|

General

|

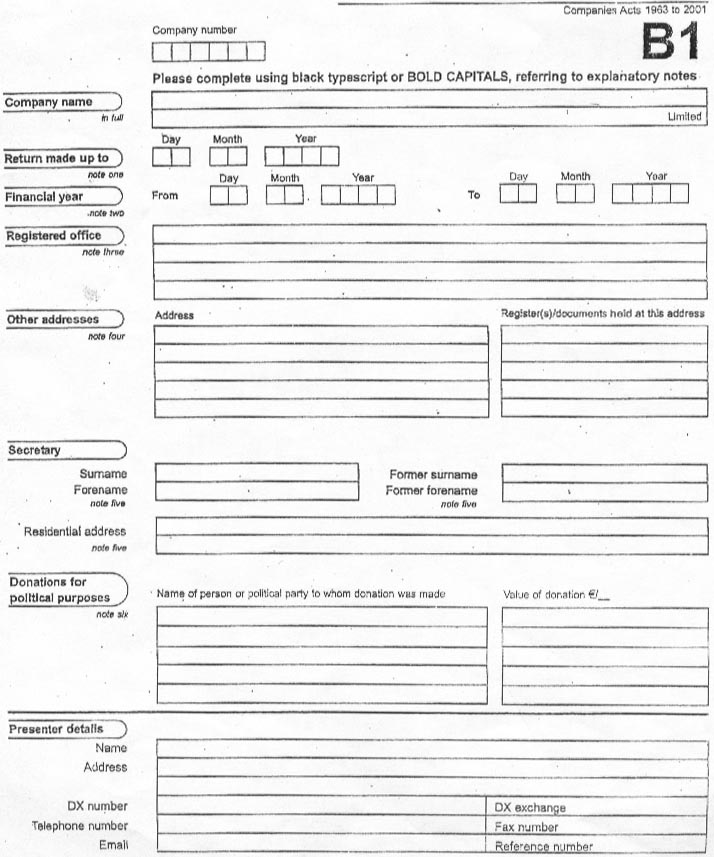

This form must be completed in full and in accordance with the following notes. Where “not applicable”, “nil” or “none” is appropriate, please state. Where €/_ appear, please delete as appropriate. Where €/_ applies, give the relevant currency, if not euro. Where the space provided on Form B1 is considered inadequate, the information should be presented on a continuation sheet in the same format as the relevant section in the form. The use of a continuation sheet must be so indicated in the relevant section.

|

|

note one

|

Returns made up to a date on or after 1 March 2002: Pursuant to section 127 Companies Act 1963 (inserted by section 60 Company Law Enforcement Act 2001), the annual return of a company must be made up to a date not later than its annual return date (ARD). The return must be filed with the Registrar within 28 days of the company's ARD, or, where the return has been made up to a date earlier than the company's ARD, within 28 days of that earlier date. Section 127 sets out the manner in which a company's ARD is determined and in which same may be altered. There are severe penalties for late filing of the annual return. Returns made up to a date prior to 1 March 2002: If this form is being used to file such a return, the return ought to be made up to the date which is 14 days after the company's AGM for the year in question and delivered to the CRO within 60 days of the AGM. All other notes are also

applicable to such returns. The late filling penalty will be charged in respect of any such return which is delivered more than 77 days after the date to which it has been made up.

|

|

note two

|

Give the date of the commencement and completion of the financial year covered by the accounts presented or to be presented to the AGM of the company for that year. Pursuant to section 7(1A) Companies (Amendment) Act 1986 (inserted by section 64 Company Law Enforcement Act 2001), the accounts must be made up to a date not earlier by more than nine months than the date to which the annual return is made up. In the case of the first annual return since the company's incorporation, the period since incorporation is required to be covered by the accounts. In any other case, the accounts are required to cover the period since the last set of accounts file with the CRO.

