Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties' representatives and BAILII by email. The date of hand-down is deemed to be as shown above.

MR JUSTICE MARTIN SPENCER :

- On Sunday, 15 February 2015 at about 06:45 hours, the deceased, Albino Otero

Rodriguez, to whom I shall refer either as Albino or the deceased, was killed when a collision occurred on the A511 near Burton-on-Trent between a Nissan Primstar mini-bus in which the deceased was a front seat passenger and a Scania articulated goods vehicle being driven on the wrong side of the road. The driver of the Scania vehicle was convicted of causing death by careless driving and liability has not been in dispute. This action concerns the quantification of loss sustained by the estate of the deceased pursuant to the Law Reform (Miscellaneous Provisions) Act 1934 and the value of the dependency pursuant to the Fatal Accidents Act 1976.

The Deceased

- The deceased was born on 16 January 1965. The claimant, Ana Belen Cacheda Chouza, to whom I shall refer as Mrs Cacheda, was born on 13 August 1968 and in 1984, when she was 16 years old, she formed a relationship with the deceased which was to last the rest of their lives. On 22 May 1985, Mrs Cacheda gave birth to Alberto and on 21 December 1985 she and Albino were married. They had 3 further children, David born on 22 September 1989, Lucas born on 30 August 1994 and Ana-Belen born on 1 January 2004. By all accounts, Albino doted on his daughter but that is not to say that he did not have a close and loving relationship with all four of his children: he clearly did. Thus, in his witness statement, David said: "I would say that my father was dedicated to me and the rest of our family he was particularly close to my younger sister."

- In 1988, the deceased set up a business, Excavaciones Sanxenxo S.L. ("Excavaciones") together with a business partner, although the deceased was the driving force behind the business. For many years prior to his death he had been running the business on his own. Excavaciones owned a fleet of HGVs and a quantity of construction plant and provided associated services, leasing out the construction plant (such as excavators and backhoe loaders) and the vehicles together with drivers and operators. The business was successful so that, for example, in 2008 it generated sales of 594,896. However, the profit generated was relatively small. Attached to the expert forensic accountancy report of Ms Amanda Fyffe at Schedule 3 is a summary of the profit and loss accounts for Excavaciones for the years 2008 to 2015. In 2008, the net profit before wages and taxation was 139,503 but after personnel expenses had been taken into account, that is wages and salaries and social security payments in connection therewith, the profit before taxes was only 1,391. David Otero told me that the business was hit hard by the global financial crisis in 2008 which affected the whole of the construction industry in Spain. This is reflected in the summary of the profit and loss accounts which shows that from 2009 the turnover of the company reduced substantially and the company had fallen into deficit with operating losses of over 31,000 in 2009, over 58,000 in 2010, over 70,000 in 2011 and over 41,000 in 2012. At Schedule 4 to Ms Fyffe's report is a summary of the balance sheets for Excavaciones in the same years and this shows the substantial debts owed by the company, with liabilities of 373,606 in 2012. It seems clear that the company was insolvent.

- The deceased did not, however, wind up the company. Its main assets were the vehicles and construction plant which, upon winding up, would be sold to clear the debt so far as possible. However, there was a problem: the company was the holder of an authorisation issued by the Sanxenxo Municipality dated 21 January 2008 ("the transport licence") covering the use of the vehicles and construction plant, but by Article 26 of Order FOM/2185/2008, under Spanish Law if a transferor wished a transferee of the vehicles to have the benefit of the transport licence, it was necessary to have been the holder of the transport licence for at least 10 years. I understand that the vehicles and equipment are significantly more valuable if transferred with the benefit of a transport licence. Thus, I was told by David Otero that his father planned to wind up Excavaciones in 2018 by when the company would have been the holder of the transport licence for 10 years and when, accordingly, the assets of the company would realise their full value. David Otero said in his witness statement that the word he would use to describe his father would be "honourable". He described his father as being very well liked and respected in their town as shown by the attendance at the deceased's funeral numbering over 2,000 people and including the mayor and other politicians. I was told that the deceased, being honourable, wanted to pay off the external debts of the company leaving only the family as creditors and, to do this, he needed to keep the company going and preserve its assets, these being by 2018 six items of construction plant and two lorries, until 2018 when the transport licences could be transferred with the equipment.

- On 1 October 2012, the deceased, acting through Excavaciones, entered into a contract with Andeona Solucions SL ("Andeona"), a company working internationally in the construction industry, to provide his services as both a "palista" which I understand to mean the operator of construction plant such as excavators and backhoe loaders, and also as a lorry driver, transporting material from the central headquarters of Andeona to the different works and back. The plant and transport for use by the deceased were to be provided by Andeona. The price of the contract was agreed to be 250 per day net of Value Added Tax. Thereafter, the income and turnover for Excavaciones was, as I understand it, principally generated by the provision of the deceased's services to Andeona. This meant that the other activities of Excavaciones could cease, or at least reduce, and although the company continued to operate at a loss, this was much reduced, particularly because the wage bill was reduced with the laying-off of workers, namely those who had been operating the six items of construction plant and driving the two lorries. David Otero told me that it was necessary to maintain the plant and lorries in good condition until they could be sold and that it was therefore necessary for the company to continue to incur expenses on fuel and maintenance.

- From October 2012, the deceased's work for Andeona took him not just around Spain but also abroad to Romania, Italy and eventually England. The claimant, Mrs Cacheda, said in evidence that the pattern was that the deceased would work for two months abroad and then come home for two to three weeks. When at home, she said he would only do a little work on company business because there was not much work available. Ms Veronica Miguez Magdalena, the managing director of Grupo Hedomin of which Andeona is a part, told the court that whilst working abroad, the deceased would commonly work six days out of seven and had all his expenses paid including his hotel on full board. The company would also pay for his hotel on any days he was away but not working. In her report, Ms Fyffe uses the turnover of Excavaciones for 2014 of 67,708 to calculate that, on the basis this income was wholly generated by the deceased's work for Andeona, this represents 271 days worked at 250 per day, and this forms a principal component of the dependency claim. I consider from paragraph 28 below whether this is a reasonable basis upon which to proceed.

- When at home, the deceased was described by his wife as the 'lynchpin' of the family, undertaking all DIY, maintenance and other tasks. She said that he would take care of all the plumbing and electrics at home so that they never had the need for professionals and if there was something particularly complex, there was always someone in the family who could lend a hand. There was also a substantial parcel of 1900 m² of land adjoining the house which was used as a garden and to grow vegetables, keep chickens and a pig. Mrs Cacheda said that her husband did most of the work in the garden: they would grow tomatoes, peppers, leeks, onions, spinach, strawberries, potatoes and other vegetables and there was also an orchard with orange, lemon and apple trees. In addition, they owned 3000 m² of land close to the home in four separate parcels which was not cultivated but just grassed. Mrs Cacheda said that her husband would tend to this land by cutting the grass. The character of the deceased portrayed by Mrs Cacheda and the other members of the family was of a man who worked very hard, both when away working and at home, who had little leisure time, and who was dedicated to his family. She said:

"Albino was at his happiest when sat at our kitchen table, with a glass of wine and preparing barbecue for family and friends."

She described him as frugal, spending very little on himself, even to the extent of wearing his son's old clothes rather than spending money on himself. She said he had no particular hobbies or sports to spend money on.

- Finally, in relation to the deceased, it is relevant to note that, at about the age of 22, he was diagnosed as suffering from ulcerative colitis. This led to the deceased receiving an ill-health/disability pension of 4,647.12 per annum pursuant to articles 193-200 of the Spanish Social Security General Law. The expert in Spanish law instructed on behalf of the claimant, Ms Ana Romero, stated in answer to Part 35 questions:

"In attendance to the above articles, the Permanent Contributory Disability is the situation of the worker who, after having undergone the prescribed medical treatment, present severe anatomical or functional reductions, subject to objective determination and which remain foreseeably [permanent],that decrease his/her work capacity in the minimum of 33% having contributed to the Social Security during at least 800 days for the 10 years preceding the incapacitating event.

