysis is at the "heart of the application of the arm's length principle", while explaining at para. 1.9 that there are cases, for example involving specialised goods or services or unique intangibles, where a comparability analysis is difficult or complicated to apply.

- In its discussion of comparability analysis, para. 1.15 of the 1995 version states:

"Application of the arm's length principle is generally based on a comparison of the conditions in a controlled transaction with the conditions in transactions between independent enterprises. In order for such comparisons to be useful, the economically relevant characteristics of the situations being compared must be sufficiently comparable. To be comparable means that none of the differences (if any) between the situations being compared could materially affect the condition being examined in the methodology (e.g. price or margin), or that reasonably accurate adjustments can be made to eliminate the effect of any such differences. In determining the degree of comparability, including what adjustments are necessary to establish it, an understanding of how unrelated companies evaluate potential transactions is required. Independent enterprises, when evaluating the terms of a potential transaction, will compare the transaction to the other options realistically available to them, and they will only enter into the transaction if they see no alternative that is clearly more attractive. For example, one enterprise is unlikely to accept a price offered for its product by an independent enterprise if it knows that other potential customers are willing to pay more under similar conditions. This point is relevant to the question of comparability, since independent enterprises would generally take into account any economically relevant differences between the options realistically available to them (such as differences in the level of risk or other comparability factors discussed below) when valuing those options. Therefore, when making the comparisons entailed by application of the arm's length principle, tax administrations should also take these differences into account when establishing whether there is comparability between the situations being compared and what adjustments may be necessary to achieve comparability."

Similar text appears at paras. 1.33 and 1.34 of the 2010 version.

- As can be seen from this, it is essential that the "economically relevant characteristics" are "sufficiently comparable", in the sense of any differences either not having a material effect on the relevant condition (term) of the transaction, or being capable of being adjusted for with reasonable accuracy so as to eliminate their effect.

- Paragraph 1.17 of the 1995 version expands on the concept of differences as follows:

"… In order to establish the degree of actual comparability and then to make appropriate adjustments to establish arm's length conditions (or a range thereof), it is necessary to compare attributes of the transactions or enterprises that would affect conditions in arm's length dealings. Attributes that may be important include the characteristics of the property or services transferred, the functions performed by the parties (taking into account assets used and risks assumed), the contractual terms, the economic circumstances of the parties, and the business strategies pursued by the parties…"

Again, this is reflected in the 2010 version, at para. 1.36. For present purposes, the references to functions, risk and economic circumstances are noteworthy.

- Under a sub-heading "Factors determining comparability", the guidelines discuss among other things the importance of a functional analysis, which "seeks to identify and to compare the economically significant activities and responsibilities undertaken or to be undertaken by the independent and associated enterprises" (para. 1.20 of the 1995 version). As part of this, the guidelines identify the relevance of risks assumed by the parties:

"… Controlled and uncontrolled transactions and entities are not comparable if there are significant differences in the risks assumed for which appropriate adjustments cannot be made. Functional analysis is incomplete unless the material risks assumed by each party have been considered since the assumption or allocation of risks would influence the conditions of transactions between the associated enterprises." (Para. 1.23 of the 1995 version; para 1.45 of the 2010 version.)

- The OECD guidelines make clear that, in general, tax administrations should not disregard actual transactions. Both the 1995 and 2010 versions give two examples of when, exceptionally, this might be done (paras. 1.36 to 1.38 of the 1995 version; paras. 1.64 to 1.66 of the 2010 version). The first is where the economic substance of a transaction differs from its form, the classic example being debt that in economic substance amounts to equity. The second is a situation where the arrangements differ from those that would be entered into by commercially rational independent parties and the effect is to impede the application of transfer pricing principles, an example being a transfer of unlimited rights to intellectual property relating to future research. It was not suggested that either of these exceptions is in point.

- A further point clarified by the guidelines is that the presence of a tax motive or purpose does not justify non-recognition of the parties' characterisation or structuring of a transaction. Rather, the fact that a transaction has been entered into with tax savings in mind is not relevant for transfer pricing purposes: paras. 9.181 and 9.182 of the 2010 version.

- Mr Prosser referred us to the 2022 version of the OECD guidelines in relation to two points. The first is the treatment of synergies available from membership of a group. The guidelines clarify that incidental benefits arising from group membership need not be adjusted for even if they are substantial. The example is given of an improved credit rating available to a borrower by virtue of membership of a group, as compared to what it would be on a standalone basis (paras. 1.177, 1.178 and 1.184 of the 2022 version). This point is also addressed in both the 1995 and 2010 versions at para. 7.13.

- Secondly, in a section dealing with intra-group loans, para. 10.56 of the 2022 version notes that where a parent grants a loan to a subsidiary the grant of security is less relevant to its risk analysis because it already has control and ownership, such that the absence of contractual rights over the assets of the borrower "does not necessarily reflect the economic reality of the risk inherent in the loan". The same section also addresses covenants, pointing out (in effect) that the drivers leading to covenants being required at arm's length may not be present in an intra-group context and that it will be appropriate to consider whether there is in practice the "equivalent" of covenants (para. 10.86).

The FTT Decision

- The FTT considered the evidence of two experts, Timothy Ashley for BlackRock and Simon Gaysford for HMRC. Mr Ashley had had significant experience in treasury management and the debt capital markets. Mr Gaysford did not have debt capital market experience. His expertise was as an economist.

