Neutral Citation Number: [2024] UKUT 26 (LC)

Case No: LC-2023-554

IN THE UPPER TRIBUNAL (LANDS CHAMBER)

ON APPEAL FROM THE FIRST-TIER TRIBUNAL (PROPERTY CHAMBER)

FTT Ref: LON/00BK/OLR/2022/0535

Royal Courts of Justice

12 December 2023

TRIBUNALS, COURTS AND ENFORCEMENT ACT 2007

LEASEHOLD ENFRANCHISEMENT - PREMIUM - improvements - value of precarious rights - comparables - post-valuation date evidence - relativity - value of Act rights

BETWEEN:

DAEJAN INVESTMENTS LIMITED

Appellant

-and-

NIGEL AND LINDA COLLINS

Respondents

207 Ashley Gardens,

Emery Hill Street,

London,

SW1P 1PA

Judge Elizabeth Cooke and Mr Mark Higgin FRICS FIRRV

Decision date 9 February 2024

Ms Nicola Muir for the appellant, instructed by Wallace LLP

Mr Mark Loveday for the respondents, instructed by Lawrence Stephens Limited

© CROWN COPYRIGHT 2024

The following cases are referred to in this decision:

Carey-Morgan and Stephenson v Trustees of the Sloane Stanley Estate [2012] EWCA Civ 1181

Contractreal Ltd v Smith [2017] UKUT 178 (LC)

Deritend Investments (Birkdale) Limited v Treskonova [2020] UKUT 164 (LC)

Elmbirch Properties plc [2017] UKUT 314 (LC)

Mallory v Orchidbase Limited [2016] UKUT 468 (LC)

Midland Freeholds Ltd & Anor [2017] UKUT 463 (LC)

Nailrile Ltd v Cadogan & Ors [2009] RVR 95

Reiss v Ironhawk [2018] UKUT 311 (LC)

Roberts & Anor v Gardner & Anor [2018] UKUT 64 (LC)

Sarum Properties Ltd v Webb and Ors [2009] UKUT 188 (LC)

Sinclair Gardens Investments (Kensington) Ltd [2017] UKUT 494 (LC)

The Trustees of the Sloane Stanley Estate v Mundy [2016] UKUT 223 (LC)

Trustees of Barry and Peggy High Foundation v Zucconi and Anor [2019] UKUT 242 (LC)

Introduction

1. This is an appeal from a decision of the First-tier Tribunal ("the FTT") about the price to be paid for an extended lease of a London flat pursuant to the Leasehold Reform, Housing and Urban Development Act 1993. Applications to the FTT for permission to appeal and to cross-appeal identified a number of errors in the decision and the FTT gave both parties permission. The Upper Tribunal then directed that the appeal would be by way of re-hearing.

2. The appellants were represented by Ms Nicola Muir and the respondents by Mr Mark Loveday, both of counsel, and we are grateful to them.

The legal background

3. The Leasehold Reform, Housing and Urban Development Act 1993 gives to qualifying tenants of flats the right to acquire a new lease on giving notice in accordance with section 42. Section 56 provides that where such notice has been given, a new lease extending the existing lease by 90 years shall be granted and accepted in substitution of the existing lease upon payment of the premium payable under Schedule 13.

4. The granting of the new, extended lease enhances the value of the tenant's interest and reduces the value of the landlord's reversion. Paragraph 2 of Schedule 13 provides that the premium payable for the new lease is the sum of (1) the diminution in the value of the landlord's interest resulting from the grant, (2) the landlord's share (50%) of the marriage value, and (3) any compensation payable to the landlord under paragraph 5 (in this case agreed to be nil). In calculating the value of the landlord's interest and his share of marriage value, any increase in the value of the flat which is attributable to an improvement carried out by the tenant at his own expense is to be disregarded.

5. Marriage value was explained by Morgan J in Carey-Morgan and Stephenson v Trustees of the Sloane Stanley Estate [2012] EWCA Civ 1181 at paragraphs 17 - 18:

"The concept of marriage value is relatively straightforward in the case of a long lessee acquiring the freehold reversion on his lease (e.g. where the premises comprise a house). If the value of the freehold reversion (ignoring any bid for it by the existing lessee) is £X, if the value of the existing lease is £Y and if the value of the freehold with vacant possession is £Z, then it will often be the case that X + Y is less than Z. ... The difference is called the marriage value... Thus, if the existing lessee, who owns a lease with a value of £Y, were to be able to buy the freehold reversion for £X, he would obtain a freehold with vacant possession with a value of £Z and would secure all of the marriage value for himself. In the open market, free from statutory assumptions, it is to be expected that the freeholder would only agree to sell the freehold reversion to the existing lessee on the basis that the marriage value is shared between the freeholder vendor and the lessee purchaser. ...

18. The concept of marriage value is a little more complex where one is concerned not with the purchase of a freehold reversion but instead with the grant of a new long lease or an extended lease to the existing lessee. In the latter type of case, marriage value is the subject of an elaborate definition in para 4 of Sch 6 1993 Act. Where the unexpired term of the existing lease exceeds 80 years, marriage value is ignored. Paragraph 4(1) provides that the freeholder's share of marriage value is 50 per cent."

6. The calculations both of the diminution in value of the landlord's interest and of the marriage value require a value to be ascribed to the new lease, and thence to the notional value of the freehold interest with vacant possession ("FHVP"). A further component of the calculation of the marriage value is the value of the existing lease. Conventionally that value is ascertained by the use of a "relativity", that is, a percentage figure that enables the value of the existing short lease to be calculated by reference to the FHVP. The statute also requires that the existing lease be valued on the assumption that there was no right to an extended lease under the 1993 Act ("without Act rights"). That assumption is difficult to value because there is now no market in long leases without Act rights.

7. As we shall see, all those elements of the calculation were in dispute in the present appeal. We now set out the facts and then our determinations of the points in dispute, and finally set out the calculation of the premium.

Background

8. The appeal relates to a first floor mansion flat at 207, Ashley Gardens, Emery Hill Street, London SW1P 1PA, just south of Victoria Street and close to Westminster Cathedral. The block of which the flat forms part occupies a corner position and is arranged over six floors. It has a distinctive corner turret with a domed roof.

