Introduction

1.

This is a reference to determine the amount of compensation payable to

Mr Charles James Braithwaite (“the claimant”) following the compulsory purchase

by the London Borough of Enfield Council (“the acquiring authority”) of his

freehold interest in 22 Lakeside, Enfield, Middlesex EN2 7NN (“the property”).

2.

The property was acquired pursuant to The London Borough of Enfield (22

Lakeside) Compulsory Purchase Order 2009 (“the order”), which was confirmed by

the Secretary of State on 13 October 2010. The order was made to fulfil the

aims of the acquiring authority’s Empty Property Strategy in bringing empty and

neglected property back into residential use. The future sale was to be subject

to a covenant to ensure that the property was fully renovated and occupied

within a defined timescale. On 23 September 2013 the acquiring authority made a

General Vesting Declaration (“GVD”), under which the freehold interest in the

property was vested in the acquiring authority on 23 October 2013, which is the

valuation date.

3.

The reference was made by the claimant on 22 October 2019, and the

parties agreed that it should be determined under the Tribunal’s written

representations procedure.

Summary of the dispute

4.

In his particulars of claim, enclosed with a letter to the acquiring

authority dated 21 October 2019, the claimant sets out his claim in the

following amounts:

Market value of property less outstanding debt

Sale proceeds from auction on 18

November 2013 £594,000

Additional amount arising from Special

Conditions of sale £17,000

£611,000

Less mortgage balance due to GE Money (rounded)

£550 £610,450

Basic loss payment

7.5% of £610,450

£45,783

Disturbance

compensation

Cost of petrol

for removal trips to Enfield from Norwich £717

Increase in monies owed to sister for

her share of Norwich

residence, resulting from delay in

receiving compensation £9,695 £10,412

TOTAL CLAIM:

£666,645

5.

In its statement of case dated 29 November 2019, the acquiring authority

sets out its opinion of the claim in the following amounts:

Market value of property less outstanding debt

Sale proceeds from auction on 18

November 2013 £594,000.00

Less mortgage balance paid to GE Money

£538.67 £593,461.33

Basic loss payment

7.5% of £593,461.33

£44,509.60

Disturbance compensation

Cost of petrol - insufficient evidence

of link to household removal Nil

Costs relating to Norwich residence - inadmissible

Nil

TOTAL CLAIM:

£637,970.93

Facts in chronological order

6.

On 23 September 2013, as evidenced by the postmark on the envelope

received by the claimant, notice of the making of a GVD in respect of the

property was posted to him at his address in Norwich. A further copy of the

notice was served the same day by DX on the claimant’s solicitors, Irwin

Mitchell of Sheffield. They wrote to the claimant at his Norwich address on 24

September enclosing copies of the letter and notice. The letter requested that

the claimant should arrange to remove his personal belongings from the property

by the vesting date of 23 October 2013.

7.

The acquiring authority took ownership and possession of the property on

23 October 2013, which is the valuation date. At this date the property was a

three bedroom detached brick house which was not occupied by the claimant (or

anyone else) as a residence and had fallen into some disrepair.

8.

The acquiring authority instructed Barnard Marcus to offer the property

for sale and it was included in their national property auction in London on 18

November 2013. The claimant has helpfully supplied relevant extracts from the

auction catalogue, with guide price and viewing list. The entry for Lot 50 (the

property) described it as having “development potential (subject to consents)”

and stated “The property may be suitable for an extension to provide additional

accommodation - subject to necessary consents and purchasers must rely on their

own enquiries.” The special conditions of sale (“special conditions”) included

at conditions 6 and 7:

“6. The transfer to

the Purchaser shall contain the following covenant:

“12.1 The Purchaser covenants with the Seller as follows:

a.

To execute such works as are necessary to bring the Property up to the

Decent Homes Standard as defined in paragraph 5 in the Department for

Communities and Local Government update June 2006, hereinafter referred to as

‘the Works’ (or other such definition of “Decent Homes Standard” as may be

issued from time to time by the Department for Communities and Local

Government)

b.

To obtain all necessary licences and consents that may be required to

carry out the Works and allow for occupation.

c.

To notify the Seller as soon as the Works have been completed and the

said Works are subject to inspection and approval by the Seller’s Private

Sector Housing Department.

d.

To complete the said Works within 12 months from the date of transfer;

and

e.

To ensure that the Property is occupied on a full time basis as

residential accommodation within the 12 month period.

7. The Purchaser shall apply to

register the following restriction on the Register of Title to the Property:

“No disposition of the registered estate (other than a

charge) by the proprietor of the registered estate is to be registered without

a certificate signed by the Solicitor for the Mayor and Burgesses of the London

Borough of Enfield of Civic Centre Silver Street Enfield Middlesex EN1 3XA that

the requirements of clause 12.1 of a transfer dated made between the

Mayor and Burgesses of the London Borough of Enfield (1) and (2) have been

complied with”

9.