I confirm that in accordance with article 200 the beneficiary of the disability pension shall be subject to regular medical reviews, the timing of which will be determined by the Spanish Social Security in its resolution about the disability pension."

Despite suffering from this condition, the deceased was described by his family as having been in rude good health at the time of his death with the only limitation on his activities being an inability to carry out heavy lifting. Mrs Cacheda said that the condition had arisen as a result of stress but that as he got older, the deceased was able to manage the condition better, controlling it through diet, keeping hydrated and sleeping. He had not consulted a doctor about the condition since 2013 and had not needed hospital treatment since he was in his 20s. The defendants make the point that this seems inconsistent with the deceased's continued receipt of a disability pension that assumes a 33% reduction in work capacity, particularly when Mrs Cacheda, stated in evidence that the deceased needed to go back for assessment once a year.

The Family

- Mrs Cacheda described herself as a housewife at the time of the accident and not formally employed. As for the children:

- Alberto was aged 29 at the time of his father's death and had left the family home to live with his girlfriend. They live near the family home and Alberto is a self-employed owner and manager of a garage which repairs and sells cars. He had been supported by the deceased, both personally and financially, in setting up the business. He says: "I was not financially dependent on my father at the time of the accident, but he did help me with DIY and other tasks that I would otherwise have paid for. He would also provide me with gifts as any loving parent would."

- David was aged 24 at the time of his father's death, and was living and working in Madrid as a trainee Financial Adviser for Deloitte. When his father died, David took leave of absence from Deloitte and returned home to look after his mother and sister and take over the management of Excavaciones. Although he returned to Deloitte in September 2015, he claims that his career trajectory was adversely affected and he makes a dependency claim for his loss of earnings which is considered further in paragraph 57 et seq below.

- Lucas was aged 20 at the time of his father's death and was studying to be a heating engineer, doing an internship. He considered himself compelled to abandon his studies and internship in order to assist David with Excavaciones and he similarly makes a dependency claim based on his loss of earnings.

- Ana-Belen was aged 11 when her father died and was a schoolgirl. She is described by her mother as bright and studious and has an ambition to study equine veterinary medicine in Madrid. It is the claimant's case that the deceased would have continued to maintain her through her studies, paying for her tuition fees and accommodation expenses.

Disclosure

- Mrs Cacheda, Alberto, David and Lucas all gave evidence to the court by video link and with the assistance of an interpreter. Despite these limitations, I was able to assess them as witnesses and I can indicate that they all came across as wholly honest, straightforward and reliable witnesses who were doing their best to assist the court. There is, however, an issue that arises in this case over the alleged failure on the part of the claimant to obtain, produce and disclose relevant documentary evidence, and this lacuna in the evidence has formed an important part of the submissions by Mr James on behalf of the defendants. He subjected David, in particular, to searching cross-examination about the efforts David had made to secure relevant documentation and the answers to those questions led Mr James to suggest to David that he had engaged in a "campaign of deliberate concealment" of relevant documents from the court and from the defendants. Mr James also asked the court to draw adverse inferences from the claimant's failure to make proper disclosure.

- The documents in respect of which it is said that there has been inadequate disclosure come in the following categories: the deceased's bank statements; the deceased's tax returns; the deceased's Spanish Social Security records; the deceased's medical records. These were all addressed by David Otero in his evidence. He said that he and his mother were told by the bank manager that the deceased's bank account had been closed and the bank was unable to help. He and his mother also had a face-to-face appointment with the relevant Spanish public body responsible for tax returns and they were told it would not be possible to provide his father's confidential information. In relation to the Social Security records, they were told that these could not be provided as the deceased had been de-registered due to his death and there was no way to get hold of the records. Finally, they spoke with the family doctor and were only provided with the brief Health Report dated 17 October 2017 from Dr Cesar Garcia (page 374 of the bundle).

- It may well be that further, additional efforts could have been made to secure relevant further documentation. For example, the claimant's solicitors could have engaged a lawyer in Spain to assist in obtaining disclosure from the authorities, rather than leave David and his mother to their own devices. Mr James submitted, reasonably, that if it were true that David and his mother were being told by the various authorities that they could not assist, he would have expected there to have been some kind of documentary confirmation of this. In a statement dated 15 April 2021, Mr John Bates, the claimant's solicitor, accepted that he should have insisted on some proof that the documents in question could not be obtained, stating "but David explained that the meetings were face-to-face and that any such negative declaration was not going to be forthcoming from the relevant Spanish institutions."

- However, more fundamentally, in my judgment this should all have been sorted out and dealt with by the parties well before trial and if the defendants were dissatisfied with the disclosure that had been made, they could and should have applied to the Master for appropriate orders to be made. In Promontoria (Oak) Ltd v Emanuel [2020] EWHC 104 (Ch), Marcus Smith J stated:

"A trial is a culmination of a process. That process involves identifying and framing the issues between the parties, and then ensuring that proper disclosure of documentary evidence appropriate to the resolution of those issues takes place. Generally speaking, the issue of a party's failure to produce an original ought to be raised and resolved well-before trial. The English courts have established procedures, taking place well before trial, to flush out the points parties are taking in relation to documents. Thus, for instance, the fact that a party is contending that a certain document is a forgery will not (absent wholly exceptional circumstances) be raised for the first time at the trial itself. There will have been anterior debate about the precise allegation being made, and the mechanism (for instance, the use of handwriting experts) whereby the allegation of forgery is to be resolved. When considering the best evidence rule, a trial judge will, plainly, take into account the interlocutory steps that have, or have not, been taken by the parties in bringing their dispute to trial."

Although, as is apparent from this passage, that case was one which concerned the "best evidence" rule and which is therefore not directly on point, it seems to me that the principle is of universal application, namely that the court expects the parties to have taken the necessary steps to resolve issues over documents well before trial, and would certainly expect a defendant to have done so before accusing a claimant (or witness for the claimant) of having conducted a campaign of deliberate concealment. Having found, as I have, that David Otero was an honest and straightforward witness who was doing his best to assist the court, I have no difficulty in rejecting any suggestion that he had deliberately suppressed any documents and I take the view that I must decide this case on the basis of the evidence that I have even if, in some regards, that evidence is not as complete as I (and the defendants) might have wished it to be.

The Claim

- The claim in this case consists of the following heads of loss:

(i) Under the Law Reform (Miscellaneous Provisions) Act 1934, PSLA, interest, funeral and other expenses, and increased liabilities;

(ii) Under the Fatal Accidents Act 1976, past loss, bereavement, past financial dependency, Alberto's dependency, David's dependency, Lucas' dependency, past DIY and maintenance, past care of family land and garden, future financial dependency, court resolution, future DIY and maintenance, future care of family land and garden, future loss of intangible benefits. Ana-Belen's dependency is accepted to be subsumed within the general claim for future dependency.