9. A lease of the flat for a term of 177 years calculated from 25 December 1898 was granted in on 28 January 1985; the respondents, Mr and Mrs Collins, purchased it in November 2021 for £973,000. Their vendor assigned to them the benefit of a notice served on 7 January 2022 pursuant to section 42 of the 2002, claiming an extended lease. The notice proposed a premium of £146,750. At that date there were 53.96 years unexpired.

10. The appellant is the head lessee of the block, and the competent landlord so far as the extension of the lease is concerned. It served a counter-notice on 17 March 2022 proposing a premium of £451,470. There is also an intermediate lessee of the block whose lease ends one day later than the appellants'; the intermediate lessee has agreed terms and is not a party to this appeal.

11. The flat has three bedrooms, a reception room, kitchen, bathroom and an additional separate WC. The plan to the lease shows only one bathroom and a larger kitchen; at some point the kitchen has been reduced in size to make space for the extra WC and a short access corridor. The floor area is agreed between the parties to be 1,407 sq ft. The flat is located to the rear of the block with only the windows in the lounge facing west on to Emery Hill Street. The bathroom, kitchen and two of the bedrooms face east onto Greencoat Row.

12. The terms of the extended lease have been agreed and only valuation is in dispute.

13. As to valuation, a number of matters are agreed, as follows:

Valuation Date: 8th January 2022

Unexpired term 53.96 years

Intermediate Landlord's Unexpired Term: 53.96 years plus 1 day

Competent Landlord's Unexpired term: 875.94 years

Deferment Rate: 5%

Capitalisation Rate: 6%

Extended Lease Relativity 99% of FHVP

Relativity of Competent Landlords Lease 99% of FHVP

Premium payable to Intermediate landlord £1.

14. The following table, helpfully set out in Ms Muir's skeleton argument, shows where disagreement remains:

Appellant Respondents FHVP £1,470,315 £1,207,206

Price psf (freehold) £1045 psf. £858 psf.

Relativity 70.19% 74.38%

Extended Lease Value £1,455,612 £1,195,134

(and value to Competent Landlord)

Existing Lease Value £1,042,600 £897,920

GIA 1,407 sq ft 1407 sq ft

Value of Act Rights 7.87% 5.75%

Premium £259,923 £193,215

15. It will be seen therefore that the gap between the parties' positions has narrowed considerably. The points in issue fall into two groups. The first group of issues is about comparables and adjustments, and its impact is on the freehold value with vacant possession and the extended lease value:

a. What are the appropriate comparables?

b. How should they be adjusted for time?

c. Should the valuation allow for a right to park?

d. Has the flat been improved by the additional WC and if so was that improvement carried out by the lessee (in which case it has to be disregarded in valuing the property)?

e. Other adjustments to the comparables

16. There are two issues in the second group, and both affect the existing lease value:

a. What is the value of Act rights?

b. What is the appropriate relativity?

17. Both parties have instructed expert witnesses on valuation. For the appellants we had evidence from Robin Sharp FRICS, a former director of Keith Cardale Groves who now practices on his own account. The respondents' expert was James Rangeley MRICS, a director of Egertons. Each produced a report for the FTT and then a supplemental report for the Tribunal.

Comparables and adjustments

18. One of the primary components in the calculation of the premium payable for an extended lease is the "FHVP", the freehold value of the flat with vacant possession. The figure is needed both to calculate what the lessor loses as a result of the extension and also to calculate marriage value (we set out the full calculation at the end of our decision). It is ascertained by valuing the extended lease, which the valuers agree is worth 99% of the freehold; and the value of the extended lease is ascertained in the usual way by consideration of comparable sales, in this case flats in the vicinity, some in the block.

19. As noted above, we are asked to determine a number of points whose resolution will enable us to determine the value of the extended lease and of the FHVP.

What are the relevant comparables?

20. Ashley Gardens comprises a series of blocks on both sides of Emery Hill Street, and the eastern sides of Thirleby Road and Ambrosden Avenue. The comparables are drawn from each of these locations.

21. The experts have some comparables in common, namely numbers 145A, 178A, 182, 100, 143B and 106A Mr Rangeley additionally referred to numbers 43, 211, 224 and 107A. Mr Sharp also included No.46 in his report. The following table contains the salient details of the various transactions.