- The experts were asked to consider whether the Loans differed from those which would have been made between independent enterprises, including whether they would have been entered into at all. The FTT found that there was broad agreement between them on most issues, including that "an independent lender would, on the strength of the [BGI US] business, be willing to lend $4 bn to LLC5 but would have required covenants from LLC5 to do so" (para. 69 of the FTT Decision). This was reiterated at para. 77 in the following terms, by reference to a joint statement and Mr Gaysford's report:

"… the experts agree that it would have been possible for LLC5 to execute a $4 billion debt transaction in December 2009 with an independent enterprise at similar interest rates to the actual transaction that took place between LLC5 and LLC4, but subject to different terms and conditions that independent lenders would have required to manage the credit risks appropriately."

- Mr Ashley's report listed various types of covenant, but he agreed in oral evidence that the "critical ones" were:

"(1) Additional debt covenant restricting the amount of debt that could be raised at LLC6 or [BGI US] level to cap the amount of incremental debt that could subordinate or subvert LLC5 lenders; and/or

(2) Provision of additional covenants (e.g. preference share payment covenant from LLC6)…" (Paras. 70 and 71 of the FTT Decision.)

Other covenants on Mr Ashley's list included negative pledges restricting LLC6's ability to makes loans to LLC4 or other group entities and the ability of LLC6 and BGI US to grant security to other lenders.

- As to the "preference share payment covenant" referred to in (2) above, the FTT recorded at para. 72 that:

"In evidence Mr Ashley also agreed that a covenant would be required to ensure that LLC6, if it was going to do so, would pay a dividend to LLC5 first to, "make sure that it is effectively honouring the preference shares which are preferred and pay that dividend flow first." However, he confirmed that there was "nothing more" to the covenants he would be suggesting than that although he believed that it was not possible to compel LLC6 to declare a dividend."

- The covenants that Mr Gaysford stated were required are set out at para. 73 of the FTT Decision. No doubt reflecting his different expertise, they are somewhat less specific and described more by overall effect rather than content, in particular covenants to "remove the existing uncertainty" and prevent "actions that could reduce the value of LLC5".

- The FTT went on to consider the experts' evidence in further detail. On the question of the additional terms and conditions that an independent lender would require, the FTT set out at para. 78 the following extract from section 14 of the joint statement:

"f. The preference share structure was unusual but not necessarily problematic given BGI US was already a successfully performing business. The preference shares carried an expectation that [LLC5] should receive over USD700m annually in income which would have given it a sizeable debt capacity. The main issue was that the flow of value from BGI US to LLC6 and then to [LLC5] via the preference shares was paid at the discretion of LLC4. Whilst a lender would probably be unlikely to accept this position, it should have been possible for BGI US, and LLC6 – with the explicit consent of LLC4 – to effectively ratify the legal and financial position to which [LLC5] was entitled, that is via inter-company agreements and covenants which would have formed part of [LLC5's] borrowing transaction. Both experts agree that an independent lender would have required the protection described in this paragraph and that it probably could have been put in place. Mr Gaysford believes that it would have been costly and complex to do so. Mr Ashley believes it would have been straightforward and the associated 'cost' would have been an 'opportunity cost' (ie reduced flexibility to enter into further transactions rather than a cash cost).

g. In addition to the protections discussed in f above, the purpose of which would have been to secure the flow of value from BGI US and preference share dividends from LLC6, the experts agree that an independent lender would likely also have required other structural enhancements to the terms of the loans, to ensure the cashflow generation of BGI US could not be diverted in any way. Possible additional clauses would include (1) a negative pledge on further indebtedness within BGI US, LLC6 or indeed [LLC5], (2) a change of control clause and (3) a restriction on BGI US or LLC6 being able to lend money to any other entity – whether inside the BlackRock Group or not. These are well known standard clauses required in almost every external debt transaction – though to emphasise, one would not expect to see them in an inter-company loan transaction within a group.

h. The experts cannot say with certainty whether all of the possible additional clauses listed in paragraph g would have been required to support a USD4bn loan or bond transaction by [LLC5]. However, in view of the structural subordination of LLC5 (being 2 entities away from the generation of cashflows), the experts agree that an independent lender would have required at least some of the enhancements discussed in paragraph g.

i. Again, both experts agree that the enhancements discussed in paragraph g would have been necessary, and probably could have been achieved. Mr Ashley believes it would have been straightforward to do so and that the associated 'cost' would have been an 'opportunity cost' (ie reduced flexibility to enter into further transactions) rather than a cash cost. In Mr Ashley's experience, such enhancements are very common terms in debt transactions, including the BlackRock's group own revolving credit facility. Mr Gaysford believes it would have been costly and complex to do so, and that any 'opportunity cost' would have been significant."

The extract went on to record a difference between the experts as to whether some form of parental support was also required, Mr Ashley's view being that it was not.

- HMRC's case before the FTT was, essentially, that the transaction would simply not have taken place at all at arm's length. The FTT concluded that both HMRC's submissions, and Mr Gaysford, were wrongly focusing on the position of the BlackRock group as a whole. Their objection was that there was a much simpler commercial alternative for a commercial lender to the group which did not involve a loan to LLC5, whereas the required comparison was between the actual lending transaction and a hypothetical loan to the same borrower (para. 101). The FTT went on:

"102. Both experts agreed that an independent lender would have entered into an arrangement subject to it being able to obtain the necessary covenants. On balance, given that Mr Gaysford accepted that his concerns in relation to cost and complexity did not amount to "deal breakers", I prefer the evidence of Mr Ashley that the covenants would have been forthcoming. Similarly I prefer the evidence of Mr Ashley regarding parental support especially as Mr Gaysford was unable to say with "certainty" that the transaction would not have proceeded in its absence.