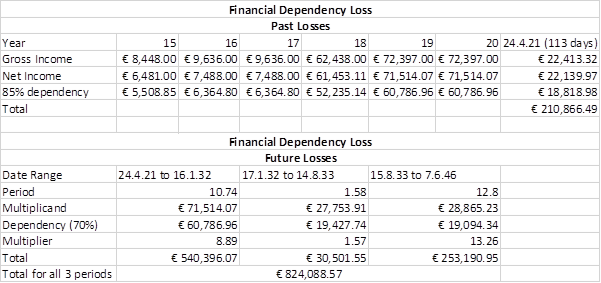

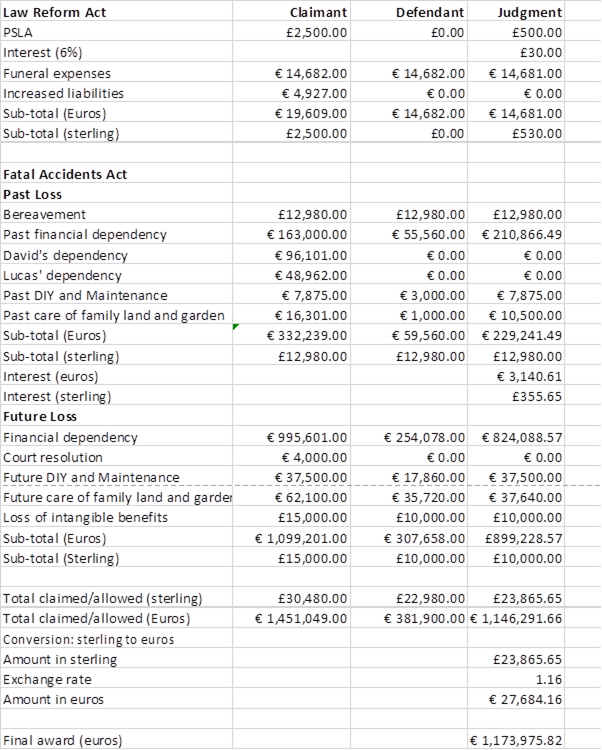

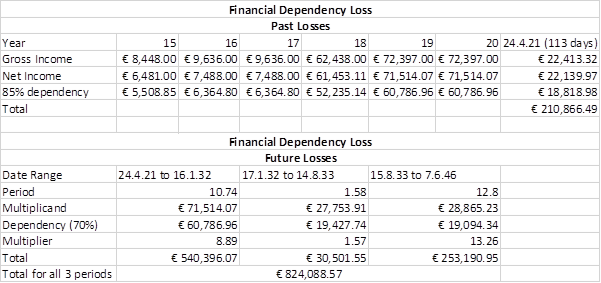

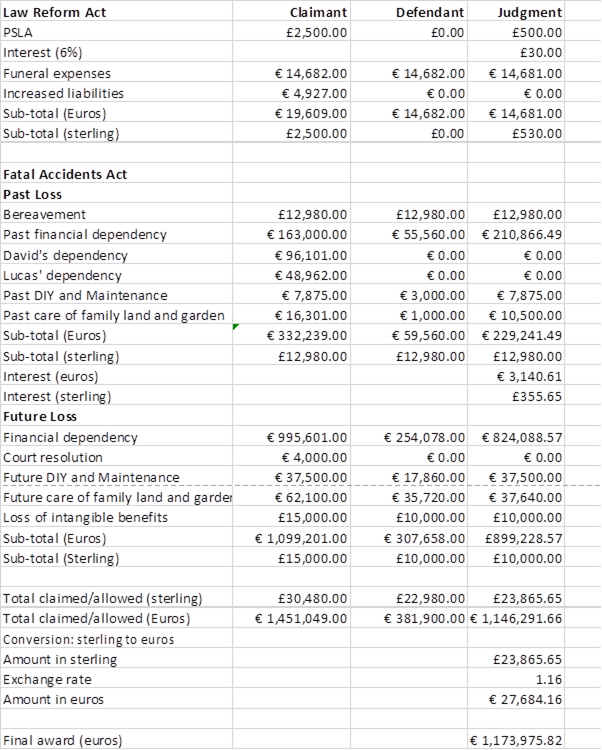

Of these, the only agreed items are for bereavement (£12,980) and funeral and other expenses (14,682). The parties' respective contentions in respect of the damages to be awarded are represented in the following table (agreed heads in italics):

|

Law Reform Act |

Claimant |

Defendants |

|

PSLA |

£2,500.00 |

£0.00 |

|

Funeral expenses |

€ 14,682.00 |

€ 14,682.00 |

|

Increased liabilities |

€ 4,927.00 |

€ 0.00 |

|

Fatal Accidents Act | | |

|

Past Loss | | |

|

Bereavement |

£12,980.00 |

£12,980.00 |

|

Past financial dependency |

€ 163,000.00 |

€ 55,560.00 |

|

David's dependency |

€ 96,101.00 |

€ 0.00 |

|

Alberto's dependency |

€ 10,962.00 |

€ 0.00 |

|

Lucas' dependency |

€ 48,962.00 |

€ 0.00 |

|

Past DIY and Maintenance |

€ 7,875.00 |

€ 3,000.00 |

|

Past care of family land and garden |

€ 16,301.00 |

€ 1,000.00 |

|

Future Loss | | |

|

Financial dependency |

€ 995,601.00 |

€ 254,078.00 |

|

Court resolution |

€ 4,000.00 |

€ 0.00 |

|

Future DIY and Maintenance |

€ 37,500.00 |

€ 17,860.00 |

|

Future care of family land and garden |

€ 62,100.00 |

€ 35,720.00 |

|

Loss of intangible benefits |

£15,000.00 |

£10,000.00 |

The Issues

- At the start of the trial, I was presented by Mr Swoboda, for the claimant, with a helpful list of issues for the court to decide, as follows:

PSLA

(1) Should any award (and if so in what sum) be made for the deceased's pain suffering and loss of amenity?

Financial Dependency

(2) Would the deceased have closed Excavaciones in 2018 upon the transport licence becoming transferrable?

(3) Would the deceased have worked for Andeona upon, or around the time of, the closure of Excavaciones?

(4) Would the deceased's earnings of 250pd have been net or gross?

(5) How many days per year would the deceased have worked, 271 or something lesser?

(6) Would the deceased have retired at age 70?

(7) Would the deceased have received the full or average state Spanish pension, and would the Claimant's pension have been the minimum non-contributory pension?

(8) Is the appropriate dependency ratio, to take into account the deceased's expenditure solely on himself, 90% pre-retirement and 75% post-retirement or should the court use the conventional 75% with dependent children and 66% with no dependent children?

Dependency of Alberto, Lucas and David

(9) Do these dependency claims fall within the scope of s3(1) of the Fatal Accident Act 1976 and are they recoverable in law?

(10) If the dependency claims of David, Lucas and Alberto are recoverable in law what is the loss?

Dispute on other heads of loss

(11) Are the increased liabilities flowing from the deceased's death recoverable in law?

(12) Are the costs of obtaining a court resolution in Spain to ensure the award is not subject to taxation in Spain recoverable in law?

(13) What is the quantification of the family's dependency on the deceased in respect of DIY and maintenance?

(14) What is the quantification of the family's dependency on the deceased in respect of the family land and garden?

(15) Is a claim for loss of intangible benefits are recoverable in law and, if so, should an award be made to C and all four of the deceased's children, or C and the youngest child only; and what is the quantification of the award for each dependent?

- Resolution of these issues will enable me to assess the damages to be awarded in this claim and I shall consider each of them in turn before making my awards in relation to each of the recoverable heads of loss.

Issue (1): Should any award (and if so in what sum) be made for the deceased's pain suffering and loss of amenity?

- There is, before the court, an agreed report from Mr Christopher Phillips, a Consultant in Emergency Medicine. This report contains a description of the accident derived from the statement of the driver of the minibus, a Mr Rivas:

"4.1 The index road traffic accident occurred on the morning of 15 February 2015 when a group of 9 workers were travelling in a minibus from their hotel to their place of work.

They had left the hotel between 6:20 and 6:25am. Mr Rodriguez was sitting on the front seat at the right of the vehicle where the driver would sit in a right-hand drive vehicle.

4.2 Mr Rivas states that he was travelling at 60 to 65 kph around a left curve in the road, when he became aware of a vehicle approaching from the opposite direction. Mr Rivas states that at this point in the road, there were double solid white lines indicating that vehicles should not cross these lines. Mr Rivas states that Mr Rodriguez shouted something like "be careful, he is coming towards us". Mr Rivas realised that the vehicle approaching from the opposite direction was on the wrong side of the road, coming directly towards them: he states that he realised that it was a large lorry; he estimates it was around 40 metres in front of the minibus when he first saw it.

4.3 Mr Rivas said he steered towards the left in an attempt to avoid the collision, but thought that he did not have time to brake.

4.4 The lorry collided with the minibus: at the point of impact, Mr Rivas states that the lorry was entirely in his lane. The impact caused severe damage to the minibus; the windscreen smashed and the airbags deployed.

4.5 Mr Rivas said that he and the middle front seat passenger climbed out through the broken front windscreen. Mr Rivas states "I saw that Albino was very bad and was trapped in the vehicle. I saw the others in the back getting out." He later states "I soon realised that Albino was dead."