|

Address |

Floor |

Bedrooms/ bathrooms |

GIA (sq ft) |

Tenure (term unexpired) |

Date sold |

Sale price (£) |

£/sq ft |

|

145a Ashley Gardens, Thirleby Road |

6th |

2, 1 and separate WC |

1,151 |

Leasehold

89.46 |

Jul-20 |

1.0m |

869 |

|

178a Ashley Gardens, Emery Hill Street |

4th |

2, 1 and separate WC |

1,294 |

Leasehold,

Share of freehold |

Mar-21 |

1.35m |

1,043 |

|

182 Ashley Gardens, Emery Hill Street |

Grd |

4,2 and separate WC |

2,314 |

Leasehold

79.74 years |

Jun-21 |

1.9m |

821 |

|

43Ashley Gardens, Ambrosden Avenue |

Lwr Grd |

4 and 3 |

1,929 |

Leasehold

999 years |

Jun-21 |

1.775m |

920 |

|

46Ashley Gardens, Ambrosden Avenue |

Grd |

4,2 and separate WC |

2,050 |

Share of Freehold |

Jun-21 |

2.25m |

1,098 |

|

100 Ashley Gardens, Thirleby Road |

Grd |

2 and 2 |

1,163 |

Leasehold,

Share of freehold |

Sep-21 |

1.0m |

860 |

|

143B Ashley Gardens, Thirleby Road |

5th |

2/3 and 2 |

1,195 |

Leasehold,

Share of freehold |

Oct-21 |

1.415m |

1,184 |

|

106a Ashley Gardens, Thirleby Road |

3rd |

2, 2 |

1,060 |

Leasehold,

Share of freehold |

Nov-21 |

1.1m |

1,038 |

|

211 Ashley Gardens, Emery Hill Street |

3rd |

3 and 2 |

1,932 |

Leasehold

53.81 |

Mar -22 |

1.625m |

841 |

|

107A Ashley Gardens, Thirelby Road |

3rd |

3, 2 and separate WC |

1,251 |

Leasehold

87.14 |

Nov-22 |

1.195m |

955 |

|

224 Ashley Gardens, Emery Hill Street |

4th |

2 and 2 |

1,778 |

Leasehold

52.82 |

Feb-23 |

1.375m |

773 |

22. The corresponding details for the subject property are as follows:

|

207 Ashley Gardens, Emery Hill Street |

1st |

3, 1 and separate WC |

1,407 |

Leasehold

53.96 years |

Nov-21 |

973,000 |

692 |

23. The comparables in the table at paragraph 21 are set out in order of the date of sale. In our view Mr Sharp was correct to focus on the transactions that completed prior to the valuation date as they constitute the evidence available to the hypothetical purchaser at that point in time. That is not to say that the transactions that took place after the valuation date have no utility, but in a case where there is sufficient evidence of sales prior to the valuation date we simply have no need to rely on them. We therefore set aside numbers 211, 107A and 224.

24. Numbers 182, 43 and 46 Ashley Gardens are 64%, 37% and 46% larger than the property. Mr Sharp made adjustments for size for these properties but provided no evidence of how he had arrived at his figures and Mr Rangeley made no adjustments at all. We are not confident that either of their approaches are correct and we conclude in any case that all three properties are too large to enable proper comparison. We therefore set those three properties aside too.

25. In our judgment the appropriate comparables are therefore numbers 145a, 178a, 100, 143B, and 106a. All but 145a are held on long leases coupled with a share of the freehold, so that their tenure is equivalent to freehold. They are between 8% and 25% smaller than the property. None is in the same block as the subject property, but 178a is in the block on the other side of the same street; indeed, 178a is the most closely comparable to the subject property being the closest to it physically and the most similar in size.

26. To allow comparison with the property it is necessary to adjust the comparables to put them on an equal footing with the property, in other words, to identify the differences that would be material to the valuation and making the appropriate allowances for them. At the end of that process we will be left with a series of values from which the FHVP can be derived. We now look at adjustments for time, which is necessary because all the transactions took place on different dates, then at parking rights for which one expert contended, then at whether there should be adjustments for parking or for improvements, and finally at various other deductions for which the valuers argued.

How should the comparables be adjusted for time?

27. In order to take account of changes in market conditions between the dates of the various transactions and the valuation date of the property, it is necessary to adjust the values in the final column of the table above, being the value expressed as £/sq ft. This is normally achieved by applying an index and the expert valuers adopted this approach. However, they did not agree on the appropriate index to use. In his report Mr Sharp had used the UK House Price Index ("UK HPI") published by HM Land Registry. The index is subdivided into geographical areas and further differentiates between property types. In this case Mr Sharp had selected the index for flats and maisonettes in the City of Westminster. The index is based on a monthly analysis of sales relating to all types of flats in every location in Westminster, without any further categorisation for additional factors such as size, condition, or unexpired term.

28. Mr Rangeley preferred to use the Prime London Residential Statistical Supplement published by Savills and appended the Quarter 3 2023 report to his supplemental report. The Savills research relates solely to prime properties which they define as;

'The prime market consists of the most desirable and aspirational property by reference to locations, standards of accommodation, aesthetics and value. Typically it comprises property in the top 5% of the market by house price'

29. Separate indices are produced for capital and rental values across a substantial geographical area stretching from Ealing in the west to Canary Wharf in the east. The north/south spread is delineated by Hampstead and Wimbledon. The indices are not based directly on transactions but rather on a regular valuation of what Savills describe as a 'standard portfolio of properties' and could therefore be influenced by valuer sentiment. They justify the use of valuation rather than transactions on the basis that the number of transactions would be too small in number and comparable in quality to form a reliable index.

30. Mr Rangeley identified several areas of concern with the UK HPI statistics, notably that the changes in value across the borough will not be uniform with what he describes as 'mini markets' in the better areas of the borough which may exhibit different rates of change to other parts. Additional concerns include volatility caused by inconsistent sales volumes and lack of allowances for condition and lease length.

31. Nevertheless we take the view that the UK HPI is to be preferred as it is based on transactions, and the section used by Mr Sharp relates solely to Westminster. We acknowledge that Westminster is diverse in the types, sizes and locations of flats that are available, but its geographical extent is far narrower than the parameters adopted for central flats in the Savills research. Similarly, in our judgement it is inappropriate to classify the property as 'prime', either in the terms described by Savills or in any other definition. Savills assume good condition and a freehold interest in their analysis resulting in data that does not accurately reflect general market conditions including properties that are in less than optimal condition and have unexpired terms of varying lengths.

32. The UK HPI is regularly updated by HM Land Registry as more data becomes available, and so having decided to use that index it is appropriate for us to apply the latest available version to our five chosen comparables and to the subject property, which we have done in the table below. The figures in the second column are the index figures for the date of the transaction; the figures in the third column are derived from the difference between that first figure and the index value at the valuation date which is 107.7; the values given in the table at paragraph 21 are then multiplied by that figure, to give the adjusted value in £/sq ft in the final column.

|

Address |

HPI |

Adjustment to be made for time |

£/sq ft adjusted for time |

|

145a Ashley Gardens, Thirleby Road |

94.8 |

1.136076 |

987 |

|

178a Ashley Gardens, Emery Hill Street |

97.2 |

1.108025 |

1156 |

|

100 Ashley Gardens, Thirleby Road |

104.1 |

1.034582 |

890 |

|

143B Ashley Gardens, Thirleby Road |

103.9 |

1.036574 |

1227 |

|

106a Ashley Gardens, Thirleby Road |

99.8 |

1.079158 |

1120 |

|

|

|

|

|

|

207 Ashley Gardens, Emery Hill Street |

99.8 |

1.079158 |

747 |

Parking

33. The lease contains a covenant by the lessee to comply with a schedule of restrictions, one of which is a covenant not to park on the private roads or communal gardens of the property. Thus the lessee has no easement to park (which would be a very valuable right indeed in this area). The block is arranged in a "C" shape enclosing on three sides a courtyard on which residents can and do park. There is a sign in the courtyard which says "Ashley Gardens Flats 204 to 227 Residents' Parking Only"; the porter issues free permits which residents can display to enable them to park. There are fewer spaces than there are flats. Westminster City Council will issue parking permits for the nearby streets, but only for residents who occupy a flat as their sole or main home.