The guide price listed for the property was £490,000. The claimant was

present at the auction and describes the sale of the property, with bids

opening at £540,000 and continuing in steps of £2,000 until the under-bidder

dropped out and the sale was transacted at £594,000.

10.

A letter dated 5 December 2013 was sent by the acquiring authority to

the claimant’s solicitors, Irwin Mitchell, confirming that the sale was

completed on 25 November 2013 and requesting the claimant’s compensation claim

form. This was sent on to the claimant by his solicitors under cover of a

letter dated 24 December 2013.

11.

A council tax bill for the property dated 2 December 2013 was addressed

to the claimant at his Norwich address. It confirmed the charge due for the period

1 April to 24 November 2013 (subsequently corrected to 22 October 2013) and

listed the “2nd Home Nil Discount”.

Market value of the claimant’s

interest

12.

Rule (2) (“rule 2”) of Section 5 of the Land Compensation Act 1961 sets

out the definition of market value for the assessment of compensation as:

"…. the amount which the land if sold in the open

market by a willing seller might be expected to realise”

Sale by public auction is a

recognised part of the open market for property and it provides sound evidence

of market value. The short lapse in time between the valuation date of 23

October 2013 and the auction date of 18 November 2013 is not sufficient to have

had an impact on the market and the claimant acknowledges this in his claim.

13.

The claimant states that the sale price achieved was towards the top end

of his expectations and that he is content with the conduct of the auction.

However, he claims that the market value of the property is represented by the

sale price plus an additional sum of £17,000 “...attributable to Enfield

Council’s relevant Special Conditions of Sale…”. The claimant took advice from

Mr Philip Murphy, whom he describes as “an experienced property developer/

property dealer/ property investor”, that the cost of works to comply with the

special conditions would be between £20,000 and £25,000, from which fittings

worth between £4,000 and £7,000 could be salvaged for a future extension. The

claimant takes mid-range figures to assess a net amount of £17,000 (£22,500

less £5,500) as “reasonably attributable” to the special conditions.

14.

The acquiring authority assert that the market value of the property is

the sale price of £594,000 achieved at public auction.

15.

In adding the net amount of £17,000 to the auction sale price the

claimant contends that, as a result of the special conditions attached to the

sale, the price achieved for the property was less than its market value as

defined by rule 2.

16.

I assume the claimant’s evidence is correct concerning the likely cost

of £20,000 - £25,000 to carry out the required works, and the potential for

salvage and reuse of some fittings for a future extension. But those matters are

within the whole range of factors which the purchaser will have had in mind in

reaching his successful bid of £594,000 at public auction. Sales of property

which require significant works of repair and improvement are not unusual and their

sale prices will reflect the anticipated cost of those works (unless a higher

value would be realised by demolition or some other project which would render

the works valueless).

17.

However, the other relevant part of the special conditions required that

a restriction be registered against the title, and that the purchaser should

within 12 months have completed the required works and ensured that the

property was occupied on a full time basis as accommodation. Those would be

unusual conditions to find on a sale in the open market. I consider that these

special conditions would have had some impact on market value in constraining

the potential for a purchaser to concentrate on gaining planning consent to extend

and improve the property in the normal way. One would expect the successful purchaser

to open a dialogue with the acquiring authority immediately, with a view to

achieving both their objectives and his own within the 12 month timeframe, but in

the minds of potential purchasers there would be some perceived risk of

hindrance. It is likely that a few more incremental bids would have been

achieved at the sale in the absence of the special conditions, raising the

price achieved to £600,000.

18.

Which is the open market value of the property: the figure of £594,000

actually achieved, or the figure of £600,000 which might have been achieved

without the special conditions? In my judgment it is the higher figure.

Ordinarily a seller in the open market is not concerned with what the purchaser

will do with the property, and will usually sell free of any onerous

obligations to achieve the best price. In this case the acquiring authority

wished the property to be brought back into residential occupation within a

relatively short time. That requirement was not a characteristic of the

property itself (its relatively poor condition was fully accounted for in the

sale price, as I have already accepted) but it diminished the price which would

otherwise have been achieved on conventional terms. The claimant is therefore

correct that the impact of the restriction must be disregarded in determining

the open market value of the property.

19.

I therefore determine the market value of the freehold property to be

£600,000. The compensation due to the claimant, after deduction of the mortgage

balance of £538.67, is £599,461.33.

Basic loss payment

20.

Section 33A of the Land Compensation Act 1973 provides:

“(1) This section applies to a person–

(a) if he has a qualifying interest in

land,

(b) if the interest is acquired compulsorily,

and

(c) to the extent that he is not entitled to a

home loss payment in respect of any part of the interest.