In the summary and opinion of the report, Mr Phillips states:

"6.3

It is conceivable that despite his serious injuries, Mr Rodriguez may have remained conscious for a short period following the head injury but if that was the case, I would have expected the minibus driver to have noticed that there were signs of life: he states that he and the other front seat passenger climbed out through the front windscreen and although not stated, he implies that Mr Rodriguez made no effort to extricate himself from the minibus. On the information provided, and in the absence of a post-mortem report, I would therefore conclude that it is more likely than not that Mr Rodrigues was killed instantly at the point of impact.

7.2 It is my opinion that Mr Rodriguez would have been aware that a severe collision was inevitable for a period of between one and five seconds before the impact. I believe that this is more likely than not that Mr Rodriguez would have experienced intense fear during this short period prior to the impact.

7.3 I believe that it is more likely than not that Mr Rodrigues died instantly at the point of impact. On the assumption that Mr Rodrigues died instantly, I do not believe that he would have been conscious of any pain for more than a split second."

- For the claimant, Mr Swoboda submits that the deceased would have been aware of the approaching lorry and the impending impact and that this must have given rise to mental anguish which is compensable. He also suggests that the deceased must have had a period of physical suffering given the violence of the collision. He contends for an award of £2,500.

- For the defendants, Mr James submits that intense fear does not amount to pain or suffering or loss of amenity and therefore no award falls to be made under this head of claim. He submits that fear on its own does not translate into actionable damage and draws an analogy with a pedestrian who is nearly run down at a pedestrian crossing, who has no claim for personal injury.

Discussion

- In my judgment, there is a distinction to be drawn between mere fear or anguish on its own and fear or anguish in association with physical injury. Although the deceased's death followed very quickly after the physical injury, nevertheless physical injury was sustained, and the expression "pain, suffering and loss of amenity" should be taken to include the fear and mental anguish which precedes physical injury. I therefore agree with Mr Swoboda that compensable damage was sustained in this case. However, I consider that the sum claimed of £2,500 to be much too high for a maximum of 5 seconds of mental anguish and fear followed by almost instantaneous death. In my judgment, the appropriate sum to be awarded is £500. Interest on the sum from the date of service of the proceedings (25 May 2018) to the date of this judgment (25 May 2021), a period of 1096 days, amounts to £30 at 2% per annum.

Issue (2): Would the deceased have closed Excavaciones in 2018 upon the transport licence becoming transferrable?

- I have referred, in paragraph 4 of this judgment, to the evidence of David Otero that his father intended to close down Excavaciones in 2018 once the transport licence became transferable and when the assets of the company could be realised for their full value.

- For the defendants, Mr James submits that an analysis of the profit and loss accounts and balance sheets of Excavaciones for the period between 2008 and 2015 shows a different story. He submits that it can be seen from the operating expenses being incurred that the deceased was still operating his hire business through Excavaciones right through to the time of his death. Thus, the company continued to incur expenses for supplies which would not have been needed were the company stagnant. He identifies that in the six years to 2014, the company had losses of 227,801 and in the same period also paid down debt of 108,373, a total deficit of 336,174. There are movements in the balance sheet to compensate so that, for example, tangible assets reduce from 370,389 to 261,306, and the movements may represent the sale of 1 or two items of plant or vehicles, or be the result of an accounting device. Mr James further submits that detailed examination of the accounts shows a pattern which is inconsistent with the claimant's case that the deceased wished to pay off his debts, when what happened was that debts to secured creditors were being paid off, with those debts being transferred to unsecured creditors.

- On the evidence before the court, Mr James submitted that there were a number of reasons for the court conclude that the deceased had no intention of winding up Excavaciones:

(i) By reference to the profit and loss accounts and balance sheet of the company, Excavaciones had been insolvent for a number of years prior to the death of the deceased, and yet he had not wound up the company.

(ii) Since 2009, the net profits before taking into account wages and taxation had been insufficient to pay the wages. 2013 or 2014 would have been the "pinch point" to wind up the company but it was not done.

(iii) From October 2012, the deceased had the benefit of the revenue stream from his contract with Andeona suggesting that, having survived the worst years, he had resolved to carry on with the company.

(iv) There was a risk to the deceased arising from the need to re-negotiate his contract with Andeona (the contract having been made through Excavaciones) if the company was wound up.

(v) There were no personal guarantees in respect of the liabilities of Excavaciones, only loans secured on the vehicles themselves. The other main asset of the company was some commercial premises which were mortgaged, and all that the deceased needed to do to avoid that assets be seized was to raise sufficient money to discharge the mortgage which he was well able to do.

- Mr James further submitted that the point about the transport licence was a false one because it is not the vehicles which could be sold until the licence had been held for 10 years, but the authorisation. Thus, Mr James suggested that the vehicles could have been sold to buyers who already had a transport licence or who did not intend to use the vehicles in Spain.

- Mr Swoboda relied principally upon the evidence of the claimant, David Otero and Alberto Otero that the deceased had made it plain when still alive that he planned to wind up the business when permitted by law to transfer the licences with the commercial vehicles. He submitted that the vehicles had significant value transferred with the benefit of the transport licence and had realised 102,559 when sold in 2018.

- Mr Swoboda relied upon the undisputed evidence of Ms Romero, the expert in Spanish law, who stated in answer to Part 35 questions as follows:

"1. With regards to Article 26 of the Order FOM/2185/2008 of the 23 July which relates to the amount of time (10 years) a commercial vehicle licence holder needs to wait before being able to sell the commercial vehicles held under the licence(s):-

a. I confirm that a single licence is granted to own/operate commercial vehicles. This is not granted in respect of each vehicle.

b. I confirm that a licence holder needs to wait 10 years from the date of grant of the licence to be able to sell the commercial vehicles to which this applies."

This answer was in response to the following question raised by the claimant's solicitors:

"1. In paragraph 20.9 & 20.10 of your report you have referred to Article 26 of the Order FOM/2185/2008 of the 23 July which relates to the amount of time (10 years) a commercial vehicle licence holder needs to wait before being able to sell the commercial vehicles held under the licence(s). Please could you clarify whether:

a. a single licence is granted to own/operate commercial vehicles or whether a licence is granted in respect of each vehicle?

b. a licence holder needs to wait 10 years from the date of grant of the licence (or alternatively the first licence) to be able to sell the commercial vehicles or whether they need to wait 10 years in respect of each vehicle?

a. i.e. If one vehicle is bought in 2005 and another in 2010 does the licence

holder need to wait until 2015 to sell both vehicles or can the second vehicle only be sold in 2020?"

There is, however, a difficulty with this. In the English version of Miss Romero's report (which appears to have been rather poorly translated), she said at the relevant paragraphs as follows:

"20.9 I understand that Mr Albino Otero had decided to keep his own company running instead of accepting an employed role with Andeona Solutions during the time he was required to keep the company and the vehicles owned by it.

20.10 In this sense under Article 26 of the Order FOM/2185/2008 of the 23rd July, the transferor of the transport licences, which were to be transmitted with the transport vehicles, must be the holder of the licences that he intends to transmit for not less than 10 years."

Thus, in her report, Miss Romero had correctly and accurately referred to the fact that Article 26 governed the transfer of the licences, not the vehicles and was arguably misled by the way that the question was put in referring to the ability to sell the commercial vehicles, which was carried through into her Part 35 answer. Thus, Mr James was, as it seems to me, right to submit that the vehicles could have been sold without the benefit of the transport licence. What he was not able to say, because there was no evidence about it, was by how much the value of the vehicles would be enhanced if sold with the benefit of the transport licence compared to without that benefit. In that regard, David Otero said, in answer to a question in cross-examination, "nobody would want to buy a lorry without a licence."

- In relation to the evidence that the company had continued to incur expenses by way of "supplies", Mr Swoboda relied upon the evidence of David Otero that the vehicles or plant that were not to be sold until 2018 needed to be maintained so that they would be in good condition when the time came for them to be sold. This would involve, for example, the engines needing to be turned over on a regular basis so that they did not seize up and for this purpose continued supplies of fuel and oil were needed. David Otero's evidence was that, by 2014, there were no employees other than his father working for Excavaciones, the last employee having been laid off towards the beginning of 2013.