103. Therefore, for the reasons above I find that although an independent enterprise would not have entered into the Loan on the same terms as the actual transaction it would, subject to the covenants described above, have entered into the Loans on the same terms as the parties in the actual transaction."

The UT Decision

- As already explained, HMRC raised a new argument in the UT, namely that in determining whether an independent lender would be prepared to lend, the transfer pricing provisions do not permit the existence of third-party covenants to be hypothesised where those covenants are not present in the actual transaction.

- In essence, the UT accepted Mr Ewart's submission that s.147(1)(a) TIOPA imposes a "two party rule", because it requires focus on the "provision…made or imposed as between any two persons". That meant that in this case only the terms of the Loans could be considered. Third-party covenants not given as part of the actual transaction may not be taken into account because to do so "materially changes the surrounding circumstances and alters the economically relevant characteristics of the transactions in question" (para. 75 of the UT Decision).

- In reaching that conclusion, the UT reasoned that the FTT had essentially compared a different transaction to the actual one, because importing third-party covenants changed the nature of the provision to be compared (para. 59). The UT also agreed with Mr Ewart's submissions that s.152(5) TIOPA did not assist BlackRock. That only applied where a guarantee was present in the actual transaction (para. 70). Further, its existence indicated that not only guarantees but other types of third-party covenant "affect the substance of the loan transaction". Those other sorts of covenant could only be taken into account if they were present in the actual transaction, because the actual and arm's length transactions would otherwise not be the same (para. 72).

- The UT recognised that the effect of this was that LLC5 would not have been challenged on transfer pricing grounds if it had gone through the "rather artificial exercise" of putting covenants in place with other group companies. However, this was unlikely to be a problem in practice because "it will be very obvious if groups have sought to manipulate the actual transaction in that way by including wholly unnecessary covenants that attempt to anticipate what an independent expert might later decide would be required by an independent lender" (paras. 72-74).

- On the basis of the FTT's finding that an independent lender would not have advanced the Loans without third-party covenants, the FTT should therefore have concluded that no provision would have been made as between independent enterprises, within s.151(2) TIOPA (para.76). The UT accordingly re-made the decision to that effect (para. 100).

- Given the UT's conclusion on this point it was unnecessary to deal with other challenges to the FTT's conclusions, but the UT went on to do so. Relevantly for our purposes, the UT concluded that the FTT did not mischaracterise the expert evidence or make unsupported findings in relation to it (paras. 79-88).

Discussion

- I consider that the UT erred in accepting HMRC's argument that the transfer pricing provisions do not permit the existence of third-party covenants to be hypothesised where those covenants are not present in the actual transaction.

- I agree that what the legislation requires is consideration of the "provision…made or imposed as between any two persons", which must be compared to the provision that would have been made between two independent enterprises. As the Special Commissioners said in DSG Retail Ltd v HMRC [2009] STC (SCD) 397 ("DSG Retail") at [65] (by reference to the predecessor legislation), two means just that, not "two or more". However, nothing in the legislation or the OECD guidelines requires the position of third parties to be ignored if it is otherwise relevant.

Comparable transactions: "economically relevant characteristics"

- The critical starting point is that, as the OECD guidelines make clear, any comparison requires the "economically relevant characteristics of the situations being compared" either to be "sufficiently comparable", or that "reasonably accurate adjustments" can be made to eliminate the effect of any material differences.

- In the real transaction, LLC4 had no need of any of the covenants considered by the experts because, quite independently of its ownership of LLC5, it had control of LLC6 and its subsidiaries, including BGI US (the "LLC6 sub-group"). LLC4 had no real world concern that members of the LLC6 sub-group might take on excessive additional debt or that they might grant unacceptable security to other lenders. It also had no real world concern that the preference share rights might be circumvented. As the UT recognised, for LLC4 to require covenants to guard against those (in practice unreal) risks would indeed be artificial. It was simply unnecessary. LLC4 was in a position to control those risks itself.

- While I appreciate that this is not the way in which the case has been argued (at least on appeal), one way of approaching this is to remind oneself that, in hypothesising a comparable transaction and with the exception of their assumed independence, the actual characteristics of the parties are not adjusted. This was helpfully explained in DSG Retail at [78] in relation to the words "differs from the provision which would have been made as between independent enterprises" which now appear in s.147(1)(d) TIOPA. After stating that this might indicate enterprises not sharing the same attributes as the actual parties, the Special Commissioners said:

"But it is clear to us that that interpretation is not consistent with the OECD model … and therefore that [the legislation] should be interpreted as requiring consideration of what provision independent enterprises sharing the characteristics of the actual enterprises would have made."

- It is worth noting that this approach finds support in the domestic legislation, because it explains s.152(4) TIOPA, which requires the fact that it is not otherwise part of the lender's business to make loans to be disregarded (see [27] above).

- If the only change to the actual transaction is to break the group relationship between LLC4 and LLC5, LLC4 would still have its direct interest in LLC6 and would therefore still control both LLC6 and its subsidiaries. On that approach covenants from the LLC6 sub-group would be unnecessary. LLC4 could ensure that the preference share dividends were paid by LLC6 as anticipated.

- As I say, the appeal was not argued on that basis, but it does underscore the artificiality of considering how LLC4 needs to be protected. In reality, and even if the control relationship was broken between LLC4 and LLC5, LLC4 does not need further protection. (I appreciate that the question whether LLC4 needs further protection is not the only one to ask, because for transfer pricing purposes it is equally necessary to consider whether LLC5 would be prepared to enter into the Loans as an independent borrower, without assurances e.g. that its preference share rights would not be frustrated. But despite that perhaps being more pertinent, it was not the focus of the debate.)