(2) A person to whom this section applies is

entitled to payment of whichever is the lower of the following amounts–

(a) 7.5% of the value of his interest;

(b) £75,000.

(3) A payment under this section must be made

by the acquiring authority.

(4) An interest in land is a qualifying

interest if it is a freehold interest or an interest as tenant and (in either

case) it subsists for a period of not less than one year ending with whichever

is the earliest of–

…

(c) the vesting date (within the meaning of

the Compulsory Purchase (Vesting Declarations) Act 1981) if a declaration is

made under section 4 of that Act (general vesting declaration); …”

21.

The claimant believes that he is entitled to a home loss payment under

section 29 of the Land Compensation Act 1973 (“section 29”) but he has

indicated in his claim that he is prepared to waive such entitlement and claim

the lower amount of a basic loss payment.

22.

The provisions of section 29 (2) (a) provide:

“(2) A person shall

not be entitled to a home loss payment unless the following conditions have

been satisfied throughout the period of one year ending with the date of

displacement—

(a) he has been in

occupation of the dwelling, or a substantial part of it, as his only or main

residence;”

..

23.

The evidence that the claimant’s address for correspondence in the

period ahead of the valuation date was in Norwich, and reference in the council

tax demand to a 2nd home discount, confirms that he was not in

occupation of the property as his only or main residence throughout the period

of one year ending with the date of displacement.

24.

The claimant is therefore entitled only to a basic loss payment. I note

that both parties assess the basic loss as a percentage of the market value

after deduction of outstanding mortgage debt. The correct figure to use is the

market value of the property, not the amount of the claimant’s equity in it.

The basic loss payment is therefore £45,000 being 7.5% of £600,000.

Claim for disturbance

compensation

25.

Rule (6) of Section 5 of the Land Compensation Act 1961 provides:

“The provisions of rule (2) shall not

affect the assessment of compensation for disturbance or any other matter not

directly based on the value of the land;”

26.

The principle of equivalence, which requires a claimant to be fully and

fairly compensated for his loss following compulsory acquisition, was reviewed

in detail by Lord Nicholls in Director of Buildings and Lands v Shun Fung

Ironworks Ltd [1995] 2 AC 11. He confirmed that compensation should cover

disturbance loss as well as the market value of the land itself, provided that three

conditions are satisfied. Firstly, there must be a causal connection between

the acquisition and the loss in question. Secondly, the loss must not be too

remote from the acquisition. Thirdly, the claimant must have complied with

their duty to mitigate their loss. To quote Lord Nicholls (at page 6):

“The law expects

those who claim compensation to behave reasonably. If a reasonable person in

the position of the claimant would have taken steps to reduce the loss, and the

claimant failed to do so, he cannot fairly expect to be compensated for the

loss or the unreasonable part of it. Likewise if a reasonable person in the

position of the claimant would not have incurred, or would not incur, the

expenditure being claimed, fairness does not require that the authority should

be responsible for such expenditure.”

27.

The first item of the claimant’s disturbance compensation claim is the cost

of fuel for trips between Enfield and Norwich when he was removing his

possessions from the property. This cost is put by him at £717.

28.

The fact that the claimant was not resident in the property has been

established earlier in this decision and is the reason that he is entitled only

to a basic loss payment as owner rather than a home loss payment. His

occupation of the property (albeit not as his sole or main residence), causing

him to have to remove personal belongings, has not been disputed.

29.

The claimant has provided photocopied evidence of petrol purchases made

by cash in Norwich on 18, 19, 21, 22 October and 3, 7, 9, 13, 14, 16, 21, 24

and 25 November. Three further receipts are only partially copied so that their

dates are not visible. However, he does not set out a schedule of trips made by

him to confirm mileages travelled and related fuel usage. The acquiring

authority do not dispute the head of claim but state that the claim requires

further corroboration. I am satisfied that there is a causal connection between

the acquisition of the property and the claimant’s need to make round trips

from Norwich to remove personal belongings. The claim, in principle, is not too

remote since the incurring of removal costs is the natural consequence of

disposal of property. But compensation can only reflect costs that would have

been incurred by a person acting reasonably.

30.

Title to the property vested in the acquiring authority on 23 October

2013 and the claimant had been requested (by the letter dated 23 September

2013) to clear the house of his personal belongings by that date. The claimant

has provided evidence of cash withdrawals from Santander Bank made in Enfield

on 16 October, before the vesting date, and again on 13, 21, 25 and 26 November

2013, all dates after the title had passed to the acquiring authority. There is

no evidence that the claimant had authorisation to access the property after

the vesting date in order to remove belongings, or that he did in fact do so, but

I acknowledge that the withdrawals are evidence of the claimant’s presence in

Enfield on those dates and that one of those dates preceded the vesting date.

31.