Discussion

- Having heard the evidence of the family, and having considered the documentary evidence available in this case, I am left in no doubt that it was indeed the intention of the deceased to wind up the company in 2018, once the transport vehicles could be sold with the benefit of the transport licence, and that is what he would have done had he not been killed. In the course of Mr James' submissions, I challenged him on whether the "pinch points" to which he referred had indeed been in 2013/2014. The summary of the accounts attached to Ms Fyffe's report at schedule 3, should the following losses before tax rebates (in Euros):

2009: 40,457

2010: 76,895

2011: 93,126

2012: 54,316

2013: 25,404

2014: 9,141

What this shows, was that the real pinch points were in 2010 and 2011, as Mr James acknowledged and accepted. The question arises: why did the deceased not wind up the company then? This would have been the logical time to have done so, absent other factors. In my judgment, those other factors are significant: first, the deceased was able to mitigate the losses by winding down the activities of Excavaciones, in particular by laying off employees; second, he secured regular and valuable income for the company by entering into the contract with Andeona on 1 October 2012. The effect was to enable him to keep the company going and to reduce the losses significantly (down to only 9,141 in 2014) until the time came when, as he intended, the assets of the company could be sold for their full value in 2018. I accept the evidence of the family that the deceased was an honourable man who would have wanted to see the external debtors of the company paid off. Finally, and perhaps most significantly of all, upon the death of their father, David and Lucas Otero did in fact themselves keep the company going until 2018 when the assets were sold, the debt was paid off and the company was wound up. In my judgment, in doing so, their actions reflected the intentions of their father which they were honouring otherwise, they would surely have wound up the company immediately upon the deceased's death in 2015.

Issue (3): Would the deceased have worked for Andeona upon, or around the time of, the closure of Excavaciones?

Issue (4) Would the deceased's earnings of 250pd have been net or gross?

Issue (5) How many days per year would the deceased have worked, 271 or something lesser?

- It is convenient to take these three issues together. In relation to them, the claimant called evidence from Ms Veronica Miguez Magdalena ("Ms Magdalena"), the managing director of Andeona's parent company. In her witness statement, Ms Magdalena said that if Andeona's agreement had not been structured via Excavaciones, then the deceased would have been offered a standard employment contract at the rate of 250 per day net, not including expenses. In cross-examination, Ms Magdalena confirmed that Andeona paid for the deceased's hotel bills on a full board basis. She said that, but for his death, the deceased would have continued to work for them as long as they had work. In that regard, there had been no shortage of work, even during the Covid-19 pandemic which had not affected her group of companies which was still operating 100%. Ms Magdalena paid full tribute to the deceased as a worker and contributor to the company, saying:

"I don't know what the future would have held if the deceased had survived but we would have paid whatever it took to keep him on because he was such a valued contributor to the company."

Mr James challenged Ms Magdalena as to whether, if employed, the deceased would have been paid 250 per day net but, whilst acknowledging this would have been more expensive for her company, she maintained that is what they would have done saying:

"If an employee, he would still have got 250 a day and we would have paid the tax on top. He was a very good contributor and that is why we would have been willing to pay that amount of money."

To avoid any doubt, she said it would have been 250 net in hand, with her company paying the tax and social security contributions. When Mr James put that this would have been very expensive for the company she replied:

"It is difficult to say what an employee is worth, but if you are talking about his professional value, it was worth paying this extra for him."

Mr James suggested that it would have made better economic sense for her company to contract with the deceased through a new company to which she replied:

"I don't know what could happen in the future. The intention was for him to continue to work for us."

She said that they had other employees in a similar situation to the deceased. Even if the deceased were working for the company in Spain, the same terms would have prevailed because the work would not have been based in Galicia where the deceased lived but in other parts of Spain thus requiring him to stay away in hotels.

- With regard to Ms Magdalena's evidence about the deceased's reliability and work ethic, this echoed and resonated with the evidence of the claimant and the other members of the family that the deceased was a very hard worker. One can well understand the attraction of such a man as the deceased to Andeona: he was a mature man, aged 50, who knew the construction industry well and had run his own company, for many years very successfully. He was a responsible, family man who had been a reliable worker for Andeona. He was the sort of man who would take responsibility for his own work and, one would have thought, the work of others where required, taking a leading role and setting a good example. It seems to me that the deceased was just the kind of worker that an employer would have wanted to retain and it came as no surprise to me that Ms Magdalena said that her company would have paid whatever it took to keep him.

- In his closing submissions, Mr James suggested, somewhat faintly, that the deceased might not have wanted to continue to work for a company which meant him being away from home, working in countries such as Romania, England and Italy, but he acknowledged that by 2018 the deceased would have been working for Andeona for 5½ to 6 years, he had an existing relationship with them and was clearly a well-regarded worker. In any event, the claimant said that her husband was happy working abroad because he was able to meet his payments and found the work satisfying. She said "it was not the right time for him to return home: he wanted to work hard as long as his body could cope with it. He loved to work and to provide for his family." Mr James put to the claimant that by, say, the age of 60 the deceased would have wanted to return to Spain, take it more easy and then retire a few years later but the claimant was not having it: she said "he was always thinking about his children and would have wanted to help them with their work, their projects and so on. Even though children grow up, they still have their projects, their dreams and he wanted them to have a very good life."

- In his submissions, Mr James forcefully contended that it was unlikely in the extreme that Andeona would have paid the deceased 250 per day net as an employee. He produced calculations showing what the gross cost to Andeona would have been to have employed the deceased on a net salary of 67,750 per annum. The income tax would amount to 38,890 and the social security payments would have been 17,704 which, if added to the 67,750 been paid net to the deceased would have cost the company 124,344. Mr Swoboda criticised these calculations on the basis that they did not take into account tax codes, but even using just the sum of 106,640, Mr James submitted that this would have been very expensive for the company, it would have put pressure on them to pay the other employees the same once the word about the deceased's remuneration got out and such salary is inherently unlikely when in 2018 the average wage for a Spanish male was 29,354. He submitted that from 2012 until his death, the deceased had been content for Excavaciones to receive the payment as a gross payment, being responsible for any tax payable upon the sums paid by Andeona and it is likely that the deceased would have been content to continue on the same arrangement.

- So far as issue 5 is concerned, the claimant's case was based upon Ms Fyffe's calculations derived from the turnover of Excavaciones in 2014 of 67,708, which would represent 271 days worked at 250 per day. This also accorded with the evidence of the claimant who referred to a pattern of working whereby the deceased would work away for 2 months and then come home for 2 to 3 weeks. There were longer holidays at Christmas and in the summer. Furthermore, on 23 April 2021, Ms Magdalena sent to the claimant's solicitors an email regarding the evidence she had given on Friday, 16 April 2021 in which she said:

"I indicate that Mr Albino Otero's working days per year would be around 270 days/year. Let me explain when we work outside the locality (outside Galicia) there are 45 days of working and 5 days off, in addition they would have 2 annual breaks of 30 days each."

- For the defendants, Mr James submitted that the most reliable guide to what the deceased would have earned had he not been killed is what he was actually earning from Andeona at the time of his death. After she had finished giving evidence, Ms Magdalena had also produced the invoices to which she had access showing how much Excavaciones had billed Andeona for the deceased's services. He submitted that these showed that in 2013 the deceased earned 31,750 and in 2014 he earned 46,750, the average of these being 39,250. He further submitted that the invoices illustrate the number of days per annum which the deceased worked for Andeona, namely 127 days in 2013 and 187 days in 2014. He submitted that the number of days charged in each invoice would suggest that the deceased had not in fact had an appetite for working 45 days with 5 days off in each block as suggested by Ms Magdalena in her email. He challenged the suggestion by Mr Swoboda that there were missing invoices and submitted that the court should be guided by the documentary evidence which is the most reliable guide to the deceased's earnings. The defendants' case is that the court should find that after the company would have been wound up in 2018, the deceased's earnings would have been between 29,354 gross (the average earnings for a Spanish male) and 39,250 gross, the net figures being 21,257 and 26,533 respectively.