- If we do put to one side LLC4's actual control of the LLC6 sub-group, then there is a significant difference between the "economically relevant characteristics" in the actual and hypothetical transactions. The risks are quite different. In the actual transaction it is obvious that the only real risks to be assessed from LLC4's perspective related to the performance of the BGI US business. In contrast, the lender in the hypothetical transaction would be exposed to an additional risk that something might be done by LLC4 or entities controlled by it to divert or otherwise frustrate the expected dividend flows on the preference shares to LLC5.

- Similarly in the actual transaction, consistently with the unchallenged evidence before the FTT and reflecting the fact that LLC4 could receive no dividends on its common shares unless dividends were paid on the preference shares (see [9] above), LLC5 was not exposed to any real risk that the expected dividend flows to it would not materialise, beyond risks related to the performance of the BGI US business. In contrast an independent borrower would have no practical assurance that nothing else would be done to switch off or reduce the anticipated dividends on the preference shares.

- There was an issue before us about the fact that evidence relevant to the point just made concerning the lack of risk for LLC5 was not reflected in findings of fact by the FTT. This point was raised in HMRC's skeleton argument but was rightly not pursued by Mr Ewart in oral submissions. The evidence was unchallenged and it must also be borne in mind that the argument we are concerned with was raised for the first time in the UT. The absence of findings is therefore unsurprising. It would also be unfair for HMRC, having raised a new argument in the UT, then to rely in this court on a failure by BlackRock to secure relevant findings in the FTT.

- As already explained, the OECD guidelines contemplate that adjustments may be made to ensure that material differences between "economically relevant characteristics" are eliminated. They also explain (see [37] and [38] above) that material risks must be identified and addressed.

- That is precisely what the expert evidence sought to do. The evidence accepted by the FTT in effect adjusted the terms of the actual transaction to ensure that the "economically relevant characteristics" of the actual and hypothetical transactions – and in particular the risks assumed – were comparable. This was done by hypothesising the existence of certain covenants from other group members. In the real world those covenants were unnecessary: the risks did not exist. In the hypothetical world the existence of the covenants addressed the risks that might otherwise exist, so rendering a comparison possible on the basis that the "economically relevant characteristics" of the actual and hypothetical transactions were then sufficiently comparable. The reference in the joint statement to it being possible for BGI US and LLC6 "to effectively ratify the legal and financial position" (see [48] above, para. f.) reflects this.

- Mr Ewart submitted that the parts of the OECD guidelines referred to above all concern comparability analyses, but in this case there was no comparable transaction because the FTT had found that an independent lender would not lend to LLC5. That finding reflected the expert evidence that there were no comparable transactions.

- In my view that overlooks the FTT's findings of fact. The FTT found that an independent lender would have entered into the Loans on the same terms, subject to third-party covenants being entered into. I do not think it matters that a precise equivalent transaction between parties acting at arm's length is not identified. This is not a transaction involving specialised goods or services or unique intangibles of the kind referred to in para. 1.9 of the 2010 version of the guidelines, where a comparability analysis is problematic. It is a lending transaction.

- What the OECD guidelines do require is that the "economically relevant characteristics" are "sufficiently comparable", and that to the extent that there would otherwise be material differences "reasonably accurate adjustments can be made to eliminate the effect of any such differences": see above. The economically relevant characteristics of the actual lender and borrower in this case include (a) LLC4's actual control of LLC6 and (indirectly) BGI US, such that in practice it had no need, when deciding to make the Loans, of any covenants from those entities (or, of course, from itself), and (b) LLC5's own position in the group, such that its board had no reason to be concerned about any possibility that the expected profit would not, if made, find its way up to it by way of preference share dividends, whether due to dividend flows being diverted or otherwise. The third-party covenants do just what the guidelines require, namely adjust for the absence of these risks in the actual transaction, so rendering the economically relevant characteristics comparable.

- Mr Ewart also submitted that there is no mention in the OECD guidelines of introducing third parties. This includes the section in the 2022 version that addresses covenants in loan transactions, which only considers covenants from a borrower (see [42] above). However, the guidelines do not rule out reference to the position of third parties, and in my view a proper application of them may, for the reasons already given, require it to be taken into account. It is also noteworthy that the consideration of covenants in the 2022 version clearly reflects the reality that intra-group loans generally do not require the sorts of protections that an independent lender would need, and recognises that it is appropriate to consider whether there is the "equivalent" of covenants in practice. This is consistent with the approach that I have described. The hypothesised covenants are designed to put the independent lender in an equivalent position to the actual lender.

- Another example also helps to illustrate the problems with HMRC's position. As emphasised in the expert evidence, arm's length lenders will always consider the source of the cashflows that will service any loan that they may make. Where the proposed borrower is a holding company rather than the entity that directly generates the cashflows, lenders will be concerned about structural subordination. This relates to the fact that the holding company's own interest in the cashflows is limited to a direct or indirect interest in another entity, and the resultant risk that subsidiaries may take action, whether by additional borrowings, the grant of security or otherwise, that will have priority over the holding company's interest, with the effect that the cashflows do not find their way up the group to service the loan.