34. The value of this possibility is an issue in the value of the extended lease, because Mr Sharp for the appellant adjusted the value of each of his comparables in Ashley Gardens by adding 3%, or as he said around £30,000, for the "parking possibility" at the subject property, on the basis that his comparables are all in other blocks which do not have that possibility. For the appellant Ms Muir argued that this is a modest adjustment, reflecting what the hypothetical purchaser would pay for the ability park in accordance with the current arrangements, while accepting that it is not an easement and can be withdrawn at any point.

35. Mr Rangeley made no such adjustment and Mr Loveday argued that the parking arrangement was worthless. He argued that the presence of the covenant not to park meant that the lessee of the subject property was in a worse position than the lessees of one of the other blocks who - he assumes - have not covenanted not to park there.

36. By contrast Mr Rangeley attributed 10% to the value of one of the comparables, 182 Ashley Gardens, on the basis that it enjoys the use - again by permission only and without an easement - of a small courtyard adjoining the flat.

37. In our judgment the presence of the covenant not to park makes no difference to the value of the right to park, precarious as it is. All the residents, whether they are subject to such a covenant or not, can apply for a permit, and obviously if they park with a permit then any breach of covenant has been waived. The covenant does not make them any less likely to be granted a permit, nor is a flat that is not subject to such a covenant in any better position.

38. Nevertheless, this is a permission not a right. It can be withdrawn at any time, or a charge could be made for parking. We were struck by the inconsistency of Mr Rangeley's adjustment by 10% of the value of 182 Ashley Gardens for the precarious right to use a courtyard and his refusal to attribute any value to the precarious right to park at the subject property. When pressed on the point Mr Rangeley conceded that a purchaser might perhaps regard it as a bargaining chip and offer an extra £5,000, or approximately 0.5% of the price. We agree that the £30,000 attributed to the parking possibility by Mr Sharp is unrealistic. Equally unrealistic is Mr Rangeley's attribution of 10% of the value of another flat to its precarious use of a courtyard. But we think his £5,000 for the parking possibility is likely to be correct, since there is no guarantee that the arrangement will continue or will continue to be free of charge.

Improvement

39. Schedule 13 to the 1993 Act, paragraph 4A(1) provides that the interest of the tenant under the existing lease must be valued:

"(c) on the assumption that any increase in the value of the flat which is attributable to an improvement carried out at his own expense by the tenant or by any predecessor in title is to be disregarded."

40. The plan to the lease of the subject property depicts a kitchen in the north-west corner, with four windows, and a small bathroom next to it. The flat currently has a smaller kitchen with one window; a partition has been added and another wall cut through, to make a bathroom, an additional separate WC, and a small corridor.

41. It is the respondents' case that this changed layout and the additional WC amount to an improvement, that it must have been carried out by the tenant at the tenant's expense, and that it should be disregarded. Mr Loveday points out that the lease plan is unlikely to have been wrong because the parties would have noticed and had it corrected; that the landlord would not have done this work; and therefore that on the balance of probabilities the work was done by the tenant.

42. The lease contains a covenant not to "cut or maim" the walls of the flat; yet no licence to alter the layout has been found.

43. For the appellant Ms Muir points out that the plan was drawn some five years before the grant of the lease and the layout could well have been changed prior to the grant. She stressed that an alteration after the grant would have been a breach of covenant. She also argued that it would not have been an improvement.

44. We think it likely that the reduction in size of the kitchen and the addition of the new WC would have been done by a tenant. It is difficult to see why the landlord would have done this before granting the lease because in our judgment it is not an improvement and would not have made the flat any more attractive to a purchaser. There is of course some subjectivity here; some households would prefer an extra WC. But equally, some would prefer a larger kitchen. Mr Rangeley said that the trend in modern flats is towards smaller kitchens and in coming to his 'adjusted value', had subtracted 5%. However, if there is such a trend that does not mean that everyone actually prefers a smaller one nor that there is no value in a spacious kitchen with four windows over two outside walls.

45. In our view the change in layout neither added nor reduced the value of the subject flat and no allowance is therefore required.

Other adjustments to the comparables

46. Both Mr Sharp and Mr Rangeley made a range of further adjustments; each indicated that the adjustments they had made were based on market practice, but no evidence was adduced to support this assertion. Mr Sharp used a cumulative approach in relation to his adjustments; having deducted, say, 10% for one factor to derive £x, he then applied the next deduction to the £x rather than to the time-adjusted valuation from which he started. This is not a method we have encountered before and it is bound to be artificially high since at each step a deduction is made from an already adjusted value.

47. Mr Rangeley adopted the correct method, which is to apply all the adjustments to the same starting-point.

48. The primary factors and adjustments made by the two experts were as follows:

|

Factor |

Adjustment |

Comments |

|

|

Mr Sharp |

Mr Rangeley |

|

|

|

|

|

|

|

Condition |

-5% to +2.5% |

-16% to -5% |

|

|

Outside Space |

-1.5% |

-5% to -10% |

The property has no balcony |

|

Floor Level |

-2.5% to +1% |

-2% to +15% |

|

|

Separate WC |

Not adjusted |

-5% |

|

|

Additional bathroom |

-2% |

-10% |

|

|

Outlook |

-2% to +2% |

0 to 5% |

|

|

Size |

-3% to 6.25% |

Not adjusted |

|

|

Parking |

3% |

£5,000 | |

49. In addition, some of the comparables were held on an unextended lease. Both experts adjusted for this factor although it was unclear exactly what had informed Mr Sharp's approach. Mr Rangeley used the average of the 2002 and 2015 enfranchisable graphs published by Savills. In The Trustees of the Sloane Stanley Estate v Mundy [2016] UKUT 223 (LC) the Tribunal commented at paragraph 170 that:

'In the past, valuers have used the Savills 2002 enfranchisable graph when analysing comparables, involving leases with rights under the 1993 Act, for the purpose of arriving at the FHVP value. The authority of the Savills 2002 enfranchisable graph has been to some extent eroded by the emerging Savills 2015 enfranchisable graph. The 2015 graph is still subject to some possible technical criticisms but it is likely to be beneficial if those technical criticisms could be addressed and removed. If there were to emerge a version of that graph, not subject to those technical criticisms, based on transactions rather than opinions, it may be that valuers would adopt that revised graph in place of the Savills 2002 graph.'