Discussion

- So far as issue (3) is concerned, I have no difficulty in finding that the deceased would have continued to work for Andeona upon the winding up of Excavaciones. This was good work within the deceased's field of expertise for an established company which could provide him with work reliably and regularly. The deceased had established an extremely good working relationship with Andeona and for all the reasons stated by the claimant and her family, I have no doubt that the deceased would have stayed with Andeona, probably until retirement. Furthermore, I consider it likely that he would have become an employee. This relationship provides security for both sides: it shows commitment by the company to the worker and vice versa, as well as providing the employee with legal protection. I can see no logical reason why the deceased would have wanted to start another company purely for the purpose of providing a corporate vehicle for the payment of his earnings.

- So far as issue (4) is concerned, despite Mr James' able submissions, the evidence to which I have referred at paragraphs 29 and 30 above convinced me that, despite the cost to Andeona, they would have been prepared to pay to the deceased 250 per day net with all his other expenses paid, even as an employee, and that this is what would have been agreed.

- In relation to issue (5), I was not convinced that the invoices produced by Ms Magdalena did in fact cover all the work done for Andeona by the deceased before his death. In her accompanying email, Ms Magdalena referred to them as being "some" of the invoices and stated: "I cannot confirm that they are all there because in Spain accounts only have to be retained for 4 years and I don't have access to all the accounts of all the companies of the business group." In any event, as an employee, the deceased would have been contractually bound to work the days specified in any agreement with Andeona. In this regard, Ms Magdalena's evidence that when working outside the locality there are 45 days of working and 5 days off with two annual breaks of 30 days each would, as it seems to me, have formed the basis of the contract of employment. Thus, whatever the deceased may in fact have worked in 2014 and 2013, I find that from 2018 he would have worked 270 days per year and he would have been paid 250 per day net with annual net earnings of 67,500. I find that the deceased would indeed have had an appetite for such a working pattern: his character was as portrayed by Mrs Cacheda, namely that of a hard-working man who lived for his family and would have done all in his power to provide for his family. He would have been bruised by the experience of what had happened with Excavaciones, he would not have wanted himself or his family to be exposed to such a risk again and he would have seized with both hands the opportunity to work for 270 days a year at these rates. This would have enabled him to rebuild the family finances and provide in due course for his daughter if and when she embarked upon her stated ambition to become an equine veterinary surgeon.

Issue (6): Would the deceased have retired at age 70?

- In her witness statement, Mrs Cacheda said: "My husband would have worked until age 70, though I imagine he would have wanted to continue to work if he was able to. Both myself and our youngest children would remain financially dependent on him until retirement, and for me, after retirement." Supporting this, Mr Swoboda relied upon the evidence of the deceased's strong work ethic. He submitted that many workers, in all walks of life, continue beyond state retirement age and where there is evidence, as here, that the deceased's "raison d'κtre" was to work and provide for his family, a retirement age of 70 should be accepted.

- For the defendants, Mr James submitted that the court should adopt a retirement age of 62½. He suggested that, by then, the family's finances would have been repaired, a submission which is strengthened by my findings in favour of the claimant that the deceased would have been paid 67,500 per annum net. By that age, the deceased would have wanted to spend more time with his wife and Ana-Belen would have been through university. In addition, the deceased's condition of ulcerative colitis would have had the potential to flare up and cause the deceased to want to be close to home. The commercial premises had been retained as a nest egg and the deceased would have been entitled to his state pension at age 65.

Discussion

- In my judgment, there is no proper basis upon which I could properly find that the deceased would have retired at age 62½. His work ethic would have militated against early retirement, and although Ana-Belen might have finished university by 2028, she would still have had her post-graduate education to be financed. On the other hand, I think it unlikely that the deceased would have worked until age 70. To work in the construction industry is hard physical work and it would have become increasingly difficult for the deceased to spend large periods of time away from home, particularly if, by then, there were grandchildren to be doted on.

- The alternative ages of retirement proffered have been at age 65 and at age 67. Mr James suggested that Ana-Belen would go to university from 2023 to 2028 and that if she then undertook 2 years of postgraduate work to 2030, that would coincide with when the deceased would have been a 65 and eligible for state pension. However, putting a daughter through university and post-graduate qualification as an equine vet would have been expensive for the deceased and I think he would have wanted to work a further 2 years in order to build up further reserves as an additional buffer against retirement. On the basis of all the evidence I have heard I consider that the appropriate retirement age to adopt is 67.

Issue (7): Would the deceased have received the full or average state Spanish pension, and would the Claimant's pension have been the minimum non-contributory pension?

- In relation to the financial position upon retirement, the issues have narrowed between the parties. It is now conceded on behalf of the claimant that the disability pension would have ceased upon payment of the state pension and that the claimant herself would have been entitled to a 25% non-contributory pension of 1,372 gross or 1,111 net. The maximum state pension in Spain is 37,231.60 gross or 27,753.91 net of tax. The issue between the parties is whether the deceased's contributions when working would have entitled him to the maximum state pension or whether, as contended by the defendants, the fairest approach is to assume that the deceased would have drawn the average Spanish pension.

- As appears from the evidence of Ms Romero, pension entitlement in Spain is dependent on the age of the person and the contributions to Social Security accumulated throughout his working life. From the year 2027, the retirement age would be 67 years of age or 65 years if there have been 38½ years of contributions. The amount of pension entitlement is reached by applying a formula set out in Articles 209 and 210 of the Spanish General Law of Social Security which involves dividing by 350 the contribution base (or monthly earnings) of the beneficiary in the 25 years immediately prior to the month before retirement. Percentages are then applied to the resulting "regulatory base" namely 50% for the first 15 years of contributions and either 0.19% or 0.18% for each additional month of contribution from year 16.

- At Appendix II to the schedule of loss, there is a table showing the calculations of behalf of the claimant based upon assumed earnings in the 25 years prior to retirement at age 70. Year 1 of the 25 years starts in 2010. Taking retirement at age 67, year 1 would start in 2007 and although we do not have details of the deceased's earnings in 2007, it is safe to assume that these would have been healthy given that this was when Excavaciones was thriving, before the financial crash. Furthermore, the table may understate the earnings of the deceased from 2018 as it uses £67,750 a year when that is, on my above findings, a net figure and not a gross figure. In any event, I am satisfied that the deceased's contributions would have exceeded, comfortably, the sum necessary to qualify him for the maximum pension of 2,707.49 a month.

- I would mention that, in so deciding, I have not taken into account the report of Ms Fyffe. Ms Fyffe's calculations are wholly derivative, depending upon assumptions in relation to earnings and retirement age and also dependent upon her interpretation of the report of Ms Romero. In this regard I consider that Ms Fyffe may have misinterpreted paragraph 19.2 of Ms Romero's report which, at paragraph 4.08 of Ms Fyffe's report, she takes to mean that the deceased would have reach state retirement age at 67 years and would have accumulated 38½ months' contribution history by that time. However, I do not interpret paragraph 19.2 of Ms Romero's report as referring to the deceased personally but to be a statement of general application.

Issue (8): Is the appropriate dependency ratio, to take into account the deceased's expenditure solely on himself, 90% pre-retirement and 75% post-retirement or should the court use the conventional 75% with dependant children and 66% with no dependant children?

- It is contended on behalf of the claimant that the deceased's frugality and lack of spending on himself should lead the court to adopt percentages other than the conventional ones derived from Harris v Empress Motors [1984] 1 WLR 212. In this regard, five factors or arguments are relied upon:

(i) Whilst working away from home for Andeona, the deceased had his expenses paid including accommodation, flights, travel expenses and meals. This would have reduced his spending on himself.

(ii) The deceased spent very little on himself in any event, on the evidence presented to the court. In her witness statement, Mrs Cacheda said:

"22. Albino spent very little on himself, I would say around 10% of his earnings only. This was made possible because he had very little expenses when working; as accommodation, food and travel was paid, leaving only a small amount needed for personal expenditure and leisure. He would only have one day off a week when working abroad so there was little opportunity to spend anything in any event.

23. Albino would wear David's old clothes and was not prone to spending any money on himself; he had no particular hobbies or sports to spend money on."

