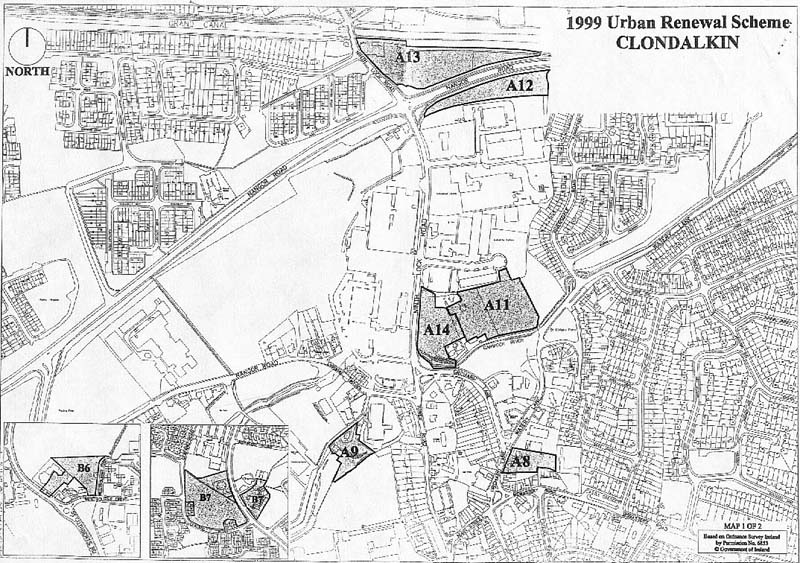

S.I. No. 229/2002 -- Taxes Consolidation Act, 1997 (Qualifying Urban Renewal Areas) (Clondalkin) Order, 2002

|

Taxes Consolidation Act, 1997 (Qualifying Urban Renewal Areas) (Clondalkin) Order, 2002 |

||||||||||||||||||||||||

|

I, Charlie McCreevy, Minister for Finance, in exercise of the powers conferred on ne by Section 372B(1) (as inserted by the Finance Act, 1998 (No. 3 of 1998) ) of No. 39 of 1997 ), and after consultation with the Minister for the Environment and Local Government hereby order as follows: 1. This Order may be cited as the Taxes Consolidation Act, 1997 (Qualifying Urban Renewal Areas) (Clondalkin) Order, 2002. 2. In this Order “the Act” means the Taxes Consolidation Act, 1997 (No. 39 of 1997) , 3. The sub-areas enclosed by red lines and shaded pink and cited as B1, B2, B3, B4, B5, B6, B7, A8, A9, A11, A12, A13 and A14 on the maps attached to this order are hereby declared to be qualifying areas for the purposes of one or more sections of Chapter 7 of Part 10 of the Act as set out in the Schedule to this Order. 4. In relation to each area which is a qualifying area for the purposes of section 372D, only the categories of buildings referred to in the Schedule to this Order in relation to that area shall be a qualifying premises within the meaning of that section. 5. It is hereby directed in relation to the areas which are qualifying areas for the purposes of sections 372C and 372D of the Act that the definition of “qualifying period” contained in section 372A of the Act shall be construed as a reference to the period commencing on 1 July 1999 and ending on 31 December 2002. 6. It is hereby directed in relation to the areas which are qualifying areas for the purposes of sections 372F, 372G, 372H and 372I of the Act that the definition of “qualifying period” contained in section 372A of the Act shall be construed as a reference to the period commencing on 1 March 1999 and ending on 31 December 2002. 7. Notwithstanding Articles 3 to 6 above, the granting of relief under this Chapter 7 of Part 10 of the Act shall be subject to the certification process provided for in section 11 of the Urban Renewal Act, 1998 ( No. 27 of 1998 ) and carried out in accordance with guidelines issued by the Department of the Environment and Local Government in May, 1999 entitled “Urban Renewal Scheme 1999 - Certification under Section 11 of Urban Renewal Act 1998”. |

||||||||||||||||||||||||

|

SCHEDULE |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

EXPLANATORY NOTE |

||||||||||||||||||||||||

|

(This note is not part of the Instrument and does not purport to be a legal interpretation). |

||||||||||||||||||||||||

|

This order provides for the designation of areas in Clondalkin under the UrbanRenewalAct, 1998. |

||||||||||||||||||||||||

|

|