- As the experts jointly explained (see [48] above, para. g), this is commonly addressed by "structural enhancements" that restrict the actions of subsidiary entities. However, an arm's length lender would not normally be satisfied by a commitment from the borrower to that effect. It would want direct commitments from the subsidiaries: indeed it would often seek security over their assets as well. As the experts indicate, the sorts of restrictions to which they refer are "well known standard clauses required in almost every external debt transaction", but would not be expected in an intra-group loan transaction. That is because they are not typically needed in that case.

- There is no principled distinction between that scenario and this one. In both cases an arm's length lender will typically require some form of third party protection. Yet there is (rightly) no suggestion that a loan to a group entity which can properly be supported by the sub-group that it owns can be challenged under the transfer pricing rules because the borrower's subsidiaries have not given negative pledges or granted security.

- I should add that, on the facts of this case, I also respectfully disagree with the UT's observations about manipulating transactions with artificial covenants ([53] above). While I agree that the covenants would have been unnecessary in the real transaction, and in that sense it would be artificial to include them, there would have been nothing wrong in doing so in fact.

The domestic legislation and s.152(5)

- There is also support for the relevance of third parties in the domestic legislation.

- The first point is that it is worth recalling that the legislation applies not only to a transaction directly between two parties (A and B) but to a series of transactions by means of which a "provision" is made or imposed between A and B. That series will clearly involve third parties, and indeed may be such that there is no direct transaction at all between A and B: see [24] above. Nevertheless, that (indirect) provision must be compared to the arm's length provision. While the "series of transactions" rule is not relevant on the facts of this case, there is an analogy because where it does apply the legislation must be contemplating that transfer pricing may involve considering the position of third parties in both the actual and hypothetical transactions. Similarly in the present case, third parties are both actually present and would be in the hypothetical transaction. The difference is that the practical comfort that they provide in the actual transaction in this case is not legally formalised, because it is unnecessary to do so.

- Secondly and more significantly, I accept Mr Prosser's submission that the existence of s.152(5) TIOPA materially undermines Mr Ewart's main submission in oral argument on the transfer pricing rules, namely that the domestic legislation does not permit any reference to third parties because, as DSG Retail determined, "two means two".

- Section 152(5) is set out at [27] above. To recap, it provides:

"(5) Section 147(1)(d) is to be read as requiring that, in the determination of any of the matters mentioned in subsection (6), no account is to be taken of (or of any inference capable of being drawn from) any guarantee provided by a company with which the issuing company has a participatory relationship."

Sub-section (6) refers among other things to "the appropriate level or extent of the issuing company's overall indebtedness".

- The rationale for this provision is best understood by an example. Assume a UK subsidiary that forms part of a larger non-UK based group. Assume further that the UK subsidiary has limited assets or that it is already funded by a significant amount of debt rather than equity. The UK subsidiary takes out a loan from a non-UK resident sister company with the benefit of a guarantee provided by the non-UK parent. An arm's length lender would also not have made the loan without the benefit of the guarantee, because it would view the subsidiary as thinly capitalised (see [19] above). Section 152(5) would have the effect that the guarantee is ignored in the hypothetical transaction, with the result that the financing costs under the loan would be disallowed.

- HMRC's position is that s.152(5) concerns a situation where a guarantee exists in the real world, whereas what BlackRock seek to do is to hypothesise something that does not exist in the real world. The UT accepted that argument.

- With respect, that misses the point. If third parties were irrelevant then there would be no role for s.152(5). It illustrates that the "two means two" mantra cannot be applied without further analysis. Further, the fact that s.152(5) applies to guarantees provided by related parties provides a clear indication that, in contrast, guarantees from third parties who are not related can be taken into account. The same must apply to arrangements involving a third party that do not fall within the definition of guarantee in s.154(4) TIOPA (set out at [28] above), irrespective of whether that third party is a related party or not.

- As to non-existence in the actual transaction, that overlooks what does exist in the real world. The appropriate comparison is not between the non-existence of covenants in the actual transaction and the covenants that a third-party lender would require, but between the actual risks in the real world and the risks in the hypothetical transaction. In the hypothetical transaction there are risks that third parties (specifically, the LLC6 sub-group) may take actions that prejudice the performance of the Loans. Those risks do not exist for the parties to the actual transaction. The covenants in the hypothetical transaction effectively bring the risks into line with each other, so that the transactions are comparable.

- Thirdly, and related to this point, it is worth reiterating just how broad the concept of "actual provision" is ("provision … by means of a transaction or series of transactions": s.147(1)(a) TIOPA). As noted at [24] above, "transaction" is very broadly defined to include "arrangements, understandings and mutual practices (whether or not they are, or are intended to be, legally enforceable)". The concept of the "actual provision" is then extended further by the inclusion of "series of transactions". The net is therefore intended to be cast very widely. Related parties are much more likely to be prepared to rely on informal understandings or non-binding arrangements than parties acting at arm's length. There is no indication in the legislation that the mere fact that an understanding or arrangement is non-binding should prevent a comparison with an arm's length arrangement that has a similar economic effect and which would, in practice, be legally binding.

Term or condition as between the lender and borrower

- A final point on the interpretation of the transfer pricing rules is that what the transfer pricing rules require is a consideration of the terms that would have been agreed between the two "affected persons" if they had been independent enterprises (see s.147(1) TIOPA). As the OECD guidelines make clear, this requires a "comparison of the conditions in a controlled transaction with the conditions in transactions between independent enterprises" (see [35] above). Where s.152 TIOPA applies, this is also spelt out by reference to the terms that would be agreed at arm's length (s.152(2), see [27] above).