50. At paragraph 59 of Appendix C to the decision, the Tribunal commented as follows:

'At the valuation dates, the Savills 2002 graph was in common use by valuers to determine the FHVP value of a property from transactions concerning leases with rights under the 1993 Act, being the only one of the graphs then current that showed relativities for such leases. That graph relies upon neither transactions nor settlements but is based solely upon the subjective opinions of a panel of valuers. We consider the Savills 2015 graph to be a significant improvement on its 2002 equivalent, being based upon recent market transactions which have been objectively analysed, albeit subject to technical criticism. But the Savills 2015 graph was not available at the valuation dates and could not have affected the market's approach to the assessment of relativity at that time.'

51. In other words, the Tribunal acknowledged that a graph based on transactional evidence was superior to one based wholly on opinion but it had some reservations which it described as 'possible technical criticisms'. In Midland Freeholds Limited & Speedwell Estates Limited [2017] UKUT 463 (LC) (at paragraph 37) it was submitted by the valuation expert for the appellants (who was a Director of Savills) and accepted by the Tribunal that these deficiencies had been addressed by a Savills Research Report dated 7 July 2017 and annexed a report to their evidence by Professor Andrew Harvey, Emeritus Professor of Econometrics at the University of Cambridge who said that the Savills 2015 enfranchisable model was statistically robust.

52. In Reiss v Ironhawk [2018] UKUT 311 (LC) the Tribunal (at paragraph 54) was explicit in its choice of graph:

'In my opinion the most reliable method of valuation in this appeal is to use the Savill's enfranchiseable graphs. This gives a relativity for an unexpired term of 75.23 years of between 90.87% (2002 graph) and 89.1% (2015 graph). I prefer the 2015 graph because it was prepared much closer to the valuation date and had been published by that time. I consider that the with Act rights relativity of the subject lease at the valuation date was 89.1%.'

53. We are aware that valuers, in the course of negotiation, still refer to the Savills 2002 graph. However, we see no compelling reason to use the 2002 graph alongside the 2015 iteration. In our view the market at the date of valuation is likely to have far more in common with the market on which the later graph is based and reliance on the earlier version would be unwise.

54. Mr Sharp adjusted for a greater number of factors than Mr Rangeley and the adjustments ranged from 0.5% for a single factor to 15% where several were aggregated. In addition to Mr Sharp's tendency to group some factors together, there seemed to be a lack of consistency in his approach to others. His propensity to make very small adjustments such as 0.5% for a modest difference in ceiling heights, did not instil much confidence in his approach. Having made his various adjustments he elected to take an average of the seven transactions at a figure of £1,112 per sq ft. However, he did not stop there; in view of the subjective nature of his analysis, and taking into account that the sales of numbers 46 and 182 were concluded in June 2021 when an unusually large volume of sales occurred, he made a final adjustment of 6% arriving at £1,050 per sq ft. No explanation other than his professional judgement was provided for the selection of that 6%.

55. Mr Rangeley made fewer adjustments than Mr Sharp and tended to be more 'broad brush' in his approach. He analysed post valuation date evidence and used the sale of the property itself to arrive at his FHVP valuation. He relied on a wider basket of comparables and considered that the price achieved on the sale of the property was 'a little too low'. He observed that buyers over and under pay but did not provide any compelling reason why the evidence from the sale should be considered less reliable than any of the other comparables. His analysis of eleven transactions resulted in an average of £852 per sq ft.

56. Mr Sharp's analyses included discounts of 1.25% to 3% for the difference in size in relation to these properties but we are not convinced that the evidence demonstrates that those in the market for flats of between 1,000 and 1,400 sq ft differentiate size in their bids to that extent. We would have been assisted by analysis that isolated this factor and identified the point at which the adjustment transitions from negative to positive. Without that insight we are unable to incorporate it into our computations.

57. Both experts commented that it was common practice in the market to make adjustments for floor levels. Mr Rangeley explained that ground and lower ground floor flats suffered from a lack of security and privacy in comparison to flats on upper floors. It appears that first floor flats are the most desirable, suffering neither of the disadvantages of the floors below and being more accessible than those above. Mr Sharp had adjusted by 0.5% per floor between the first floor and the upper floors and 1% between the first floor and the ground floor. Mr Rangeley adjusted by 1% and 10% respectively. No evidence was adduced to support either approach and between the first and upper floors we take the average of 0.75% per floor. It seems to us that the difference between the ground and first floors is likely to be more substantial and Mr Rangeley's approach is to be preferred.

58. The material we have considered so far has provided us with a time-adjusted value for each of the comparables, together with a small adjustment for parking. We can now complete our analysis and explain the adjustments we think should be applied, in the light of the two experts' evidence.

145a Ashley Gardens, Thirleby Road

59. This property has two bedrooms, a kitchen, bathroom and separate WC. It is on the sixth floor, has a balcony and faces the green space that lies between Thirleby Road and Ambrosden Avenue. Both experts agree that it is need of modernisation and from the details supplied that appears to be the case. Mr Sharp allows 2.5% and Mr Rangeley 5% for condition. In our view Mr Rangeley is correct. In terms of tenure, there were at the time of the transaction, 89.46 years left unexpired on the lease. Mr Sharp adjusted by 6.5% for what he described as 'uncertainty on the freehold' and Mr Rangeley considered that the unexpired term represented 97% of the freehold value and therefore applied a factor of 100/97. It was not clear how he had arrived at this figure as it did not correspond to the average of the 2002 and 2016 Savills graphs on which he claimed to have based his calculations. For the purposes of analysis, we adopt a factor of 92.7% taken from the Savills 2015 graph (see paragraph 53 above).