Certain unlimited companies are required to prepare accounts and annex them to Form B1: Unlimited companies and partnerships where all the members, who do not have a limit on their liabilities, are companies limited by shares or guarantee, or their equivalent if not covered by the laws of the State, or a combination of these undertakings; unlimited companies and partnerships where all the members, who do not have a limit on their liabilities, are themselves unlimited companies or partnerships of the type aforementioned that are governed by the laws of the State or equivalent bodies governed by the laws of an EU Member State or combinations of these undertakings. Unlimited companies which do not come under either of these categories do not have to file accounts nor do they have to give details of their financial year.

|

|

note three

|

Give the address at the date of this return. Any change of registered office must be notified to the CRO on Form B2.

|

|

note four

|

If not kept at the registered office, state the address(es) where the register of members, register of debenture holders, and register of directors' and secretary's interests in shares and debentures of the company are kept, and where copies of directors' service contracts/memoranda of same (if applicable) are retained.

|

|

note five

|

Insert the full name (initials will not suffice) and usual residential address. Any former forename and surname must also be stated. This does not include (a) in the case of a person usually known by a title different from his surname, the name by which he was known previous to the adoption of or succession to the title; or (b) in the case of any person, a former forename or surname where that name or surname was changed or disused before the person bearing the name attained age 18 years or has been changed or disused for a period of not less than 20 years; or (c) in the case of a married woman, the name or surname by which she was known prior to the marriage. Where the secretary is a firm, the corporate name and registered address of the firm must be stated.

|

|

note six

|

Section 26 Electoral Act 1997 requires details of contributions for political purposes, in excess of € 5,079 In the aggregate, to any political party, member of the Dáil or Seanad, MEP or candidate in any Dáil, Seanad or European election, made by the company in the year to which the annual return relates, to be declared in the annual return and directors' report of the company in respect of that year. The particulars must be sufficient to identify the value of each such donation and the person to whom the donation was made. A wide definition of donation is set out in section 22/section 46 of the 1997 Act and includes services supplied without charge, a donation of property or goods, or the free use of same.