(iii) The deceased and the claimant paid for the education of the three elder children, and would have done the same for Ana-Belen. It is submitted that as there is no separate claim for Ana-Belen's dependency, the considerable expenses which would have been incurred in paying for her education should be taken into account in the general dependency percentage (at least for the period when she would have been in education).

(iv) The deceased lavished expensive gifts on his children irrespective of their age: examples given are that he paid for David's trips abroad and for a car: for Lucas he bought a quad bike, equipment, helmets and also a car; for Alberto he bought a motorbike, bicycles and gave money towards a car.

(v) Finally, the claimant relies upon the evidence of Ms Fyffe who, at paragraph 6.02 to 6.22 carries out an analysis supporting the higher dependency ratios sought. Based upon the evidence presented to her, Ms Fyffe sets out at paragraph 6.21 a table applying a formula for calculation of the dependency which arrives at a dependency percentage of 94.2% before retirement and 87% after retirement and these calculations are said to support the claimed percentages of 90% and 75% respectively.

- For the defendants, Mr James reminds the court that the level of dependency is always, in the end, a question of fact. He points to the complete lack of documentary evidence by way of bank statements, household bills and the like which, he submits, is a prerequisite for any claimant wishing to depart from the conventional percentages. He submits that to assert that the deceased was frugal does not amount to proof of a 90% dependency. He submits that Ms Fyffe's calculations are flawed because they are based upon an assumption that the deceased was not spending any money on himself at all which, if to be substantiated, would need to be based on evidence. For example, he asks how much the deceased spent on telephones or on the Internet, particularly given that he would have wanted to stay in close communication with his family whilst away. However, no phone bills or Internet bills have been produced. Furthermore, he submits that it is fanciful to suggest that the deceased would not have spent anything on himself whilst working away. In fact the opposite is true: if away from home, the deceased would have been more likely to go out in the evening for a drink with his colleagues than if he was living at home, and the court cannot assume that he would have lived like a hermit whilst away.

Discussion

- The starting point is the judgment of O'Connor LJ in Harris where he said at page 216/217:

"In the course of time the courts have worked out a simple solution to the similar problem of calculating the net dependency under the Fatal Accidents Acts in cases where the dependence of a wife and children. In times past the calculation called for a tedious enquiry into how much for housekeeping money was paid to the wife, who paid how much for the children's shoes, et cetera. This has all been swept away in the modern practice is to deduct a percentage from the net income figure to represent what the deceased would have spent exclusively on himself. The percentages have become conventional in the sense that they are used unless there are striking evidence to make the conventional figure inappropriate because there is no departure from the principle that each case must be decided upon its own facts. Where the family unit was husband-and-wife the conventional figure is 33% and the rationale for this is that broadly speaking the net income was spent as to 1/3 for the benefit of each and one third for their joint benefit. Clothing is an example of several benefit, rent an example of joint benefit. No deduction is made in respect of the joint portion because one cannot buy or drive half a motorcar. Part of the net income may be spent for the benefit of neither husband nor wife. If the facts be, for example, that out of the net income of £8000 pa the deceased was paying £2000 to a charity the percentage would be applied to £6000 and not £8000. Where there are children the deduction falls to 25% as was the agreed figure in the Harris case."

In Owen v Martin (1992) WL 895670, Parker LJ, having cited the above passage of O'Connor LJ, commented:

"O'Connor LJ did not intend to lay down any rule that in the absence of striking evidence to the contrary two thirds of net income must be regarded as the value of the dependency I have no doubt. If he did he would clearly have been wrong. It is clear that the value of the dependency cannot be taken at such an arbitrary figure and must always depend on facts."

Parker LJ went on to refer to other well-known authorities including Mallett v McMonagle [1970] AC 167, Taylor v O'Connor [1977] AC 115 and Coward v Comex.

- In my judgment, a distinction needs to be drawn between 2 aspects: first, as referred to by O'Connor LJ in Harris, there is the methodology, namely whether the court embarks upon a painstaking and tedious examination of the household expenses or whether it adopts a more broad-brush percentage approach; second, if the percentage approach is to be adopted, what the appropriate percentage should be in any particular case. With respect to him, it seems to me that Mr James has conflated these two matters. Thus, he suggests that the absence of documentary evidence about the household expenses should lead the court away from adopting anything other than the conventional percentages of 75% (with dependant children) and 66% (husband and wife alone). To my mind, though, O'Connor LJ only intended to suggest that the absence of the painstaking or tedious approach should lead to a broader, percentage approach, but not necessarily to what those percentages should be. If the court decides on the percentage approach, it may be more ready to depart from the conventional percentages on the basis of more general evidence about the lifestyles of the family and adjust the percentages accordingly. In other words, it is not necessary, in order to depart from the conventional percentages, to descend into the nitty-gritty of the family finances and work out precisely how much was spent on the various individual items of expenditure.

- In the circumstances, I consider that I am entitled, on the basis of the evidence which has been adduced in this case, whilst still abiding by a general percentage approach, to depart from the conventional percentages and adjust them in accordance with the evidence which I accept. I do accept the evidence that the deceased was a man who spent very little on himself and that it is appropriate to adjust the percentages to reflect this. Furthermore, with the depletion of the family finances arising from the economic crisis and the collapse of Excavaciones, I consider that the deceased would have been careful to save as much as he could rather than spend money on himself. He would, nevertheless, have needed to pay for his own toiletries, underwear, shoes and other items of unalienable personal expenditure and he would have needed to feed himself whilst at home. In my judgment, the appropriate percentage to adopt is 85% pre-retirement and 70% post-retirement by when the family finances would have been replenished and there would no longer have been dependent children.

Dependency of David, Alberto and Lucas

Issue (9): Do these dependency claims fall within the scope of s3(1) of the Fatal Accident Act 1976 and are they recoverable in law?

- Although Mr Swoboda grouped the dependency claims of David, Alberto and Lucas together in his list of issues, Alberto's position is in fact rather different to that of his brothers, and it is convenient to consider his claim first.

Alberto's Claim

- In his witness statement, Alberto says:

"17. I made several payments, in cash to support the family and before we received the interim payment from the responsible driver's insurers.

18. As these were cash payments, there are no bank records, but we did record this in our family book and I attach relevant extracts to my statement."

The so-called "family book" shows the various payments made by Alberto, the entries in fact being made by David. For example, on 1 September 2015, Alberto made a payment of 440 recorded by David as "Alberto paga prestamo" which translates as "Alberto pays loan". On 21 October 2015, 800 is recorded as having been paid by Alberto, recorded by David as "Alberto paga taller" which translates as "Alberto pays workshop."

- When questioned by Mr James about the first of these payments, Alberto said that this meant he was paying the mortgage. He was asked whether this was on the family home or on the commercial premises owned by Excavaciones, to which he replied that it was for the house, to cover needs as they arose. Mr James put to Alberto that there was no mortgage on the family home, to which he replied: "it is paying for stuff in the house food, clothing." He said that "prestamo" means "loan" and it was loan to the family rather than to his mother specifically. In relation to the second payment, he said that "taller" means workshop or garage and it relates to cars. Mr James asked if it was to pay for maintenance on his mother's car, to which he replied: "I think there was only one car in the house at this time. It is a loan money is paid when needed." Mr James asked if the intention was for Alberto to be repaid in due course to which Alberto replied: "there was no thought about getting the money back it was simply a need at that time." Mr James asked if Alberto expected to be repaid from the compensation recovered in the case, to which he replied: "I'm not thinking about it like that, I am not thinking of it as a debt." These two payments, and Alberto's evidence in relation to them, give a flavour of the overall payments made by Alberto totalling 10,962 which are claimed to be separately payable under the claim as part of Alberto's dependency.

- For the claimant, Mr Swoboda submits that these payments are properly to be regarded as part of Alberto's dependency. He submitted that Alberto relied on his father to manage the family finances in order to ensure financial security for the family and, to ensure that his family, by which he meant his mother and sister, did not fall into penury following the death of the deceased given that there was no longer any income derived from the work of the deceased, Alberto gave this money to the family to keep them financially afloat. Mr Swoboda disputed that the payments were made as a loan upon the expectation that such sums would be repaid but, relying on Alberto's evidence, he submitted that it was "money given to ensure his family did not fall into hardship, which of course is another way of saying to ensure the financial security of the family, the very thing he depended on his father for."