60. We adjust for the difference in floor levels at 3.75% and the lack of parking opportunities at £5,000. This flat has a markedly better outlook and a superior internal layout in comparison to the property. We judge those attributes to be worth 7.5% and 2.5% respectively. The balcony in our view merits an adjustment of 2.5%. The aggregate effect of these adjustments leads to a figure of £978 per sq ft.

178a Ashley Gardens, Emery Hill Street

61. This flat is located in the same street at the property but forms part of the block on the western side of the street. It is on the fourth floor, has two bedrooms, a kitchen, a single bathroom and a separate WC. Mr Sharp considered that the condition was dated and made an adjustment of 1% but from the available information we judge there to be no difference between the two properties. We adjust by 2.25% for the disparate floor levels and 5% for the sizable balcony. This flat has a superior, dual aspect outlook than the property and a better layout. We account for these advantages by adopting adjustments of 5% and 2.5%. We again make an adjustment of £5,000 for parking. Our analysis results in a value of £941 per sq ft.

100 Ashley Gardens, Thirleby Road

62. This property is the only one of the cohort that is located on the ground floor. It is situated on the eastern side of Thirleby Road, with views towards the gardens. It appears to be in reasonable condition. It has two bedrooms and two bathrooms, one of which is en-suite. However, it is not without its shortcomings as the second bedroom and bathroom are accessed through the kitchen/dining room and it has no outside space. We adopt a 10% allowance for the ground floor position, 10% for a second bathroom, 2.5% for the outlook and £5,000 for parking. The adjustments result in a value of £881 per sq ft.

143B Ashley Gardens, Thirleby Road

63. This flat is in the same block as the preceding one but is on the fifth floor and is orientated to the east, overlooking a Royal Mail depot. It has been thoroughly modernised to a high standard with a new kitchen and bathrooms. The accommodation comprises a large reception room/kitchen, three bedrooms, one of which is en-suite, and a further bathroom. The layout is better than that at the property and although the outlook is not over the gardens, we judge it to be superior to the property. We adjust by 7.5% for condition, 3% for floor levels, 2.5% for outlook, £5,000 for lack of parking, and 10% for a second bathroom. Our analysis gives a figure of £928 per sq ft.

106a Ashley Gardens, Thirleby Road

64. This is the third flat in the Thirleby Road block but this time on the third floor. In common with 143B it is a rear flat with an easterly aspect. It is better condition than the property but to a lesser extent than 143B. It has two bedrooms and two bathrooms but the kitchen is not large enough to accommodate a dining table. Overall, it appears to us to have a layout which is an improvement over the property but the outlook is broadly similar. We deduct 2.5% for condition, 1.5% for floor levels, £5,000 for parking, 10% for the second bathroom and 2.5% for layout. The final figure is £950 per sq ft.

65. The following table contains a summary of the experts' and the Tribunal's analyses of the five comparables together with the property itself:

|

Address |

Mr Sharp's devaluation

(£ per sq ft) |

Mr Rangeley's

devaluation

(£ per sq ft) |

Tribunal's devaluation

(£ per sq ft) |

|

145a Ashley Gardens, Thirleby Road |

1,013 |

773 |

978 |

|

178a Ashley Gardens, Emery Hill Street |

1,190 |

927 |

941 |

|

100 Ashley Gardens, Thirleby Road |

1,035 |

832 |

881 |

|

143B Ashley Gardens, Thirleby Road |

1,181 |

835 |

928 |

|

106a Ashley Gardens, Thirleby Road |

1,145 |

927 |

950 |

|

|

|

|

|

|

207 Ashley Gardens, Emery Hill Street |

Not analysed |

810 |

928 |

|

|

|

|

|

|

Tribunal's average |

|

|

934 |

|

|

|

|

|

Conclusion

66. As to the subject property, it can be seen from the table in paragraph 32 above that its time-adjusted value is £747 per sq ft. Using the Savills 2015 enfranchisable graph (80.5%) to take account of the short lease position we arrive at £928 per sq ft.

67. The experts both took an average of their various devaluations and whilst it is convenient to do so that approach necessarily compounds a significant number of subjective adjustments. We attach slightly more weight to No 178a because it is the closest in locational terms to the property, and to No. 106a because the date of the transaction was contemporaneous with the property itself. The view that we have come to is that the appropriate value on which to base the FHVP is £940 per sq ft. We note that this figure is marginally higher that the average of our devaluations at £934 per sq.ft

Relativity and the value of Act rights

68. We now have the FHVP; the other component needed for the calculation of the premium is the value of the existing lease on the valuation date (which we have already, £747 per sq ft see paragraph 32 above) but without the right to an extended lease or "without Act rights" as it is usually put.

The value of Act rights

69. The value of Act rights is expressed as a percentage, to be deducted from the date-adjusted value of the lease.

70. Mr Sharp put it at 7.87%. He derived this from a comparison of the Savills 2016 enfranchiseable and unenfranchiseable graphs, the latter being 7.87% lower than the former.

71. Mr Rangeley put it at 5.75%. He explained that he considered the Act rights discount to be subjective and relied on previous decisions of the Tribunal. In Mallory v Orchidbase Limited [2016] UKUT 468 (LC) 5.5% was adopted where the lease had 57.68 years unexpired. In Nailrile Ltd v Cadogan & Ors [2009] RVR 95 where the unexpired term was 45 years, the discount was determined at 7.5%; in Trustees of Barry and Peggy High Foundation v Zucconi and Anor [2019] UKUT 242 (LC); where the lease had 52.56 years unexpired, the Tribunal determined 6%. Although Mr Rangeley did not provide us with a explanation of his methodology in coming to 5.75%, it appears that it was simply a matter of judgement as although it is the average of the adjustments in Mallory and Zucconi the unexpired term at the property is lower than the average of the unexpired term in those two cases.