|

|

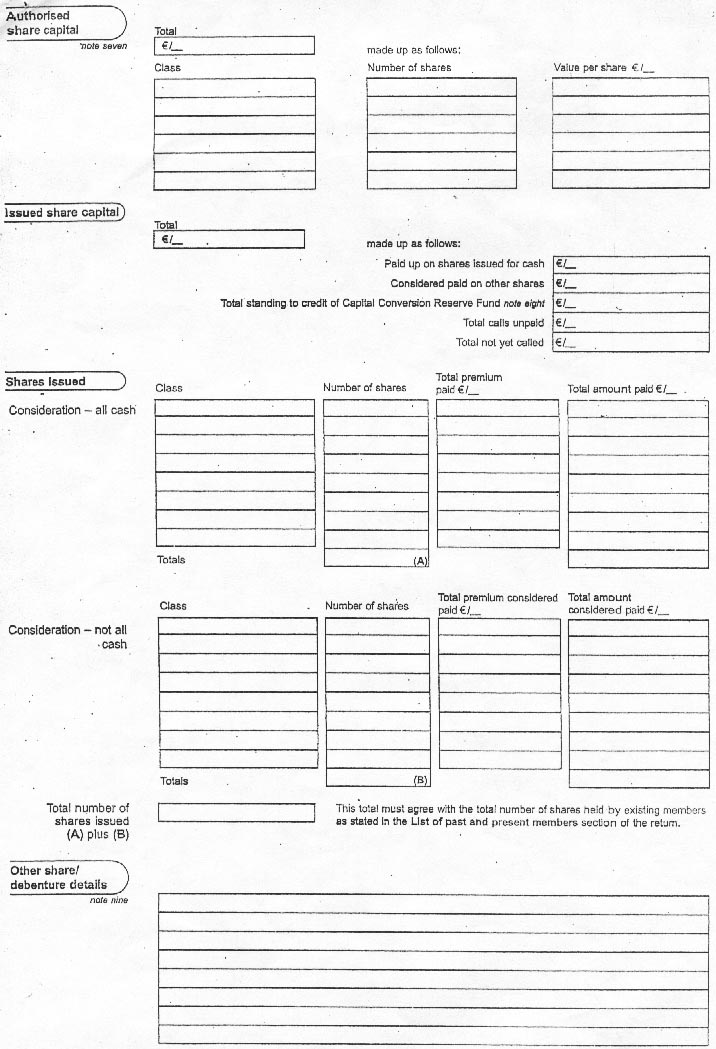

note seven

|

Where a company has converted any of its shares into stock, then, where appropriate, the references to shares shall be taken as references to stock and references to number of shares shall be taken as references to amount of stock. The second page does not apply to a guarantee company without a share capital.

|

|

note eight

|

Insert, where applicable. (If share capital has been renominalised pursuant to section 26 Economic and Monetary Union Act 1998 and there has been a decrease in the whole or part of the authorised and issued share capital or in a class of shares as a result of the renominalisation (section 26(4)(a).)

|

|

note nine

|

Details of shares forfeited, shares/debentures issued at a discount, or on which a commission was paid including share class, number of shares and amounts in each case.

|

|

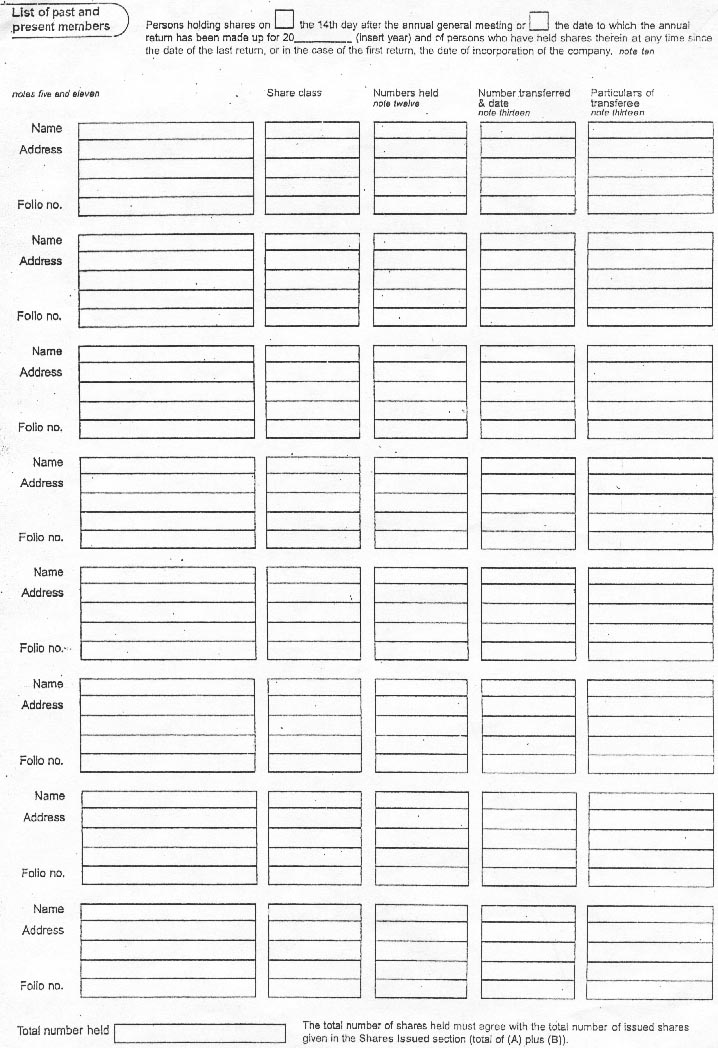

note ten

|

Tick the appropriate box (see note one above). A full list is required with all returns. However, this requirement does not apply to a guarantee company without a share capital. Where joint shareholders exist, name either all joint shareholders or the first shareholder and “Another”.

|

|

note eleven

|

Where there are more than eight shareholders, the list should be given on a continuation sheet in alphabetical order.

|

|

note twelve

|

Give the total number of shares held by each member.