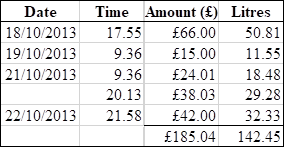

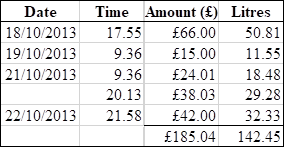

Details of the receipts for petrol purchases, made in Norwich on dates

preceding the vesting date, are set out below:

32.

Enfield to Norwich is a round trip distance of 230 miles. Assuming a low

fuel efficiency of 30 miles per gallon (6.6 miles per litre) each journey would

require 34.85 litres of fuel. The total of 142.45 litres purchased before the

vesting date would therefore represent four round trips, which could be

supported by the times and dates of the purchases.

33.

In the absence of detailed corroboration from the claimant, I assess

that a reasonable claim for the costs of removing possessions from the property

is represented by the sum of £185.04 for petrol purchases incurred over a

period of five days preceding the vesting date.

34.

Turning to the claimant’s final item of claim, the sum of £9,695

concerns money due to his sister, Dr J E G Braithwaite, in final settlement of

the estate of their late mother, Mrs B.M. Braithwaite, who died on 12 January

2010. Mrs Braithwaite’s estate, which included the property in Norwich and a

portfolio of equity investments, was to be divided equally between the claimant

and his sister. Copy documents provided by the claimant include a letter dated

4 May 2012, signed by him and his sister, authorising transfer of the

investment portfolio to Dr Braithwaite. An associated (insofar as it has

identical water staining) but undated note from their solicitor Averil Wakeham

confirms that the house, where the claimant was resident, would be transferred

into his ownership, subject to a legal charge in the name of his sister for the

net balance of the estate due to her in the sum of £95,395. The note enclosed

forms to be signed, including Form AS1 to transfer ownership and a form to

agree the legal charge.

35.

Further copy documents provided by the claimant show that registration

of the claimant’s ownership and of the charge did not take place until 27 July

2018. A letter dated 16 June 2018, addressed to the claimant by his sister and

signed by them both, confirms agreement that the legal charge would be for a

sum of £105,000 (an increase of £9,605) in recognition of the significant delays

and loss of opportunity for her to invest the sum owed to her.

36.

I note that the amount of the increase is £9,605 not £9,695 as claimed.

I deduce (because it is not wholly clear) that the claimant believes this sum

is due to him as compensation because, until he received compensation for the

acquisition of 22 Lakeside, he has been unable to discharge the debt to his

sister, thereby causing the sum owed to her to increase. He describes this as

the “Extra cost to the Claimant of providing himself with a place of abode.”

37.

The acquiring authority contend that “The accommodation costs cannot be

reimbursed as the claimant was not resident in the acquired property and

therefore suffered no losses.”

38.

This item of claim for compensation does not meet any of the conditions

set down by Lord Nicholls in Shun Fung. Firstly, there is no apparent

causal connection between the acquisition of the property in October 2013 and

costs arising from a delay of over six years in giving effect to a transfer and

legal charge prepared in 2012. Secondly, if in any way there could be shown to

be a connection, the item of claim is too remote from the acquisition. Thirdly,

it is clear to me from the supplied correspondence that the claimant has not

acted as a reasonable person would in mitigating his loss by submitting his

claim for compensation at the first opportunity following sale of the property

at an auction on 18 November 2013 which he attended and which established the

open market value of the property. The letter from the acquiring authority

dated 5 December 2013, forwarded to the claimant by his solicitor on 24

December 2013, invited him to make his claim. The solicitor requested the

claimant make contact to confirm instructions. Taking this action would have initiated

at the very least the process for an advance payment of 90% of the acquiring

authority’s estimate of compensation, enabling the claimant to discharge the

debt to his sister. Instead, the claimant waited until 22 October 2019 to make

his reference.

Decision

39.

I determine that the compensation payable to the claimant is as follows:

Market value of property less

outstanding debt

Estimated sale proceeds without

special conditions £600,000.00

Less mortgage balance paid to GE

Money £538.67 £599,461.33

Basic loss payment

7.5% of £600,000.00

£45,000.00

Disturbance compensation

Cost of fuel for estimated four

journeys prior to vesting date £185.04

TOTAL COMPENSATIION:

£644,646.37

40.

Interest is due to the claimant on the total compensation sum, for the

period from the vesting date, at the statutory rate.

Costs

41.

This reference was heard under the Tribunal’s

written representations procedure which is not a procedure under which costs

are normally awarded. I am minded to require the acquiring authority to

reimburse the Tribunal fee to the claimant but otherwise to make no order in

relation to costs. If either party wishes to propose a different order they

should do so within 21 days.

|

|

|

|

|

Mrs

Diane Martin MRICS FAAV

1

May 2020

|

|

|

|