67. As we said at the outset (paragraph 6 above), there is now no market in long leases without Act rights. So the value to be placed on them is a construct or convention. The Tribunal has considered the appropriate value to place on Act rights on several occasions over the last fifteen years; in its decision in Sinclair Gardens Investments (Kensington) Ltd [2017] UKUT 494 (LC) it listed the discount applied in what were then recent cases that related to leases with 40 years or more unexpired, and it is possible to use that list and supplement it to provide a value for leases of different lengths - as Mr Rangeley did. The advantage of this approach is that it promotes consistency; it also promotes simplicity as we shall see.

68. Below is an updated version of the table set out in Sinclair Gardens to which we have added decisions since 2017 where the value of Act rights was determined after argument (and so excluding the decision in Midland Freeholds Ltd & Anor [2017] UKUT 463 (LC)):

69. The decisions set out in the table above demonstrate a relatively simple approach: 2.5% has been applied to unexpired terms of 75.2 and 77.7 years and 3.5% to unexpired terms of between 66.8 and 69.3 years. If we take a straight line between 52.6 years and 57.68 years the appropriate value for the subject lease is 5.85%. We adopt that figure, and we commend that approach for future use.

The value of the existing lease without Act rights and the use of relativity

70. Relativity is a figure that enables the value of the existing short lease, albeit without Act rights, to be calculated from the FHVP. In circumstances where there is little or no evidence of existing values it is normal valuation practice to use relativity graphs, based on a wider sample of transactions and published from time to time by surveying practices engaged in this specialist area of work. Relativity is expressed as a percentage, to be applied to the FHVP to yield the value of a lease of the length in question without Act rights. Relativity is thus used as a tool to derive a value.

71. However, the subject property was sold only three months before the date of the application for the extension of the lease, and a date-adjusted value is readily available as we have seen. In such cases the value of the lease without Act rights can be calculated without using relativity. Obviously the value without Act rights derived from such a calculation can be expressed as a percentage of the FHVP already determined, and compared with the relativity graphs; in such cases relativity is used as a cross-check; if the value calculated without the use of the graphs is adrift from the value in the tables then something may have gone awry and it may be worth looking again at adjustments.

72. In practice valuers tend to combine the two methods, as did the expert witnesses in relation to this property. We need to look at their methods, bearing in mind that the figures they produced were derived from their own assessment of the FHVP which differed from the value the Tribunal has adopted.

73. Mr Sharp employed the 2016 graphs produced by Savills and Gerald Eve which demonstrated an average relativity of 73.81%. He described the graphs as 'reliable' and commented that their use was required to "temper" the market evidence. As far as the sale of the property itself was concerned Mr Sharp explained in his report that it was first marketed at the end of March 2021 at £1,275,000. By June, following a change of agents, the asking price had dropped to £1,050,000 and a single offer was received resulting in a sale at £973,000 in November 2021. That figure of course included the 1993 Act rights. Mr Sharp made three adjustments; he subtracted 7.87% for Act rights and added 7.5% for condition and 3.5% in recognition that the transaction was an executor's sale. He considered that the flat was dated and that any purchaser would replace the kitchen and bathroom fittings as well as renewing the decorations and carpets. His rationale for his final adjustment was that an executor would be willing to conclude a sale at a level which would expedite the transaction, in comparison to someone who was part of an ongoing chain. Mr Sharp's final figure was £1,000,000. He then divided this figure by the product of the adjusted average of his FHVP comparables (£1,045 per sq ft) and the agreed area (1,407 sq ft), namely £1,470,315, to arrive at a relativity figure of 68.01%. He then took an average of this analysis and the average of the Gerald Eve and Savills figures to arrive at 70.56%, which was the figure he deployed in his valuation.

74. We are sceptical of this approach, for a number of reasons. The first is that there is no reason to adjust the date-adjusted sale price of the property by reference to condition in this case; the objective is to ascertain the value of this lease at the valuation date, not of an adjusted lease.

75. Second, we see no substance in the adjustment on the basis of this being an executors' sale. Had this been an adjustment worth making it should have been applied at the first stage of the analysis when the FHVP was determined; there is no reason why different adjustments should be made at this stage. The only new adjustment should be the value of Act rights.

76. Finally, we do not understand the repeated averaging exercise carried out by Mr Sharp. Instead of applying his deduction for Act rights to his adjusted value for the short lease, he has averaged that value with the other comparables; and he has then averaged the resulting relativity with the relativity derived from the graphs to produce a blended figure. No explanation has been given for either of these averaging exercises; we do not understand the need to "temper" the market evidence in this way.

77. So we are not persuaded by Mr Sharp that anything is needed at this stage other than the deduction of the value of the Act rights from the existing short lease value.

78. Turning to Mr Rangeley, his methodology was slightly more circuitous. He identified what he described as the 'Mundy approach' referring to the Tribunal's methodology in The Trustees of the Sloane Stanley Estate v Mundy [2016] UKUT 223 (LC) where at paragraph 168 the Tribunal commented that:

'If the price paid for that market transaction was a true reflection of market value for that interest, then that market value will be a very useful starting point for determining the value of the existing lease without rights under the 1993 Act. It will normally be possible for an experienced valuer to express an independent opinion as to the amount of the deduction which would be appropriate to reflect the statutory hypothesis that the existing lease does not have rights under the 1993 Act'

79. He thought it too risky to rely solely on the property itself and preferred to take the average of his analyses of numbers 207, 211 and 224. This resulted in a figure of £672 per sq ft to which he applied a discount of 5.75% to arrive at a value without Act rights of £633 per sq ft. Dividing this number by £852 (being the average of his FHVP comparables) produced a relativity of 73.82%. If he had relied only on number 207 the outcome would have been 73%. He described the use of graphs as a 'cross check' and noted that in several recent Tribunal decisions concerning properties outside Central London that graphs produced by Savills in 2015 and 2016 and by Gerald Eve in 2016 had been preferred. However, he noted deficiencies in both 2016 graphs and recounted his experience of dealing with Central London properties where negotiations had been conducted with both practices and that neither had insisted on the use of the most recent graph. He said that the outcome of these discussions often aligned closely to an older Gerald Eve graph published in 1996. Mr Rangeley considered that the relativity in Central London was slightly higher than in other areas due to fewer concerns about 'mortgageability' and the cost implications of short leases. He thought that the market in Central London had proportionately more flats and the market was better informed. The 1996 Gerald Eve graph reflected his view and in relation to the property produced a result of 77.17%, some 4.5% higher in proportionate terms than the average of the Gerald Eve and Savills 2016 graphs. Taken together the three graphs (Gerald Eve 1996, Savills 2016, and Gerald Eve 2016) averaged 74.93% and his analysis of the short lease transactions (which we set out in paragraph 21) showed a relativity of 73.82%. He therefore adopted 74.38% being the average of the two methods.