- For the defendants, Mr James submitted that, even if the payments are properly to be characterised as gifts rather than loans, they are essentially included in the financial dependency claims of Mrs Cacheda and Alberto's sister and it will be a matter for them whether they repay Alberto from their damages.

Discussion

- In my judgment, the fact that these payments were diligently recorded by David in the family book shows that they were intended as loans, to be repaid from the damages in due course. In any event, I accept Mr James' submissions that these payments are included in the financial dependency claim of Mrs Cacheda. The clue is in Alberto's statement where he says that he made the payments "to support the family and before we received the interim payment from the responsible driver's insurers." This shows that the problem was essentially one of "cash flow" and supports the contention that these were loans, to be repaid in due course. In any event, I consider that it does not convert these payments into a proper dependency claim to characterise them as payments to ensure that the family did not fall into penury. In my judgment, there is no proper basis upon which these payments fall into a separate head of claim and the reality is that Alberto was not dependent upon his father at all at the time of the deceased's death.

The claims of David and Lucas

- The claims of David and Lucas are rather different to that of Alberto. The principles attaching to the recoverability of their claims are common to both.

- So far as David is concerned, when his father died, he essentially took 6 months' leave of absence from Deloitte in order to attend to the affairs of Excavaciones. He had entered into a one-year training contract with Deloitte in April 2014 which he said, in normal circumstances, would have led to a permanent contract from 7 April 2015. However, he informed Deloitte that he would not be seeking a permanent contract upon the expiry of his training contract for "family reasons". He re-joined Deloitte on 7 September 2015 on an extension to his training contract but by this time the customers with whom he was associated had been reassigned to other colleagues and no permanent contract was available for him when his training contract finished in September 2016. He decided to relocate back to Galicia: his family home is near the coast in a popular tourist area, and he now works in the hotel industry. Although he accepts that he is now paid as much as he would have been paid if he had remained a Financial Consultant, he claims that the disruption to his career has resulted in a total loss of 96,101.00.

- He explained his position in his witness statement as follows:

"47.

I was forced to leave my employment at Deloitte in order to attend to the family business and generally look after the family after this devastating blow. I effectively had to become the head of the household.

48. It was an uphill struggle and a steep learning curve to get a grip with the company, suddenly and with no preparation as well as dealing with my grief and supporting my mother and siblings. I found myself taking over a company without knowing the numbers, the clients, the suppliers, the bank arrangements.

49. I handled absolutely everything from invoicing, dealing with clients, legal aspects, debts, recovery of debts owed to the company, accounting. All this work, on top of dealing with all the house admin and taking my mother to appointments and other tasks, meant that I was effectively working full-time on the company, when I was not otherwise working for Deloitte or undertaking my studies.

50. If my father had not died, I would have expected to continue with my independent career as a financial consultant with Deloitte or similar companies. I would not have expected to have been involved in the company much and, in any event, the intention was to wind the company up as soon as commercially and practically possible."

- In relation to Lucas, he too gave up what he was doing in order to attend to Excavaciones. He says, in his witness statement:

"19. At the time of the accident, I was not working in the family business, but was studying and doing an internship. I was 20 years old. I was studying to be a heating engineer. However, following my father's death I felt compelled to abandon my studies and internship so that I could assist with Excavaciones. I undertook non-administrative work for the company. In particular I sought and undertook work which the company could invoice for. I would deal with the clients, visit sites to budget for the work, undertake maintenance and other tasks.

20. This was necessary as the company had standing costs which had to be met and which could only be met if the company had an income. In common with my brother David, I received no salary or payment for my work for the company. However it was necessary that I do this work so the company could be kept afloat until 2018, in order that the commercial vehicles, the company's substantial assets could be sold. My brother David was in charge of the administrative details of the company and its winding up

"

- Lucas' claim is based upon the fact that, but for his father's death, he would have completed his training as a heating engineer and would have obtained work earning 18,200 net per year. A claim is made on his behalf in the sum of 48,962.43 calculated in Appendix 4 to the schedule of loss by deducting his actual earnings in the period to the winding up of Excavaciones from the earnings he would have had as a heating engineer (incongruously pleaded as earnings with Deloittes as a financial consultant, but I shall assume this is an error).

The argument for the claimant

- For the claimant, Mr Swoboda submits that the claim falls within the scope of section 3(1) of the Fatal Accidents Act 1976 which, he says, is a "wide gateway" to pass through which, all that is required is to identify a pecuniary loss caused by the death or, alternatively, "a reasonable expectation of pecuniary advantage from the continuance of the life of the deceased" (quoting from Pym v The Great Northern Railway Company [1863] 4 B&S 396). This quotation was cited by Latham LJ in O'Loughlin v Cape Distributions Limited [2001] EWCA Civ 178. Reliance is placed on the following dictum in the judgment of Latham LJ at paragraph 14:

"It follows, it seems to me, that the court's task in any case is to examine the particular facts of the case to determine whether or not any loss in money or in monies worth has been occasioned to the dependents and if it determines that it has, it must then use whatever material appears best to fit the facts of the particular case in order to determine the extent of that loss."

- Mr Swoboda submits that both David and Lucas have suffered pecuniary loss as a result of their father's death, in David's case his inability to pursue his career as a financial consultant with Deloitte because he was "forced to leave" in order to take over the administration of Excavaciones upon the death of his father. He submits that David "had a reasonable expectation of pecuniary advantage from the continuation of his father's life, namely the money he would have been able to earn at work which was enabled by the deceased ensuring the financial stability of the family by his running of the family business. Similarly, with Lucas, it is submitted that he had the same reasonable expectation of pecuniary advantage from the continuation of his father's life, in his case the money he would have earned as a heating engineer. He too was effectively forced, it is said, to abandon his training and his work as a heating engineer for a number of years so as to be able to devote himself to Excavaciones until that company could be wound up in 2018.

- Mr Swoboda submits that any pecuniary loss is sufficient to show a dependency and as long as the loss arises from the familial relationship, as opposed to being a business loss, for example, it is claimable as a dependency loss provided the loss was incurred reasonably. Thus, he submits that recoverability depends upon an affirmative answer being given to each of the following questions:

(i) Is the person a dependant within the provisions of the Fatal Accident Act 1976;

(ii) Has the person suffered a financial loss consequent upon the death of the deceased;

(iii) Did the loss arise from the person's familial relationship with the deceased; and

(iv) Was the loss incurred reasonably.

It is the claimant's case that each of these questions is to be answered in the affirmative in relation to the claims of David and Lucas which are accordingly recoverable in law.

The argument for the defendants

- For the defendants, Mr James submits that these claims are essentially claims for loss of earnings for David and Lucas in consequence of the death of their father and such claims are not recoverable in law. He submits that the correct principle is that only damages arising from the financial dependency on the father at the time of death are recoverable, citing Burgess v Florence Nightingale Hospital for Gentlewomen [1955] 1 QB 349 and Malyon v Plummer [1964] 1 QB 330. Neither David nor Lucas were financially dependent on the deceased at the time of death.

- Essentially, what David and Lucas were saying in their evidence was that Excavaciones needed to be kept going until 2018 in order to uphold the "honour" or "reputation" of the family because if Excavaciones had been allowed to go under in 2015, the realisation of its assets would have been insufficient to pay off the external creditors of the company. By doing what they did, they enabled Excavaciones' assets to be sold for full value with the advantage of the transport licence, the external creditors' debts were thereby satisfied and the "honour" of the family was preserved. Mr James submitted that there is in fact no evidence or evidential basis for arguing that the honour or reputation of the family would have been affected in any way by Excavaciones being wound up in 2015 given that this would have been a consequence of the premature death of the deceased which was not the fault of the deceased or any member of his family and would have been regarded as simply an unfortunate consequence of the tragedy which had befallen the family. In any event, it is submitted that issues of honour and reputation do not usually sound in damages in negligence and although, pursuant to O'Loughlin v Cape Distributions Limited [2001] EWCA Civ 178, dependency is broad, it is not that broad.