|

|

note thirteen

|

Applicable to private companies only. Furnish particulars of shares transferred, the date of registration of each transfer and the number of shares transferred on each date since the date of the last return, or in the case of the first return, of the incorporation of the company, by persons who are still members and persons who have ceased to be members.

|

|

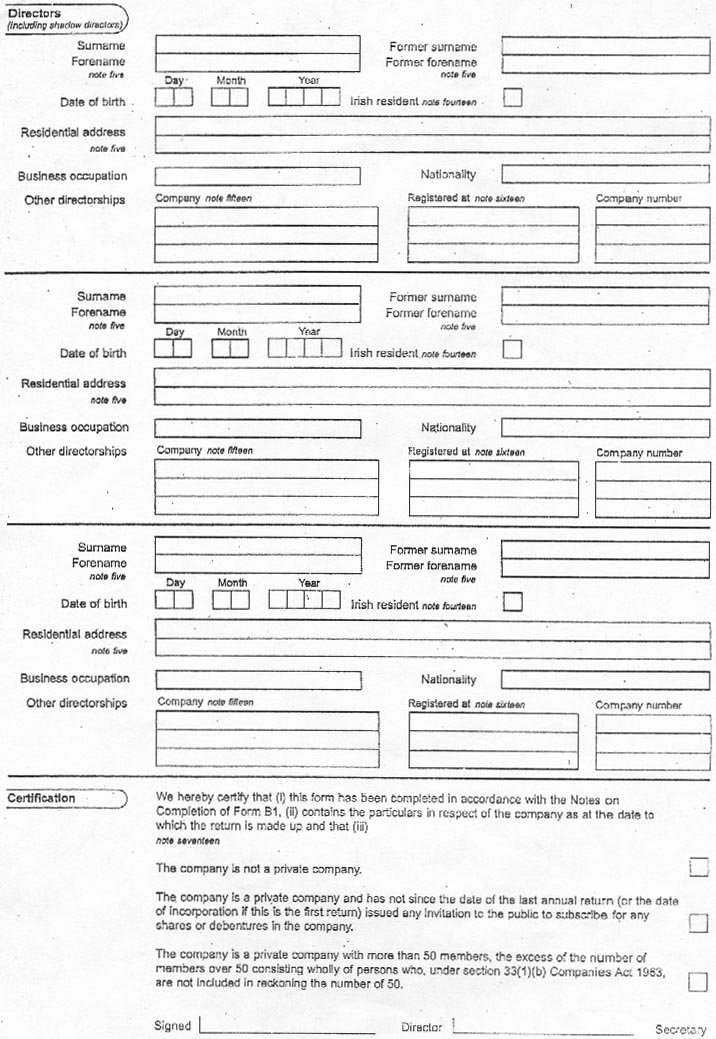

note fourteen

|

With effect from 18 April 2001, every company must have at least one Irish resident director or a Bond or certificate in place pursuant to sections 43(3) and 44 Companies (Amendment)(No.2) Act 1999. Place a tick in the box if the director is resident in the State in accordance with section 43 of the 1999 Act as defined by section 44(8) and (9). If no director is so resident, a valid Bond or certificate must be furnished with the annual return, unless same has already been delivered to the CRO on behalf of the company. (Please note that “Irish resident” means resident in the Republic of Ireland.) See CRO Information Leaflet 17.

|

|

note fifteen

|

Company name and number of other bodies corporate, whether incorporated in the State or elsewhere, except for bodies (a) of which the person has not been a director at any time during the past 10 years; (b) of which the company is (or was at the relevant time) a wholly owned subsidiary; or (c) which are (or were at the relevant time) wholly owned subsidiaries of the company.

Pursuant to section 45(1) Companies (Amendment)(No.2) Act 1999, a person shall not at a particular time be a director of more than 25 companies. However, under section 45(3), certain directorships are not reckoned for the purposes of section 45(1).

|

|

note sixteen

|

Place of incorporation if outside the State.

|

|

note seventeen

|

Tick the relevant box(es).

|