80. So while Mr Rangeley resisted the temptation to make further adjustments, his method again involved repeated averaging, both with the comparables and then with the relativity graphs, We are not persuaded that this is a reliable method and we continue to take the view that in a case such as this where there is reliable market evidence, we should start from the application of the value of Act rights to the market value, date-adjusted (the one adjustment which, oddly, neither valuer made). Relativity can then be used as a cross-check, although we reject the use of the 1996 graph which is too old to be of use.

The Tribunal's conclusion about the value of the existing lease without Act rights

81. We can now return to the analysis of the sale of the property.

82. We have already calculated the date-adjusted value of the property, at paragraph 32 above, as being £747 per sq ft (by reference to the Land Registry's House Price Index). For present purposes we have to express that as a capital value, £1,051,029. If we deduct the value of Act rights at 5.85% we get a value of £989,544, say £989,500.

83. We have already determined the FHVP at £1,322,500 and the relativity is therefore 74.8%. As discussed we can use the graphs as a cross-check. In Deritend Investments (Birkdale) Limited v Treskonova [2020] UKUT 164 (LC) the Tribunal endorsed the use of the Savills and Gerald Eve 2016 (unenfranchisable) graphs in a situations where there is no transactional evidence. That is obviously not the case here but in our view the relativity we have arrived at compares reasonably to the outcomes from the 2016 graphs, which are 74% and 73.68%. Accordingly, in calculating the premium we use £989,500 as the value of the existing lease without Act rights. It is based on a transaction at the property itself which is almost contemporaneous with the application date and there is no need to use the relativity tables as anything other than a cross-check.

84.

Conclusion

85. In light of our findings above, the points about which the valuers disagreed are resolved as follows:

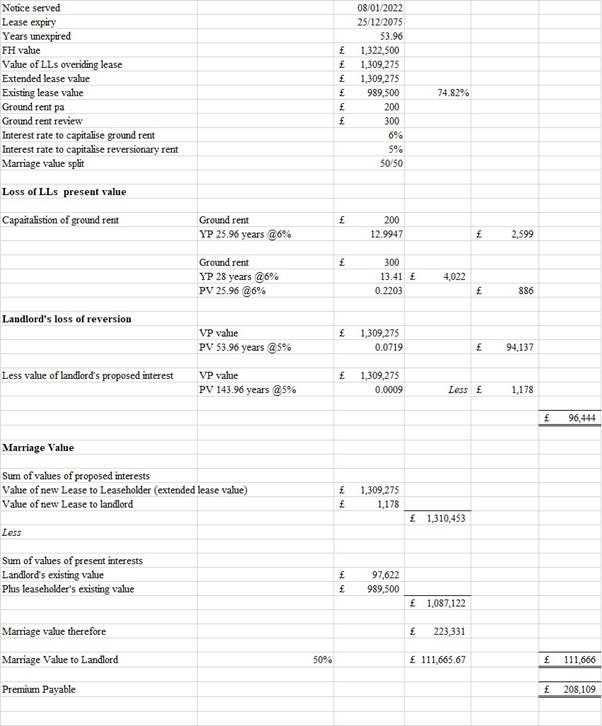

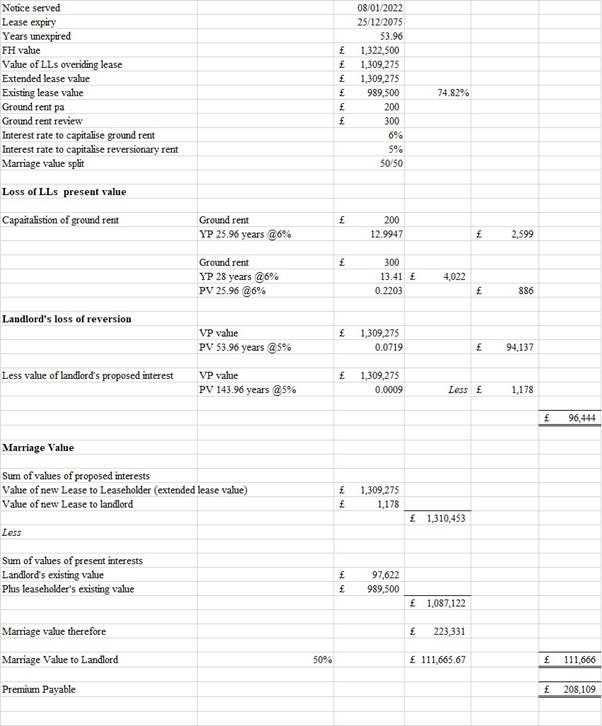

FHVP £1,322,500

Price per sq ft (freehold) £940

Relativity 74.8%

Extended Lease Value £1,309,275

Existing Lease Value £ 989,500

GIA 1,407 sq ft

Value of Act Rights 5.85%

Premium £208,109

86. The calculation of the premium is as follows:

Judge Elizabeth Cooke Mr Mark Higgin FRICS FIRRV

9 February 2024

Right of appeal

Any party has a right of appeal to the Court of Appeal on any point of law arising from this decision. The right of appeal may be exercised only with permission. An application for permission to appeal to the Court of Appeal must be sent or delivered to the Tribunal so that it is received within 1 month after the date on which this decision is sent to the parties (unless an application for costs is made within 14 days of the decision being sent to the parties, in which case an application for permission to appeal must be made within 1 month of the date on which the Tribunal's decision on costs is sent to the parties). An application for permission to appeal must identify the decision of the Tribunal to which it relates, identify the alleged error or errors of law in the decision, and state the result the party making the application is seeking. If the Tribunal refuses permission to appeal a further application may then be made to the Court of Appeal for permission.