- If a lender acting at arm's length requires a third party to provide support for a proposed loan, whether by covenant, guarantee, security or otherwise, that is properly described as a term or condition that would be stipulated as between the lender and borrower. Put simply, the lender would be saying to the borrower that it will lend only on the condition that the support in question is provided, and no doubt normally only on the basis that the support remains in place during the period for which the loan is outstanding.

- It is self-evident in those circumstances that the existence of that support will be a term or condition of the loan as between the lender and borrower. It is nothing to the point that there may also be a (separate) "provision" as between the borrower and the third party that may itself be subject to the transfer pricing rules, such as a fee payable by the borrower for the provision of a guarantee.

- Of course, this does not mean that any intra-group loan to a thinly capitalised borrower can be treated as being on arm's length terms by hypothesising some form of third party support that does not exist in the actual transaction. As already discussed, the economically relevant characteristics of the actual and hypothetical transactions, and in particular the risks assumed, must be sufficiently comparable.

The expert evidence: HMRC's Ground 1

- As already explained, HMRC's Ground 1 is that the UT erred in holding that the FTT had been entitled to conclude on the basis of the evidence before it that an independent lender would have entered into the Loans subject to it being able to obtain the necessary covenants, and that the covenants would have been forthcoming.

- Despite the carefully put submissions of Ms Choudhury for HMRC on this point, I agree with the UT that the FTT was entitled to reach the conclusions that it did on this issue.

- In summary, Ms Choudhury submitted that the FTT did not address the fact that the experts did not conceive of the covenants in the same terms, and also did not address the point that it became clear during oral evidence that Mr Ashley's conception of the critical covenant in respect of the preference share dividends went no further than the preference share rights, and so could add nothing. In contrast, Mr Gaysford's evidence made it clear that he considered that it would be necessary to go much further.

- While it would have been clearer if the FTT had explicitly addressed differences between the experts about the content of the covenants and spelt out in more detail in its conclusions exactly what covenants it was referring to, it is clear that it preferred Mr Ashley's evidence to the extent that the experts' views differed. It was entitled to do so. Further, large parts of the experts' evidence was agreed: see above. That included, critically, that an arm's length lender would lend $4 bn to LLC5 subject to suitable covenants, and that those covenants could probably have been put in place. Mr Gaysford's concern about "cost and complexity" was, as he clarified in cross-examination, really a point about there being a better commercial alternative, but as the FTT correctly identified Mr Gaysford was wrongly focusing on the position of the BlackRock group as a whole: see [49] above.

- Ms Choudhury's submission that the dividend related covenant proposed by Mr Ashley added nothing to the preference share rights ignores an important point, namely that it would provide the lender with direct contractual rights against LLC6 (and/or, potentially, LLC4) that it would do nothing to frustrate the payment of the preference share dividends. From a lender's perspective that is different to the share rights held by LLC5. Further, Mr Ashley evidently understood that LLC6 could not be compelled to pay a dividend (see [46] above) but nonetheless considered that a covenant of that nature would be critical. If Ms Choudhury's submission was right he would be insisting on something that he knew added nothing.

- Mr Ashley's position on this issue is in fact further, and helpfully, explained in his second witness statement, which the FTT must be taken to have taken into account. That describes three possible versions of what was described in section 14f of the joint statement ([48] above):

"(1) a covenant for the benefit of the third party investors ensuring that LLC6 will pay the preference share dividends to LLC5 in advance of anything paid to holders of the ordinary shares;

(2) a covenant in favour of the third party investors to the effect that no other form of cash distribution from LLC6 to holders of the ordinary shares (e.g. loans or loan repayments) was permitted as a means of subverting the preference share dividends; or

(3) a signed consent and acknowledgement or other appropriate undertaking from LLC4 as the holder of the ordinary shares to the effect that nothing was able to interrupt the preference share dividend payments from LLC6 to LLC5 and / or that it would take no steps to subvert payment of the preference share dividends to LLC5."

- It was therefore clear that the covenants Mr Ashley had in mind were ones that would ensure that the preference share rights were adhered to. That is reflected in section 14f of the joint statement, which as already noted refers to covenants which "ratify" LLC5's position.

Summary

- In summary on the Transfer Pricing issue, I would conclude that deductions for interest on the Loans are not restricted under the transfer pricing rules. I would therefore allow LLC5's appeal on Ground 1, set aside the UT Decision on that issue and re-make it by dismissing HMRC's challenge to the conclusion reached by the FTT. Insofar as the conclusion I have reached relies on evidence before the FTT about the risks assumed in the actual transaction that was not reflected in a finding of fact (see [65] and [66] above) I would make additional findings of fact, pursuant to s.14 of the Tribunals, Courts and Enforcement Act 2007, that accept that unchallenged evidence. I would also dismiss HMRC's challenge to the FTT's findings about the expert evidence (HMRC's Ground 1).

THE UNALLOWABLE PURPOSE ISSUE

Relevant legislation

- The unallowable purpose rule in s.441 CTA 2009 forms part of Part 5 of that Act, which contains the provisions governing the treatment of "loan relationships" for corporation tax purposes. The concept of a loan relationship includes any lending transaction, such as the Loans (s.302). In very broad terms, Part 5 provides for credits and debits from loan relationships to be determined in accordance with generally accepted accounting practice. For a non-trader like LLC5, net profits (that is, any excess of credits over debits) are taxed as non-trading profits. A net loss (being an excess of debits over credits) is a "non-trading deficit" (s.301). Among other things, non-trading deficits are available to be surrendered by way of group relief to offset UK profits of other group members.

- Sections 441 and 442 CTA 2009 relevantly provide:

"441 Loan relationships for unallowable purposes

(1) This section applies if in any accounting period a loan relationship of a company has an unallowable purpose.

…

(3) The company may not bring into account for that period for the purposes of this Part so much of any debit in respect of that relationship as on a just and reasonable apportionment is attributable to the unallowable purpose.

…

(6) For the meaning of "has an unallowable purpose" and "the unallowable purpose" in this section, see section 442.

442 Meaning of 'unallowable purpose'

(1) For the purposes of section 441 a loan relationship of a company has an unallowable purpose in an accounting period if, at times during that period, the purposes for which the company—

(a) is a party to the relationship, or

(b) …

include a purpose ("the unallowable purpose") which is not amongst the business or other commercial purposes of the company.

…

(3) Subsection (4) applies if a tax avoidance purpose is one of the purposes for which a company —

(a) is a party to a loan relationship at any time, or

...

(4) For the purposes of subsection (1) the tax avoidance purpose is only regarded as a business or other commercial purpose of the company if it is not—

(a) the main purpose for which the company is a party to the loan relationship…, or

(b) one of the main purposes for which it is or does so.

(5) The references in subsections (3) and (4) to a tax avoidance purpose are references to any purpose which consists of securing a tax advantage for the company or any other person."

- "Tax advantage" is defined in s.1139 Corporation Tax Act 2010. It is common ground that the deduction of loan relationship debits in respect of interest pursuant to Part 5 CTA 2009 is a tax advantage.

The issues on this appeal in outline

- As already indicated, the FTT decided that, although there was an "unallowable purpose" in the form of a main purpose of securing of a tax advantage, there was also a commercial purpose. It further decided that none of the interest deductions should be attributed to the unallowable purpose on a just and reasonable apportionment, with the effect that they were deductible in full.

- The UT decided that the FTT had erred in applying the reasoning in the well-known case of Mallalieu v Drummond [1983] 2 AC 861, 57 TC 330 ("Mallalieu") in deciding whether there was an unallowable purpose, but nevertheless concluded that there was no material error in the FTT's conclusion that there was a main purpose of obtaining a tax advantage. However, the UT also decided that the FTT did make a material error in its application of the just and reasonable apportionment test, and determined that all of the debits should be attributed to the tax advantage purpose.

- BlackRock agree that the FTT erred in applying Mallalieu but say, as Ground 2 of their appeal, that the UT should not have substituted its own finding of a tax avoidance purpose in the absence of any finding by the FTT that LLC5 actually did have such a purpose. Ground 3 is that the UT erred on the apportionment issue.

- In their Respondent's Notice, HMRC say that the UT erred in concluding that the FTT had been entitled to find that one of the main purposes of LLC5 and the Loans was a commercial purpose (HMRC's Ground 2), and that the UT was wrong to decide that the FTT had misapplied the test in Mallalieu and subsequent authorities (HMRC's Ground 3).

Interpretation of s.442: common ground

- There was a significant element of common ground between the parties in their interpretation of s.442. In particular, both parties accepted that this court should follow a summary by Newey LJ (with whom the other members of the court agreed) in Travel Document Service v HMRC [2018] EWCA Civ 549, [2018] STC 723 ("TDS") at [41], in relation to the predecessor legislation in para. 13 of Schedule 9 to the Finance Act 1996:

"i) A company had an "unallowable purpose" if its purposes included one that was "not amongst the business or other commercial purposes of the company" (see paragraph 13(2) of schedule 9 to FA 1996 );

ii) A tax avoidance purpose was not necessarily fatal. It was to be taken to be a "business or other commercial purpose" unless it was "the main purpose, or one of the main purposes, for which the company is a party to the relationship" (see paragraph 13(4));

iii) It was the company's subjective purposes that mattered. Authority for that can be found in the decision of the House of Lords in Inland Revenue Commissioners v Brebner [1967] 2 AC 18 , which concerned a comparable issue, viz. whether transactions had as "their main object, or one of their main objects, to enable tax advantages to be obtained". Lord Pearce concluded (at 27) that "[t]he 'object' which has to be considered is a subjective matter of intention", and Lord Upjohn (with whom Lord Reid agreed) said (at 30) that "the question whether one of the main objects is to obtain a tax advantage is subjective, that is, a matter of the intention of the parties"…"

- It was also not disputed that, in deciding whether a loan relationship has an unallowable purpose, what matters is the company's subjective purpose or purposes in being a party to the loan relationship in question. In this case that means LLC5's purpose or purposes in being a party to the Loans. The focus can also be narrowed further to LLC5's entry into the Loans, because it is common ground that its purposes in being a party to the loan relationship did not change thereafter.

- The parties were quite right not to dispute the fact that what matters is the company's subjective purpose or purposes in being a party to the loan relationship in question. The purpose or purposes for which a company is a party to a loan relationship may or may not be the same as, for example, the purpose or purposes for which the company exists, or the purpose or purposes of a wider scheme or arrangements of which the loan relationship forms part. Those other purposes may, for example, encompass the purposes of other actors. There is a contrast here between the unallowable purpose rule and the "targeted anti-avoidance rule" introduced by Finance (No.2) Act 2015 as ss. 455B-455D CTA 2009. That rule requires consideration of the main purpose or purposes of "arrangements".

- It was also common ground that for a corporate entity such as LLC5, which can only act through human agents, it is necessary to consider the subjective purpose of the relevant decision makers. Unless they have been bypassed or are effectively acting on instruction, that will normally be the board of directors. The same would apply to LLC5, although strictly its board was termed a "Board of Managers", appointed pursuant to the terms of its LLC agreement. There was no suggestion that the board of LLC5 had either been bypassed or were acting on instruction when they agreed to enter into the Loans.

- In contrast to the UT's conclusion that the FTT should have relied solely on the principles derived from TDS, both parties (rightly) accepted that it was appropriate to consider other case law, and in particular Mallalieu, MacKinlay v Arthur Young McClelland Moores & Co [1990] 2 AC 239, [1989] STC 898 ("MacKinlay") and Vodafone Cellular Ltd v Shaw [1997] STC 734 ("Vodafone"), However, they differed in the application of the principles to be derived from those cases to the facts of this case.

Mallalieu, MacKinlay and Vodafone

- In Mallalieu, Baroness Mallalieu (then Miss Mallalieu) sought tax deductions for the cost of replacing and cleaning the (predominantly black) clothing that she wore in and on her way to court and chambers to work as a barrister. That clothing reflected Bar Council requirements about court dress. On her appeal against the Inland Revenue's refusal to allow those amounts as expenses "wholly and exclusively laid out or expended for the purposes of" her profession, the General Commissioners found that she would not have bought the disputed items but for the requirements of her profession, and that considerations of warmth and decency had not crossed her mind when she did. However, and other than in respect of a collar designed to enable bands to be worn, they dismissed the appeal on the basis that she had a dual purpose, in the following terms (recorded in Lord Brightman's speech [1983] 2 AC 861 at p. 872):

"We consider, in the present case, that when Miss Mallalieu laid out money on clothes for wearing in court her purpose in making that expenditure was to enable her to earn profits in her profession and also to enable her to be properly clothed during the time she was on her way to chambers or to court and while she was thereafter engaged in her professional activity, and in the other circumstances indicated in paragraph 2 we do not consider that the fact that her sole motive in choosing the particular clothes was to satisfy the requirements of her profession or that if she had been free to do so she would have worn clothes of a different style on such occasions altered the purpose of the expenditure which remained the purpose of purchasing clothes that would keep her warm and clad during the part of the day when she was pursuing her career as well as the purpose of helping her to earn profits in that career. We think, therefore, that the expenditure had a dual purpose one professional and one non-professional ..."

- The full version of the Commissioners' case stated appears in the Tax Cases report (57 TC 330). Apart from the comment – inappropriate at least to 21st century eyes – that "Miss Mallalieu is an attractive blonde barrister", paragraph 2 (referred to in the quoted passage above) recorded the Commissioners' findings that the clothes in question were not to her taste, that she virtually never wore them except at or travelling to work, and that she wore them in chambers due to her busy court practice and the likelihood of being required to attend court at short notice. It was also the case, however, that the disputed items were of a kind that others might wear by choice.

- The High Court reversed the Commissioners' decision, holding that the only proper conclusion on the facts was that the sole purpose was to satisfy professional requirements. The Court of Appeal affirmed that conclusion. However, the House of Lords allowed the Inland Revenue's appeal. Lord Brightman gave the leading speech, with which Lords Diplock, Keith and Roskill agreed. Lord Elwyn-Jones gave a short dissenting speech agreeing with the courts below, essentially on the basis that it was not open to the Commissioners to disregard the evidence that they had accepted of Miss Mallalieu's "actual motive and purpose", which was to carry on her profession, other benefits being "purely incidental".

- Lord Brightman described the "wholly and exclusively" test, then in s.130(a) Income and Corporation Taxes Act 1970 ("ICTA 1970"), in the following terms (at p.870):

"To ascertain whether the money was expended to serve the purposes of the taxpayer's business it is necessary to discover the taxpayer's "object" in making the expenditure: see Morgan v Tate & Lyle Ltd. [1955] AC 21, 37, 47. As the taxpayer's "object" in making the expenditure has to be found, it inevitably follows that (save in obvious cases which speak for themselves) the commissioners need to look into the taxpayer's mind at the moment when the expenditure is made. After events are irrelevant to the application of section 130 except as a reflection of the taxpayer's state of mind at the time of the expenditure.

If it appears that the object of the taxpayer at the time of the expenditure was to serve two purposes, the purposes of his business and other purposes, it is immaterial to the application of section 130 (a) that the business purposes are the predominant purposes intended to be served.

The object of the taxpayer in making the expenditure must be distinguished from the effect of the expenditure. An expenditure may be made exclusively to serve the purposes of the business, but it may have a private advantage. The existence of that private advantage does not necessarily preclude the exclusivity of the business purposes. For example, a medical consultant has a friend in the South of France who is also his patient. He flies to the South of France for a week, staying in the home of his friend and attending professionally upon him. He seeks to recover the cost of his air fare. The question of fact will be whether the journey was undertaken solely to serve the purposes of the medical practice. This will be judged in the light of the taxpayer's object in making the journey. The question will be answered by considering whether the stay in the South of France was a reason, however subordinate, for undertaking the journey, or was not a reason but only the effect. If a week's stay on the Riviera was not an object of the consultant, if the consultant's only object was to attend upon his patient, his stay on the Riviera was an unavoidable effect of the expenditure on the journey and the expenditure lies outside the prohibition in section 130."

- Thus, in all but obvious cases it is necessary to "look into the mind" of a taxpayer, and object must be distinguished from effect. Both of those points apply equally to the unallowable purpose rules.

- After considering the wider ramifications of a decision in the taxpayer's favour, Lord Brightman went on to reject the lower courts' conclusion that all that mattered was what was in Miss Mallalieu's conscious mind, and that warmth and decency was merely an incidental effect. He said this (at p.875):